Table of Contents

Everyone is talking about Bitcoin (BTC) hitting all-time highs in the past few weeks. But what else crushed all-time highs? Bitcoin mining difficulty. As BTC keeps printing new highs, a lot of people are having the same thought - why don’t I run a mining rig and mine Bitcoin? But then you actually calculate electricity costs, and think about how your neighbors would react to your loud, and hot ASIC miners turning your place into a sauna. Maybe it wouldn’t be so easy…

But this is a big reason why cloud mining has exploded recently, with the global cloud mining market expected to reach over $9 billion in value in 2025. Cloud mining allows users to mine crypto without having to deal with physical hardware, and for lower electricity costs. All sounds good, right? But as with all things (especially in crypto): if it sounds too good to be true, it probably is. Some users are making decent returns, others are learning expensive lessons about contracts and fees, and many more are getting outright scammed. Let's break down what's happening in the cloud mining space.

What is Cloud Mining?

With cloud mining, you pay a company to use their mining rigs on your behalf. You can think of it as like hiring a company to manage your rental property. As payment for managing your rental property, you share a percentage of your income to the company. It’s basically the "I don't want to deal with hardware or technical hassle" approach to crypto mining.

How does it work? Typically in areas with lower electricity costs, companies build large mining farms packed with top of the line ASIC miners. When you enter into a cloud mining contract, you are renting a slice of the cloud mining company's computational power. This is usually measured in terahashes per second - TH/s. The mining company then pools everyone's rented computational power, mines cryptocurrency with it, and distributes rewards based on contract size accordingly.

Your involvement is mostly monitoring dashboards and tracking earnings. You don’t need to worry about firmware updates, cooling systems, or surprise electricity bills, as you typically would in a traditional mining setup. The provider handles everything on the technical side while you watch your profits go up (hopefully).

It’s easy to see why this type of investment would be attractive. You’re able to mine cryptocurrency without having to turn your basement into a sweltering server farm or explaining to your neighbors why your house sounds like a helicopter landing pad.

Types of Cloud Mining

There are many different types of cloud mining. The main differentiator amongst them is the level of hands-on involvement.

Hosted Mining

With hosted mining, you lease specific hardware that stays and is operated in the provider's facility. You might get an Antminer S21 Pro allocated to your account, but it stays in their climate-controlled warehouse. This provides you transparency and specifics about which machine is generating your returns.

The provider still handles everything on the operations side, such as power, cooling, and repairs. But with hosted mining, you get cleaner insight into your mining performance. Some providers even offer services where you pick which mining pools to join and more customized settings, allowing you to take control of your mining strategy.

What’s the trade-off? Hosted mining generally comes with higher costs and longer

commitments since you're able to reserve specific equipment. Another potential downside is that your returns are tied directly to your leased machine's health. This can obviously be problematic if the machine breaks down.

Leased Hash Power

This is cloud mining for people who just want to click buy and watch their profits. In this model, you purchase raw computational power instead of leasing specific equipment like an Antminer S21 Pro. The provider then pools everyone's computational power and distributes rewards proportionally to each user’s leased hashed power.

This model is seen as the simplest method of cloud mining. There are also typically lower minimum contracts, and can be good for beginners who are mining for the first time. There’s no need to worry about individual machine issues as everything is pooled together and managed collectively.

The downside is that you have less transparency and control. You are buying a share of the provider's operation without knowing specific operational details. Your returns are dependent on their efficiency and honesty. Naturally, this model introduces higher counterparty risk.

Virtual Hosted Mining

This is for the semi-technical crowd who wants some customization without hardware ownership. You get a virtual server configured for mining where you can install your preferred software and tweak settings.

This model offers much more customization, and users can experiment with different algorithms and mine different cryptocurrencies. The drawback is that it requires actual mining knowledge. You’ll need a good understanding of software, pool configuration, and optimization. It's also pricier than basic hash power leasing due to the added complexity.

Advantages of Cloud Mining

Traditional mining comes with many pain points. Cloud mining solves many of these:

Low Entry Barrier

Traditional crypto mining requires high upfront and ongoing costs, upkeep, and a steep learning curve. ASIC miners can cost over $10K each, plus ongoing electrical costs. Mining network difficulty continues to rise, and newer, more efficient miners hit the market. This makes previous hardware and setups less profitable over time. A home mining setup requires understanding of hardware specs, and ongoing optimization.

Cloud mining contracts, on the other hand, can start at just $100. This offers a much lower barrier to entry, and is accessible to a lot more people.

No Maintenance or Setup Required

Traditional mining requires both hardware and software knowledge, while coming with some frequent issues to consider:

- Hardware failures

- Firmware updates

- Cooling issues

- Hash rate monitoring

- Pool performance

- Electricity costs

- Profitability across different cryptocurrencies

This is just a few of the complexities involved in running and maintaining a home mining rig. With cloud mining, facilities employ dedicated teams to handle these headaches 24/7. Cloud providers also use AI systems to optimize operations, quickly and automatically choosing between the most profitable coins to mine. What about the heat noise? Mining facilities are built to handle these issues with industrial cooling and acoustic treatments.

Accessibility and Convenience

Cloud mining platforms typically offer user-friendly mobile apps and web interfaces for managing everything from real-time earnings tracking to contract management. Settings also include automated features like reinvestment and profit optimization.

Want to scale? Just purchase additional contracts. No need to buy additional hardware or rent additional space.

Disadvantages of Cloud Mining

Everything sounds good so far, right? Let’s see what the drawbacks of cloud mining are.

Lower Profit Margins

Facility costs, equipment, electricity, cooling, staff, and profit margins. These overheads provided by cloud providers typically eat 20-40% of gross mining revenues before you see anything. If you have the required technical chops and live in a cheap electricity area, you may be more profitable running your own mining rig.

Contract Limitations

Another downside is that long-term profit calculations are difficult. Cloud miners stay locked into fixed payments based on their contracts, which can last up to several years, whereas home miners can voluntarily shut down at any time. With crypto price volatility, network difficulty, and maintenance costs, a home mining rig can offer more flexibility.

High Risk of Scams

The cloud mining space is full of scams that have cost investors hundreds of millions of dollars. Crypto mining is naturally complex, and scammers exploit this to their benefit. They use complex crypto jargon to create convincing, but fake platforms with guaranteed returns to entice investors.

To avoid scams, know that there are no guaranteed returns in mining because of mining’s dependence on unpredictable factors like crypto price volatility and network hashrate.

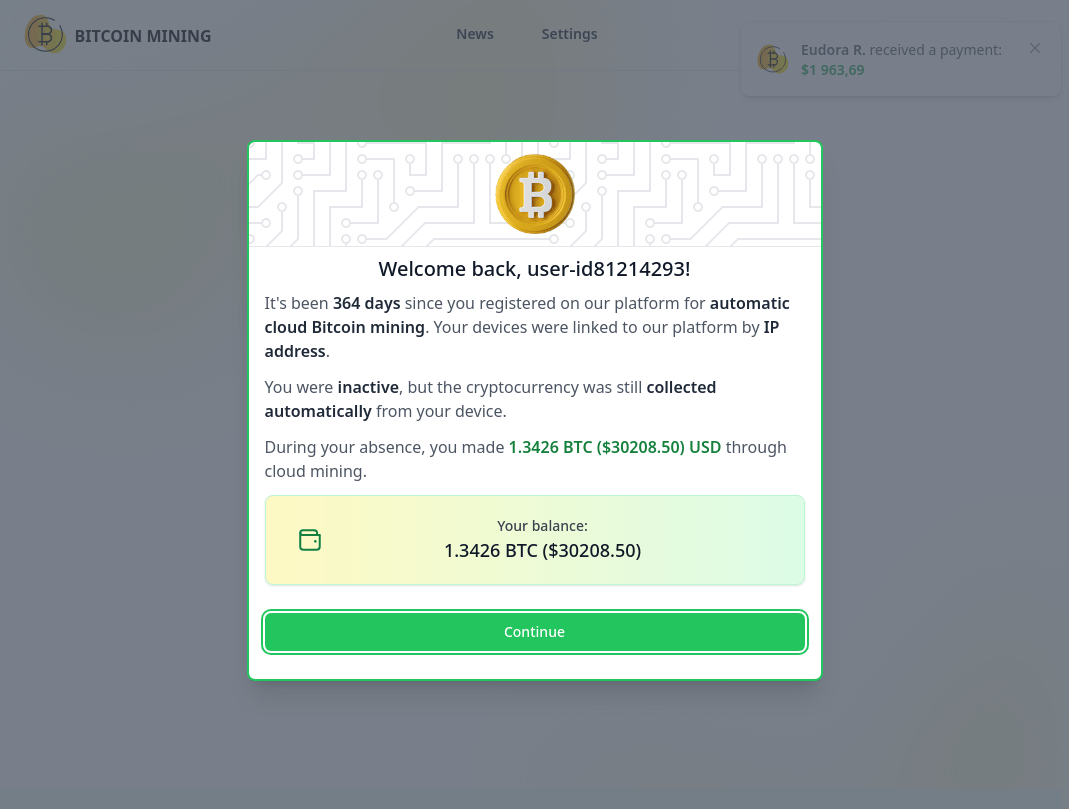

Fake mining dashboards and phishing emails are popular scam techniques. Scammers send emails like the one below for users to “claim” their mining rewards in an attempt to get the user’s login details and/or download malware.

How to Choose a Reliable Cloud Mining Provider

Choose a trustworthy provider to minimize risk of fraud and maximize returns.

Security and Transparency

You can use a checklist to determine a cloud mining provider’s security and transparency.

Security:

- SSL encryption

- Two-factor authentication (2FA)

- Cold storage

- Up to date third-party audits

Transparency:

- Verifiable information about facilities, equipment, team members, legal status

- Verifiable real-time mining stats via public pool data

- Facility tours, live camera feeds, detailed equipment inventories

- Data center locations, power sources, hardware partnerships

- Proper business registrations, licensing requirements

- Clear terms of services, privacy policies, dispute resolution procedures

Customer Support and User Reviews

Before signing any contracts, run a test on potential providers by contacting their support with technical questions. Rate them based on their knowledge and response times.

Watch out for overly positive reviews and bland / generic testimonials. Businesses naturally accrue mixed reviews over time, and exclusively positive reviews can signify that a business may not be legitimate. Instead, look at third-party platforms like Reddit, crypto forums, and other social media sites to gauge authentic user feedback. While mixed reviews are natural, pay attention to specific legitimate negative reviews on things like delayed payouts, unresponsive support, and one-sided contractual changes.

Company Track Record

A long and battle-tested track record provides legitimacy to a business. Watch out for:

- How long the company has been in business

- Previous milestones and future roadmap

- Industry partnerships, particularly with major hardware manufacturers

- Any past controversies, regulatory issues, payment delays

- Backing from recognized investment firms

Also pay attention to whether the company has endured crypto cycles (bull and bear markets) to get an idea of their resilience.

The Best Cloud Mining Platforms in 2025

A few platforms have established themselves amongst competitors through consistent operations and user satisfaction.

Binance Cloud Mining

Binance is the world’s largest crypto exchange, and its infrastructure is leveraged to offer cloud mining services. The main benefit is integration with Binance’s ecosystem, allowing seamless transfers, consolidated management, and trading features. Bitcoin cloud mining contracts typically last from 6 months to 1 year, with daily payouts to Binance accounts.

One downside is that there may be limited altcoin options compared to some specialized providers. Cryptocurrencies available for mining include BTC, ETHW, ETC, BCH, LTC, DOGE, PEPE, CFX, ZEC, RVN, DASH, KAS, and CKB. There are also geo restrictions in place, with the US, Canada (Ontario), and other jurisdictions restricted likely due to regulatory requirements.

YouHodler (previously StormGain)

Youhodler offers a mobile-first cloud mining model. Through Youhodler’s mobile app, you can mine up to 0.05 BTC per month through a gamified experience.

The returns are generally modest however, and the service is viewed primarily as an educational tool. Youhodler’s platform also features trading, wallet services, and educational resources.

Ecos

ECOS offers BTC mining contracts starting as low as $150. This comes with comprehensive analytics, profitability calculators, mobile apps, integrated wallet services, and all done through transparent fees.

ECOS is regulated and based in Armenia’s Free Economic Zone. This regulatory framework provides legal protections and dispute resolution methods, unlike many other cloud mining providers. ECOS also has partnerships with major manufacturers like Bitmain. Some users have raised concerns about customer support concerns / fee issues, and is a reminder to carefully evaluate contract terms and maintenance fees.

BeMine

BeMine offers a fractional ownership model allowing users to purchase shares of actual ASIC equipment rather than abstract hash power. Users can even buy shares as small as 1% of individual machines.

With optimization systems powered by AI, you can automatically switch mining between different cryptocurrencies based on real-time profitability. Features also include live monitoring, mobile apps, and gamified interfaces to help enhance engagement. Facilities are based in regions with low electricity costs to help optimize efficiency.

The downside to BeMine’s fractional ownership model is that users are generally required to have an understanding of basic mining economics, hardware depreciation, and crypto market dynamics. Profitability can depend on a user’s level of knowledge.

Conclusion

As BTC and other cryptocurrencies reach new highs, cloud mining offers mining exposure to users without the technical complexity and high upfront capital associated with traditional mining. The global cloud mining market is expected to reach over $9 billion in value in 2025. As the market matures with more legitimately cloud mining providers and mobile-friendly interfaces to entice new users, the market will likely continue to grow in the years to come.

And whether you're just curious about mining or dreaming about passive income, cloud mining gives pretty much anyone a chance to mine their favorite cryptocurrency without turning their house into a burning server farm. As always though, crypto moves fast! Today's opportunity can become tomorrow's cautionary tale, so keep your eyes open for scams. And remember that learning is all part of the journey of crypto. Happy mining!

Disclaimer: The content provided in this article is for educational and informational purposes only and should not be considered financial or investment advice. Interacting with blockchain, crypto assets, and Web3 applications involves risks, including the potential loss of funds. Venga encourages readers to conduct thorough research and understand the risks before engaging with any crypto assets or blockchain technologies. For more details, please refer to our terms of service.