Table of Contents

Monero’s wild price ride this week wasn’t just another crypto rally, it was likely fueled by one of the biggest hacks we’ve seen in a while.

Let’s break it down.

In Brief:

- A $330M BTC theft likely triggered Monero’s wild price surge

- Hackers laundered funds by swapping BTC into XMR

- Someone may have manipulated the market by also going long on XMR derivatives

- It’s probably not Lazarus Group this time but just smart (and shady) independent actors

💡 First, what’s Monero?

Monero (XMR) is a privacy coin, unlike Bitcoin or Ethereum, its blockchain doesn’t show who sent how much to whom.

That makes it a go-to for privacy advocates, but also, let’s be honest, a tool used by hackers and money launderers looking to disappear their funds.

📈 The Surprise Surge

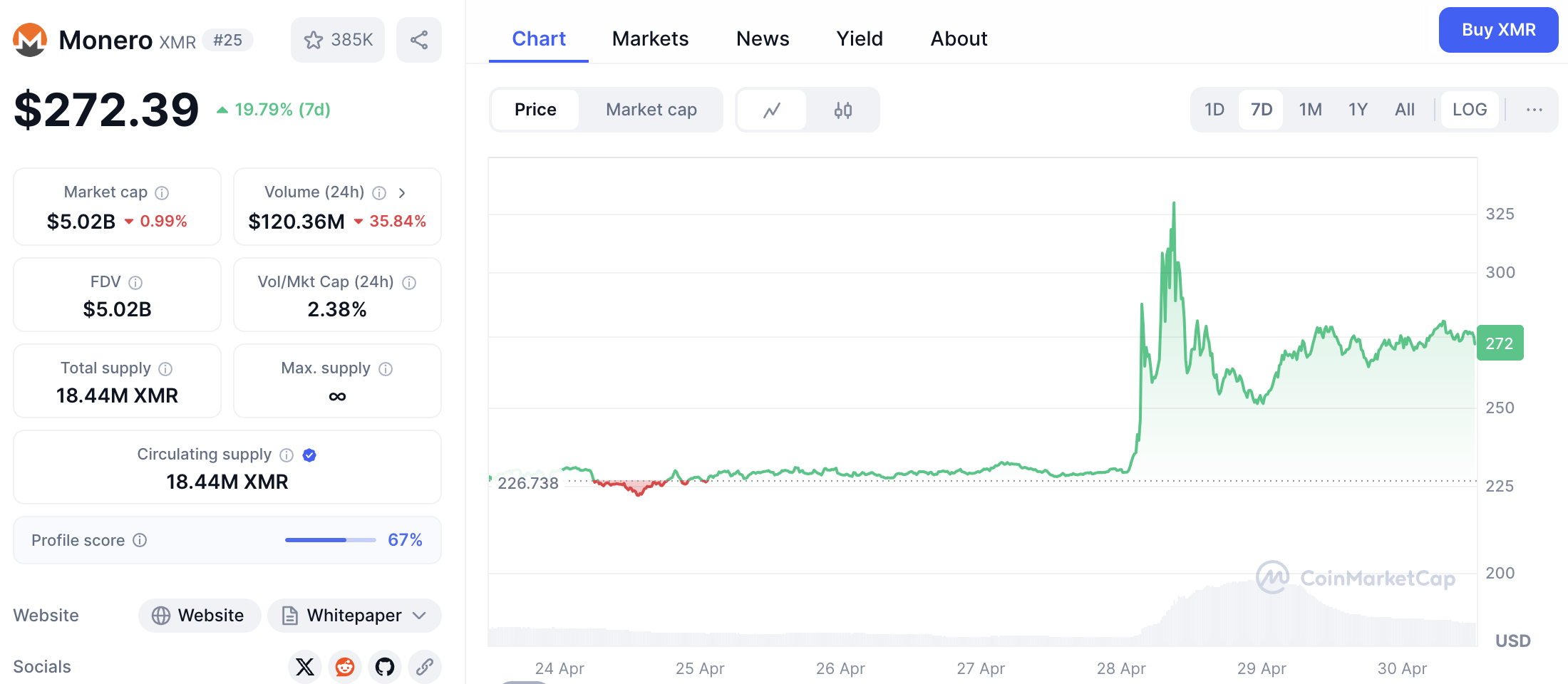

On Monday, Monero suddenly spiked over 50% in a single day, jumping from around $220 to nearly $350 before cooling off to the $250 range. It was the kind of price action that gets traders hyped but something about it didn’t add up.

Enter crypto investigator ZachXBT, who connected the dots.

💰 The $330M BTC Transfer

Zach flagged a suspicious transfer of 3,520 BTC, worth over $330 million, from a long-dormant wallet.

The wallet had ties to exchanges like Gemini, Coinbase, and River, but suddenly started splitting up funds and sending them in small chunks through a web of instant exchanges.

What happened next?

Well... those BTC were swapped for XMR, of course.

🧼 Laundering, Liquidity & a Derivatives Twist

Why Monero? Because it’s tough to trace and even harder to freeze. But Monero isn’t very liquid, meaning big buys move the price fast. The sudden buying pressure likely triggered the massive price surge.

But here’s the kicker, someone may have gone long on Monero derivatives just before the pump. That’s a textbook manipulation strategy: pump the spot price, profit off the derivatives.

According to Coindesk, open interest in XMR futures more than doubled during the spike. way more than expected just from the price move alone.

Someone clearly knew what was coming...

🕵️ Who Did It?

Speculation pointed to North Korea’s Lazarus Group, known for massive crypto heists, but ZachXBT shut that down. He believes this was likely a group of independent hackers, possibly targeting an old-school Bitcoiner.

The stolen BTC could even date back to the early days of crypto, though the exact origin remains unclear.

This wasn’t a rally, it was a crypto thriller in real time!

Disclaimer: The content provided in this article is for educational and informational purposes only and should not be considered financial or investment advice. Interacting with blockchain, crypto assets, and Web3 applications involves risks, including the potential loss of funds. Venga encourages readers to conduct thorough research and understand the risks before engaging with any crypto assets or blockchain technologies. For more details, please refer to our terms of service.