Table of Contents

Did you know crypto meets Wall Street in a way that lets investors participate without needing blockchain knowledge nor private keys?

Yes! You can now totally invest in crypto without needing to set up the related wallets nor bothering with the seed phrases.

But how? Through ETFs (Exchange-Traded Funds). A Crypto ETF lets you invest in crypto through the more familiar routes of traditional finance. You get a slice of the cryptocurrency market without having to worry about buying coins or managing wallets.

More and more investors are turning to crypto ETFs because they make dipping into crypto simple, safe, and hassle-free. An easy way to join the crypto conversation while keeping things familiar.

In this piece, we will be exploring what a crypto ETF is, how it functions, and why it matters for investors seeking safe, regulated crypto exposure. Venga!

What Is a Crypto ETF and Why Does It Matter?

An ETF is simply a basket of assets like stocks, bonds, or commodities that you can buy or sell on a stock exchange, just like an ordinary stock.

Some characteristics:

- Diversification: instead of betting everything on one asset, you get exposure to many.

- Liquidity: you can buy or sell anytime the market is absolutely open.

- Transparency: you can see exactly what’s inside the basket, how it’s tracked, and what fees apply.

Now, what’s a Crypto ETF?A crypto ETF works the same way as a normal ETF, but in this case the basket holds cryptocurrencies or tracks their prices. This means you can invest in crypto without buying or storing coins yourself. You conveniently get the benefits of an ETF while dipping into the cryptomarket safely and conveniently.

Crypto ETFs make it super easy to invest in crypto through the same channels you already use for stocks or other funds. They open the door for everyone to access digital assets safely and conveniently from first-time investors to experienced pros. Evidently, crypto is moving out of niche markets into everyday portfolios, helping bridge the gap between traditional finance and the digital asset world.

How ETFs Apply to Cryptocurrency Markets

Applying the ETFs models to crypto can be explained in two ways:

- Tracking Crypto currencies

When the ETF holds cryptocurrencies, it tracks their movements. Just as stocks. The ETF rises and falls when the prices of the coins go up and down respectively.

- Track companies or blockchain infrastructure

Here, the ETF invests in businesses involved in blockchain or crypto, like mining companies, exchanges, or tech firms. Its value reflects how these companies perform in the crypto space.

Both approaches allow you to participate in the crypto market without handling coins themself nor the need for wallets. This can be entirely done through your brokerage account; a great way to explore crypto from a soft and comfortable spot.

What Makes a Crypto ETF Different from a Traditional ETF?

Even though ETFs share the same structure as traditional ETFs, there are a few key differences you should keep in mind as an investor.

Think of it as dipping your toes into the crypto pool without diving in head first. Think of a smooth, familiar, easy, no-fuss ticket into the crypto party, just remember: big rewards often come with big swings.

What Types of Crypto ETFs Exist?

Here, let's look at some crypto ETFs. You will be amazed by their advantages as well as knowing their risk profile that will help you invest smarter.

- Spot Crypto ETFs

Spot Crypto ETFs are like your VIP pass to the crypto world. They hold the actual coins, like Bitcoin or Ether. Their values move almost exactly with the price of the crypto.

This is the closest you can get to owning a crypto without having to deal with a wallet nor with private keys. A good example is the iShares Bitcoin Trust (IBIT). But just like every VIP pass, fees can be higher, and regulators are watching closely.

- Futures-Based Crypto ETFs

Future-Based crypto ETFs are for big gamers, those who want to bet on where crypto prices will go without actually owning the coin. They invest in futures contracts, an agreement to buy or sell crypto at a set price in the future.

The ProShares Bitcoin Strategy ETF (BITO) tracks Bitcoin futures contracts which will allow you to speculate on Bitcoin's future price movements without owning the cryptocurrency itself.

Here is the heads up: Prices can sometimes drift from the actual coin's value, and rolling over contracts can add extra costs.

- Blockchain-Themed ETFs

Blockchain-themed ETFs don’t hold cryptocurrencies themselves. Instead, they invest in companies building or using blockchain technology, like crypto miners, exchanges, or tech firms developing blockchain solutions. More like investing from the backdoor.

A good example will be the Siren Nasdaq NexGen Economy ETF (BLCN) that tracks companies involved in blockchain technology, such as Accenture and Qualcomm.Think of it as investing in the engine behind crypto.

How Does a Crypto ETF Work in Practice?

You now already have a grasp of what an ETF is and how it works. If you are thinking "similar to a traditional ETF", you are correct. But instead of holding stocks or bonds, they hold cryptocurrencies or crypto-related assets. Let's look at its mechanics of Creation and Redemption for better understanding.

Fund Creation and Redemption

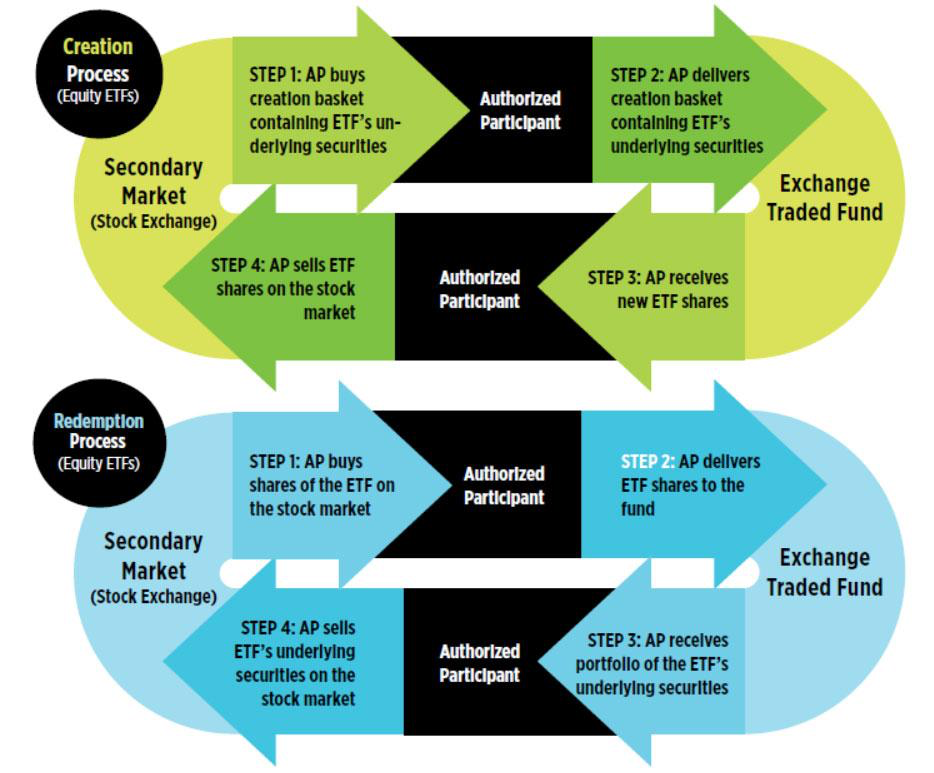

Fund Creation: As the word suggests it simply means creating a new fund. How does this process take place? When demand for a crypto ETF goes up, big financial institutions called authorized participants (APs) can create new ETF shares.

They do this by giving the fund the right assets (like Bitcoin, Ether, or futures contracts). In return, the fund gives them new ETF shares, which they can then sell to investors on the stock market. All this happens quietly once a day based on Net Asset Value (NAV).

Fund Redemption: This process happens when demand goes down, when there are more ETF shares in the market than needed. Authorized participants then take ETF shares from the market and return them to the fund. In exchange, the fund gives them the underlying assets the ETF holds.

For example, for a spot crypto ETF, that would be actual coins like Bitcoin or Ether, and for a futures-based ETF, it would be futures contracts. The returned ETF shares are then removed from circulation, reducing the total number of shares available. This back-and-forth magic keeps the ETF’s price tight with the real crypto value, making sure it doesn’t wander off like a lost coin on the market.

How Crypto ETF Prices Keep Up with the Market

Crypto ETFs mirror the performance of the crypto market. Let's take for example Spot ETFs, they move almost hand-in-hand with the real coins. If Bitcoin jumps, your ETF usually jumps too. Futures-based ETFs track crypto futures, while blockchain-themed ETFs ride the wave of companies building the crypto universe.

Heads-up: Though sometimes the price isn’t perfectly synced, futures ETFs can drift a bit because of contract rolling, and blockchain ETFs can be swayed by stock market vibes. But overall, these ETFs are designed to stick close to the real action, giving you a chill way to surf the crypto waves without touching a wallet.

What Are the Benefits of Investing in a Crypto ETF?

Generally, the pecks in crypto are many, likewise we can't get enough of crypto EFT. I can guess now we all are thinking of investing ASAP. Let's quickly reaffirm on the benefits of investing in crypto EFTs

- Easy access: No wallets, no private keys, just buy through your regular brokerage. Easy-peasy.

- Diversification: Diversify across coins or blockchain companies to lower risk. Spread the love, it's just that simple with ETFs.

- Trade anytime: ETFs move with the market, jump in and out, buy and sell anytime the market is open.

- Full transparency: See what you own, no guessing games.

- Regulated & safe-ish: Many ETFs are regulated by rules, audits, and custody protections all have your back.

What Are the Risks and Limitations of Crypto ETFs?

We would be bluffing if we say crypto ETFs are all sunshine, rainbow and moonshoots. Anything-crypto comes with a little rainfall then comes the rainbow. It's important to know its limitations as we look forward to sunny days.

- Volatility and Market Uncertainty: With crypto it's always a rollercoaster, so buckle up. Even though ETFs can make investing easier, they can’t escape crypto’s wild swings. Prices can jump or drop fast, and your ETF will ride those same waves along with them.

- Tracking Errors and Management Fees: Crypto ETFs aim to mirror the underlying assets, they are not the assets themselves. They are obviously not perfect. Spot ETFs track actual coins, futures ETFs follow contracts, and blockchain ETFs follow company stocks. Each can at any time drift slightly from the real market. On top of that, management fees take a bite out of returns, so your gains aren’t 100% pure crypto juice.

- Regional Restrictions and Limited Availability: Unfortunately not every country is buying the idea of crypto ETFs. Some places don’t allow them at all, while others have strict rules holding them by the neck. That means your access to crypto ETFs might be at the mercy of your location.

Which Are the Most Popular Crypto ETFs Around the World?

Crypto has been under regulations, crypto EFTs are not left out flying under the radar just because they are EFTs. They’re green-lit and watched over by big regulators like the U.S. SEC, Canada’s CSA, and European financial authorities. Which to a greater extent is good for investors because these funds play by the rules, so investors get some peace of mind while riding the crypto wave.

Check out the hottest crypto ETFs worldwide.

In January 2024, the SEC said "yes" to Spot Bitcoin ETFs from big names like BlackRock, Fidelity, and Grayscale. This was just the spark Bitcoin needed to light up the market, get Wall Street buzzing, and make money flow into Bitcoin without the wallets and seed phrases.

The SEC has also been creating conducive atmospheres for crypto ETFs. In September 2025, it dropped a jaw breaking announcement, changing the 240 days wait to 75 days only for ETF issuers. This means we are not only talking Bitcoin and Ether ETFs anymore; get ready for a whole buffet of crypto ETFs hitting the market.

Buying Crypto ETFs Vs Buying Crypto Itself.

In the crypto world, we have those who wouldn't mind going in heads-on, and those who want just to take a foot dip. In either case, we all want to be part of crypto in one way or the other whether it means through crypto ETFs or through buying crypto itself. In this section, we will look at the differences while, you decide for yourself what kind of crypto holder you want to be.

Ownership, Control, and Security

Buying crypto directly means you own the coins. Every Bitcoin or Ether you buy is all yours, and you control where it’s stored, be it in hot or cold wallets. That also means you’re responsible for safekeeping (wallets, and private keys), lose them, and puff, they’re gone! Crypto ETFs, on the other hand, hold the crypto for you, so you get price exposure without handling the coins yourself. Less stress, but also less control.

Convenience vs. Autonomy

ETFs are so easy, you buy them through your normal brokerage account, and the fund handles storage, security, and compliance. Super convenient, especially if you’re just dipping a toe in. Direct ownership is the full DIY experience. Total autonomy, but more responsibilities. You’re the captain of your crypto ship, and there’s no autopilot. Be ready to "Jack Sparrow" your ship by yourself.

So is Investing in a Crypto ETF Right for You?

At this point, you already know the difference between holding crypto ETFs and holding crypto itself. If you just want to watch the crypto match from the bench, crypto ETFs give you the comfort but if you’re the type who loves full control, autonomy, and doesn’t mind the extra responsibility, buying crypto directly might be more your style.

At the end of the day, your focus should be matching your choice to your risk tolerance and investment goals. Whether you go ETF or DIY, make sure it vibes with your strategy and enjoy the ride.

Disclaimer: The content provided in this article is for educational and informational purposes only and should not be considered financial or investment advice. Interacting with blockchain, crypto assets, and Web3 applications involves risks, including the potential loss of funds. Venga encourages readers to conduct thorough research and understand the risks before engaging with any crypto assets or blockchain technologies. For more details, please refer to our terms of service.