Table of Contents

Sustainability is a primary consideration of modern times. Most industries run off finite, nonrenewable energy sources that will one day go dry. Oil and gas are estimated to exhaust within 50 years, while coal’s expiry date sits around 130 years, if consumption rates stay the same.

Business-wise, planning the future on sources that become scarcer is a major operational risk. However, the biggest problem of using fossil fuels is that it is not about availability; it is about the climate.

Human-induced carbon dioxide (CO₂) emissions are approximately 90% due to fossil fuel usage. The elevated CO₂ levels create a greenhouse effect which results in warmer average temperatures, extreme weather and degraded ecosystems.

In addition, since the Industrial Revolution, the earth's average surface temperature has risen by an estimated 1.5°C. Furthermore, projected increases in the average global temperature are expected to be another 1.5°C by the end of this century.

Such a rise in temperature could cause up to 90% of coral reefs to be diminished, one ice-free summer on the Arctic Ocean each century and the sea levels to rise by 77 cm (30.31 inches). That translates to hundreds of millions of people losing their living space and being displaced.

Sustainability is also a real concern in the cryptocurrency space. Below we look at energy use in blockchains, how lower-energy designs reduce environmental impact and a few green cryptocurrencies worth watching.

The Problem of Energy Consumption in Traditional Cryptocurrencies

The business cycle is the same in most blockchains: transactions are gathered in blocks, the network agrees on the validity of blocks, they are confirmed by block producers and new coins are released as block rewards after confirmation.

The key distinction regarding energy usage lies in the way the blockchain achieves consensus and the method used to create the blocks. The early generation of blockchain networks, which include Bitcoin, utilizes the Proof-of-Work (PoW) consensus mechanism. It relies on miners using large amounts of computing power to perform extensive hashing calculations to produce new blocks.

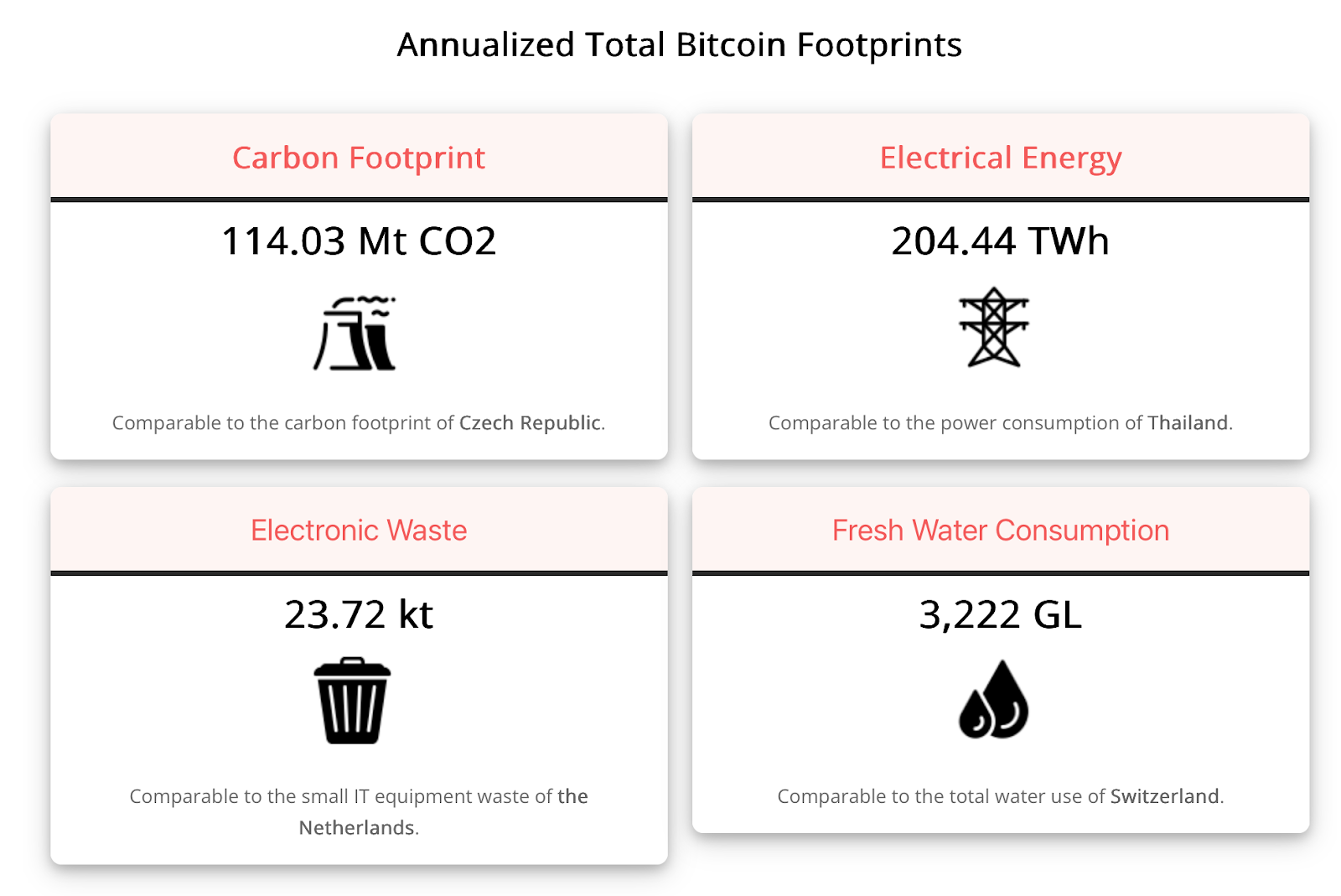

Mining is a highly energy-intensive process. Bitcoin alone is estimated to consume around 204 TWh of electricity annually. The number far exceeds the annual electricity consumption of entire countries, like Poland, the Netherlands and Thailand.

What’s more, nearly half of Bitcoin mining operations depend on fossil fuels. Though renewable energy use rises, Bitcoin’s carbon footprint is still as large as the Czech Republic.

How Eco-Friendly Blockchains Work

Blockchain technology is decentralized. There are no intermediaries and no central authority to hold accountable; instead, trust is established by network participants who put something at stake.

In PoW blockchains, that is the energy spent through mining. Later consensus mechanisms, such as Proof-of-Stake, Proof-of-Authority and Delegated Proof-of-Stake, introduced structures to build trust with much less energy.

Proof-of-Work vs. Proof-of-Stake: The Energy Debate

Proof-of-Stake (PoS) replaced mining with staking, and miners with stakers. The consensus mechanism does not require spending computing power to produce blocks; instead, validators who stake (in other words, lock) a certain amount in the blockchain do the job.

PoS lowers the energy needs of a blockchain enormously. A famous example of that reduction is Ethereum.

After seven years with PoW, Ethereum migrated to the PoS consensus mechanism in 2022 through an event dubbed “The Merge.” The blockchain is now run by validators that stake ETH to compete for and confirm blocks.

Ethereum had been consuming around 28 TWh of electricity annually before The Merge, a number comparable to the yearly consumption of Serbia and Ireland. Migration to PoS reduced Ethereum’s electricity consumption by over 99 percent to 0.0026 TWh.

Alternative Consensus Mechanisms: PoA, PoH, DPoS, and Beyond

PoS is not the only consensus mechanism that is considered “green.” Other approaches reach consensus differently while still keeping energy use much lower.

- Proof-of-Authority (PoA): This mechanism is widely used by permissioned blockchains. There is no mining or staking on PoA; it is run by validators that are selected by an authorized group. What is at stake this time is reputation; validators are not anonymous and have to go through an identification process.

- Proof-of-History (PoH): It can be described as a supporting consensus mechanism, which usually complements PoS. Transactions are confirmed by validators that stake a certain amount. PoH adds a shared clock to the mix. Network participants use this clock as reference and agree on transaction order without constant coordination.

- Delegated Proof-of-Stake (DPoS): This consensus mechanism works similarly to PoS, but with some variations. Again, validators produce blocks, but not all stakers become validators. Stakers elect a small group of validators and “delegate” confirmation authority to them.

- Proof of Space and Time (PoST): Blocks are produced through mining on PoST chains, but with much less energy consumption. Miners have to allocate storage space and a certain amount of time to compete for blocks. Contrary to PoW systems, what’s at stake is the investment in hardware power, not the energy.

Green Cryptocurrencies in Simple Terms

As a result of increasing interest in sustainable technologies and eco-friendly consensus methods, there are now what many people would consider "green cryptocurrencies".

Green cryptocurrencies are defined as those that make conscious decisions to lower their own footprint by way of either infrastructure design or direct actions. Most utilize green consensus mechanisms as well as equipment that uses much less power than did most of the older high-energy coins. Some green cryptocurrencies go beyond just limiting the amount of footprint they create, including using renewable energy sources, purchasing carbon credits, and promoting environmental causes.

Top Green Cryptocurrencies to Watch

Plenty of projects now describe themselves as green cryptocurrencies. A few have gained attention for their transition to PoS:

Ethereum (ETH)

ETH is currently the largest altcoin in terms of market capitalization and contains one of the biggest ecosystems on any blockchain. Ethereum recently transitioned from Proof-of-Work to Proof-of-Stake (PoS) and has drastically cut its energy consumption.

The community also began work on an initiative known as the Ethereum Climate Platform after the transition, which was named “The Merge”. This initiative will seek out projects that reduce greenhouse gas emissions and support those projects.

Solana (SOL)

Solana is another major cryptocurrency in the green category. The blockchain uses a combination of PoS and PoH as the consensus mechanism, which keeps energy requirements at the bottom end.

The project presents its environmental concern through its initiatives. The blockchain claims to be “carbon neutral” by buying carbon offsets, and also releases periodic reports on the network’s energy usage and carbon emissions.

Tezos (XTZ)

Tezos utilizes a variation of PoS, called the Liquid Proof-of-Stake. The consensus mechanism requires very low energy to run the blockchain and process transactions.

The blockchain has an ongoing mission of reducing energy usage per transaction, and the metrics are published live on its website on a dashboard.

The blockchain’s environmental impact is also reviewed by a reputable third-party organization, PwC. The Big Four company releases a report on Tezos that explains the impact is kept limited, and can even go lower as the network scales up.

Hedera Hashgraph (HBAR)

Sustainability is a main consideration for Hedera Hashgraph. Apart from developing a unique, energy-efficient consensus mechanism named hashgraph, the blockchain claims to be carbon-negative, as it regularly buys carbon offsets.

Hedera Hashgraph also developed a toolkit for Environmental, Social and Governance (ESG) policies: the Guardian / Sustainability Studio. The platform allows organizations to tokenize such policies and create a verifiable record onchain.

Chia (XCH)

Chia is the innovator of the PoST consensus mechanism. There is no mining or staking involved; network participants spare storage space and time to join governance. PoST lowers energy demands significantly while also ensuring a higher level of decentralization compared to PoS and its variants.

The blockchain aims to be an eco-friendly infrastructure for real-world applications. Chia also supports Climate Action Data Trust (CADT), a decentralized initiative to create a global registry of carbon markets.

Advantages, Risks, and Criticism of Sustainable Cryptocurrencies

Green cryptocurrencies offer the most obvious advantage to the globe: this generation of coins reduce energy usage, carbon emissions and slow down human-induced climate change. Lower energy usage means lower costs for network participants as well.

That said, eco-friendly consensus mechanisms can also introduce centralization risks. In PoS systems, stakers can gain disproportionate power by staking more coins. Minimum staking requirements are high on most chains. So network participants tend to join pools and delegate their voting power in return for a portion of block rewards. Such a layout makes the blockchain vulnerable to possible attacks for personal gain.

Sustainability and environmental preservation are increasingly important matters. Some projects may be capitalizing on this trend by making false eco-friendly claims. This method even has its name, greenwashing, and includes practices like making vague disclosures, not announcing the methodology and releasing misleading metrics.

How to Determine Whether a Coin Is Truly “Green”

A project claiming to be a green cryptocurrency could actually be just taking advantage of the sustainability trend. Below are some factors to consider when determining whether a coin is truly green:

- Check consensus mechanism: A green crypto should be on a low-energy blockchain. See if the blockchain uses consensus mechanisms with less electricity consumption, like PoS, DPoS, PoA and PoH.

- Validator distribution: Concentrated voting power makes the chain vulnerable to attacks. Ensure there is an even distribution among validators.

- Look for reports and audits: A claim is just a claim without proof. Check whether a project releases carbon emissions reports and goes through audits by independent organizations.

- Search for commitments: A project claiming to be green should show an ongoing focus on the environment. Look for sustainability initiatives it supports or partnerships with organizations that share that goal.

Conclusion

Cryptocurrencies have grown into a giant industry in less than 20 years. Some of them made the list of the world’s most valuable assets, but their power consumption has reached levels that rival entire countries.

Blockchain technology kept moving forward and branched into eco-friendly variations. Green cryptocurrencies are built on this infrastructure; energy-intensive mining is replaced by mechanisms with much less electricity consumption and carbon emissions are kept limited.

Some projects with a special focus on sustainability go the extra mile by buying carbon offsets and supporting green initiatives. Though there are some risks involved with green cryptocurrencies like centralization and greenwashing, paying attention to some indicators can help you tell genuine efforts from marketing.

Disclaimer: The content provided in this article is for educational and informational purposes only and should not be considered financial or investment advice. Interacting with blockchain, crypto assets, and Web3 applications involves risks, including the potential loss of funds. Venga encourages readers to conduct thorough research and understand the risks before engaging with any crypto assets or blockchain technologies. For more details, please refer to our terms of service.