Table of Contents

Have you ever heard myths about the spoon? You haven’t — because the spoon is simple, visible, and centuries old. Crypto is the opposite: new, fast-changing, and mostly invisible until you try it — perfect conditions for hot takes to harden into “truth.” As crypto keeps getting easier to use, the myths about it somehow travel faster than your friend who “bought the top.”

With this friendly guide, our aim is to clear up the most common misconceptions with simple explanations.

Why Are There So Many Myths About Crypto?

Short answer: myths thrive where things change fast and most of the action happens out of sight. Crypto’s “plumbing” — private keys, consensus rules, token design — operates behind the scenes, while the parts you do see run 24/7 and can swing wildly. That combo invites neat stories that travel faster than nuance: a memeable headline beats a careful explainer, feeds reward outrage, and influencers chase clout with takes that outpace corrections.

Jargon doesn’t help; words like “staking,” “gas fees,” or “layer-2” sound like spells until someone shows you what they mean in a wallet. Screenshots circulate out of context, and recycled talking points from past tech booms resurface to create media buzz, while real-world progress happens in quiet. Routine use of cryptocurrencies like paying a bill, sending money home, or redeeming a loyalty perk rarely makes the news.

The Rise of Crypto and the Spread of Misinformation

Crypto adoption lands as millions of tiny moments — QR scans at cafés, Sunday remittances, in-game items traded without a bank, loyalty points that live on-chain. Even as markets rally and institutional interest grows, those everyday wins are missing from the headlines, which favor hacks or moonshots.

Misinformation is everywhere right now, and cryptocurrencies get more than their share. Core ideas like private keys and smart contracts are complex concepts for mainstream audiences, and media and quick-hit explainers take advantage by flattening them into lines like “wallets are bank accounts” or “it’s all scams.”

With markets running 24/7, sharp moves and fresh headlines hit at all hours, stoking outrage feeds and giving bad claims a constant push. So let’s clear the air. Below, we’ll start by debunking common claims about cryptocurrencies, then walk through the basics in clear language, and finish with habits you can use the next time you tap the Pay button.

Why It’s Important to Separate Fact from Fiction

Myths don’t just waste scroll time — they steer decisions. If you assume crypto is only for crime, you’ll skip cheaper cross-border payments and stick with slow and pricey rails. If you think every network “chews through oceans of energy,” you’ll miss that many popular chains now run on low-energy designs and that usage patterns differ by technology.

Lumping everything together causes everyday friction. Treat all “coins” as interchangeable, and you’ll try to buy groceries with a gaming token, then blame “crypto” when the cashier stares back.

Confuse price with value, and the “cheap” coin at a few cents suddenly looks like a bargain, even if its supply is massive. Mix up custody risk (how you store assets) with network risk (how the chain works), and you might leave savings on an unsafe exchange while worrying about the wrong thing.

Clear facts lead to safer choices. You can match the right tool to the job: stablecoins for budgeting or remittances, a major network for long-term savings, a test wallet for experiments. You’ll know where fees come from, when they spike, and how to avoid them. You’ll set small but powerful protections — off-platform backups, spending limits, alerts — that save headaches later.

Myth #1: Cryptocurrency Uses More Energy Than Most Industries

Short answer: no — and the context matters. The big energy headline is Bitcoin’s proof-of-work (PoW), where computers compete to add blocks (security via real-world cost). U.S. Energy Information Administration estimates Bitcoin’s 2023 electricity use around ~120 TWh (terawatt-hours), which accounts for roughly 0.2%–0.9% of the global demand — material, yes, but nowhere near “most industries” (and try to guess how much AI use consumes nowadays).

In comparison, data centres consumed about 460 TWh in 2022, with predictions that it could reach 1,000 TWh by 2026. According to the International Energy Agency (IEA), this prediction is roughly equivalent to Japan’s electricity consumption.

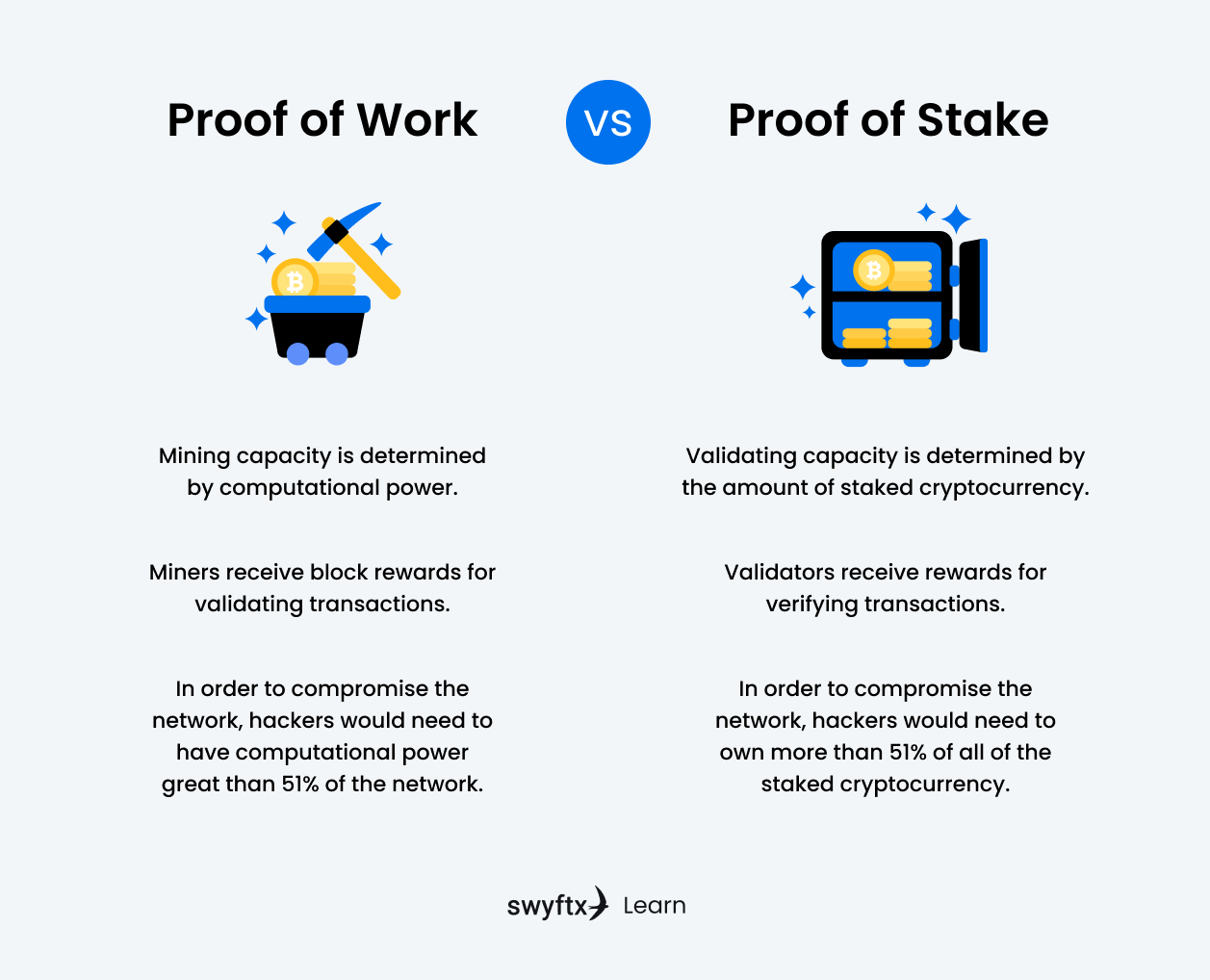

Also, not all crypto uses PoW. Major networks like Ethereum shifted to proof-of-stake (PoS) in 2022 — validators stake coins instead of burning energy — cutting network electricity by orders of magnitude. Meanwhile, mining hardware gets more efficient, and more sites run on surplus renewables, pairing better economics with a smaller footprint.

Myth #2: Bitcoin Mining Is Inherently Wasteful

PoW uses energy by design — the cost that secures an open, tamper-resistant ledger. But “inherently wasteful” ignores how mining is evolving on three fronts.

First, miners keep getting more efficient. Newer ASICs deliver more power per watt , and efficiency has steadily improved; even regulators track the trend. The network also hardens its security without increased electricity use as older machines get retired.

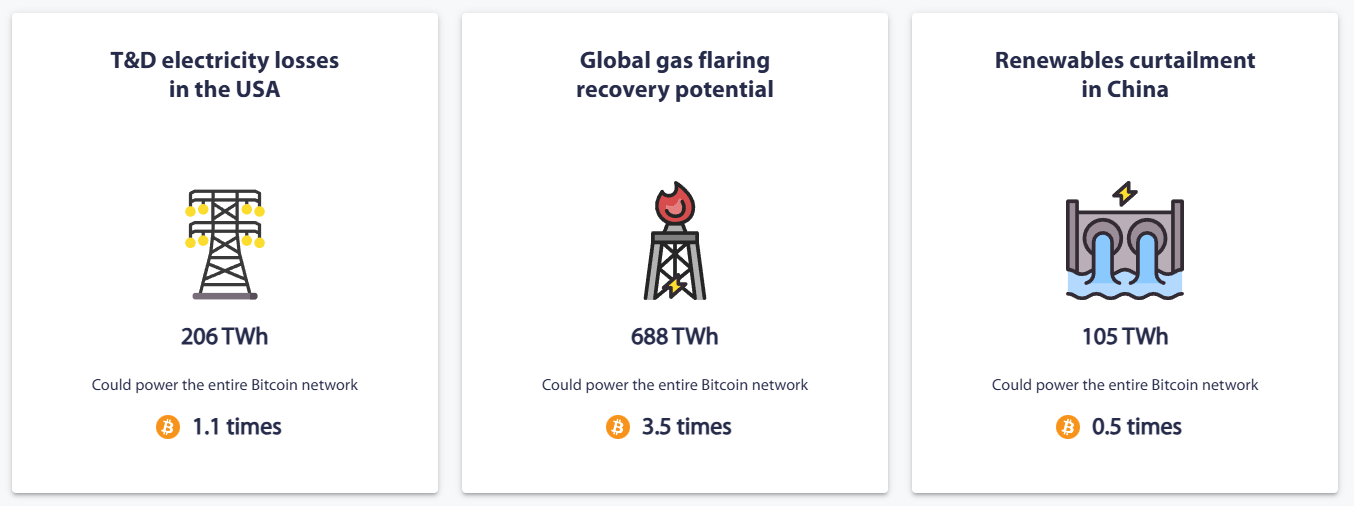

Second, miners increasingly monetize energy that would otherwise be wasted. At oil sites, for example, the gas that would normally be flared can be fed into small generators to make electricity on-site, and that power runs mining rigs instead of being burned off into the air. Because the gas is burned more completely in a generator than in an open flare, far less methane leaks. According to the Cambridge Bitcoin Electricity Consumption Index, global gas flaring recovery could power the entire Bitcoin network 3.5 times.

It’s not a free pass for fossil fuels, but it turns a liability into something useful while producers and regulators work on longer-term fixes. You’ll also see similar “use-what-would-be-wasted” setups with surplus hydro or wind at off-peak hours, where cheap, otherwise curtailed energy is converted into compute.

Third, mining behaves like a flexible, interruptible load that can stabilize grids. In Texas, large facilities powered down during peak stress in formal demand-response programs, freeing capacity for homes and hospitals.

On energy sources, estimates differ by study and season as miners move, grids change, and methods vary; so you’ll see a range rather than a single “right” number. What’s clearer is the direction: more sites are parking next to surplus or lower-carbon power because it’s abundant and affordable. That trend doesn’t fix every concern, but it steadily links more computing to cleaner, otherwise underused electricity.

Myth #3: Blockchain Can’t Contribute to Sustainability

“Blockchain = bad for the planet” is an old take. Today’s reality: major networks run on PoS (validators lock coins instead of burning energy), slashing energy usage by about 99.84% in Ethereum’s example — removing the headline objection and clearing space for real ESG wins.

Environmental (E): Transparent supply chains curb waste and greenwashing. Walmart’s Hyperledger-based traceability shrank mango traceback from seven days to 2.2 seconds — the kind of proof-of-origin auditors use.

Social (S): Humanitarian cash aid gets faster and more accountable on a shared ledger. The UN World Food Programme’s Building Blocks has supported refugees in Jordan and Bangladesh and saved millions in bank fees.

Governance (G): Carbon markets need integrity and audit trails. Bank-backed infrastructure like Carbonplace aims to bring settlement-grade rails — traceability, retirement records, and institutional access — to voluntary credits, with nine global banks collectively investing $45 million in the platform.

Through-line: verifiable data. Tamper-evident records + automated rules (smart contracts) make claims checkable, incentives programmable, and reporting audit-ready. Energy debates still matter for PoW chains, but painting all blockchains with one brush misses projects already delivering measurable sustainability outcomes.

Myth #4: Crypto Is Mostly Used for Illegal Activities

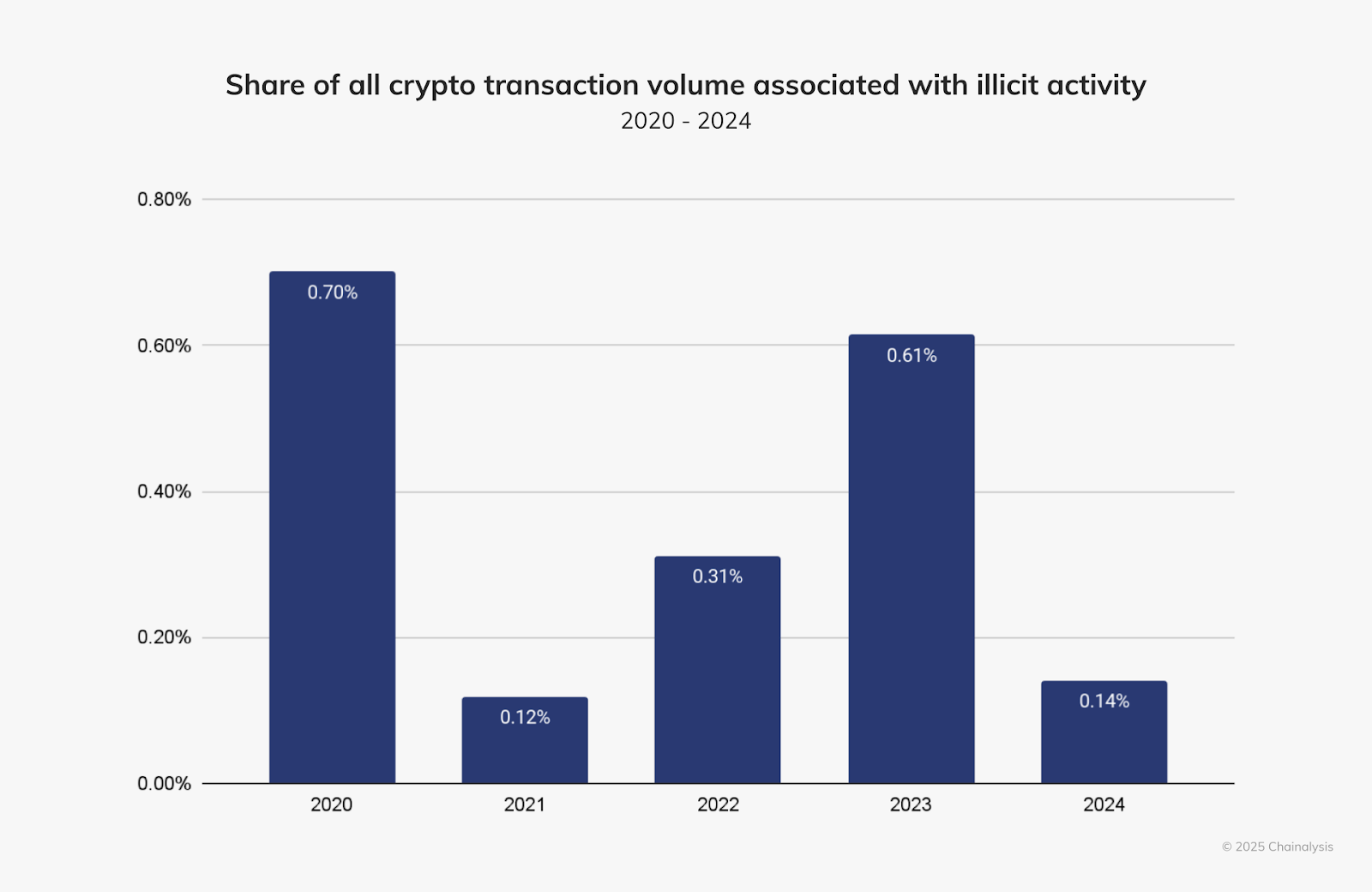

Nope. The illicit share of crypto activity is a tiny slice, not the main course. TRM Labs claims that in 2024, illicit crypto volume was 0.4% of total transactions (down from 0.86% in 2023) — a sliver of the overall flow. Chainalysis likewise shows $40.9 billion flowing to bad actors in 2024; however, that represents only 0.14% of the total on-chain transaction volume. In other words, the dollars are headline-worthy, but the base rate is small.

Because analysts track cryptocurrency figures from public blockchains, the percentages can wiggle with headlines, but they remain low. Separate studies reach similar conclusions: most crypto goes to everyday payments, trading, and investing, not crime. To put numbers on it, one report pegged 2020’s illicit crypto at 0.34%, whereas economist Ken Rogoff estimates roughly a third of U.S. cash is unaccounted for, likely crime or tax evasion.

Cryptocurrency is also unusually traceable. The DOJ’s Colonial Pipeline recovery and regular multi-agency seizures show that on-chain flows aid investigations rather than hide them. Regulators reflect this with the FATF pushing “same risk, same rules” for virtual-asset services, and the U.S. Treasury still highlighting cash —not cryptocurrencies— as the main laundering rail.

Myth #5: Cryptocurrencies Have No Intrinsic Value

“Intrinsic value” isn’t just about cash flows. In decentralized networks, value emerges from verifiable scarcity and real demand for blockspace (the finite capacity to record activity on-chain). Bitcoin is the cleanest example: a hard cap of 21 million and a censorship-resistant settlement that people willingly pay for.

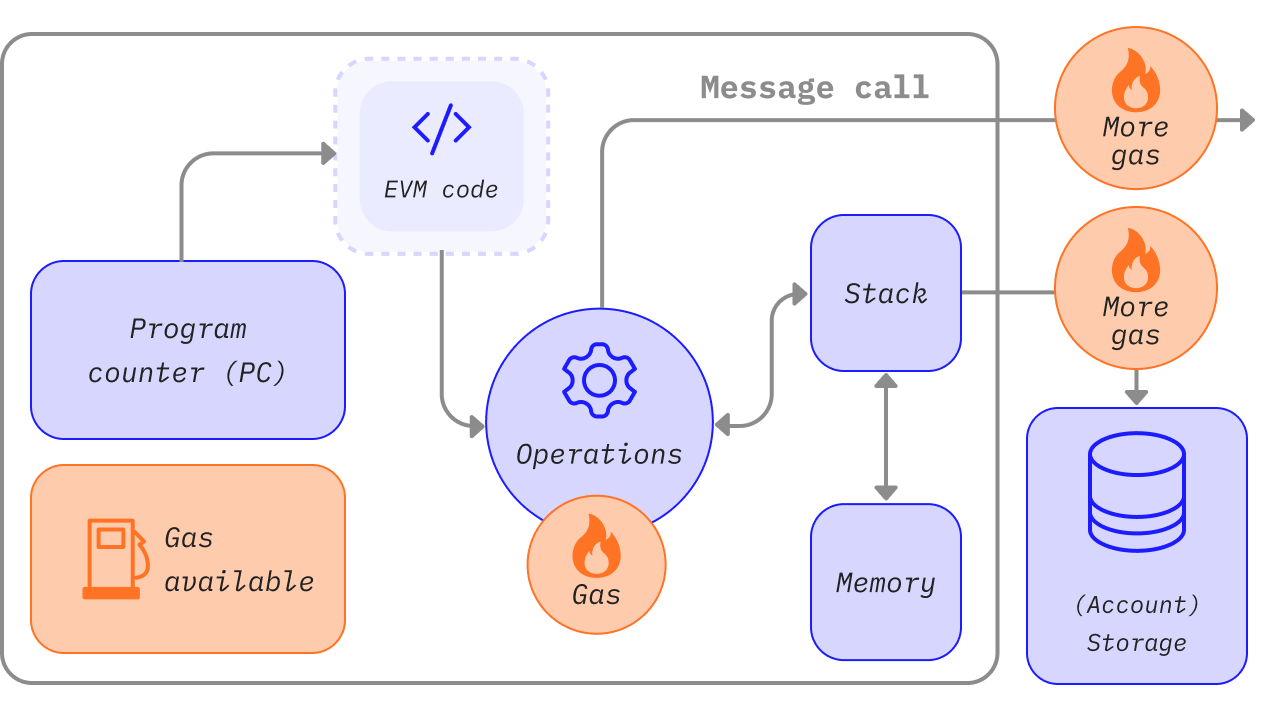

On Ethereum, users spend gas to run apps and settle trades. A base portion of each gas fee is automatically burned, so heavy usage can reduce net supply and tie network activity to ETH’s economics.

Some tokens also grant utility and governance (voting rights on protocol rules) or serve as staking collateral that secures PoS networks and earns rewards. In practice, judge an asset by what it lets people do and how its token is wired into that system.

Myth #6: All Cryptocurrencies Are the Same

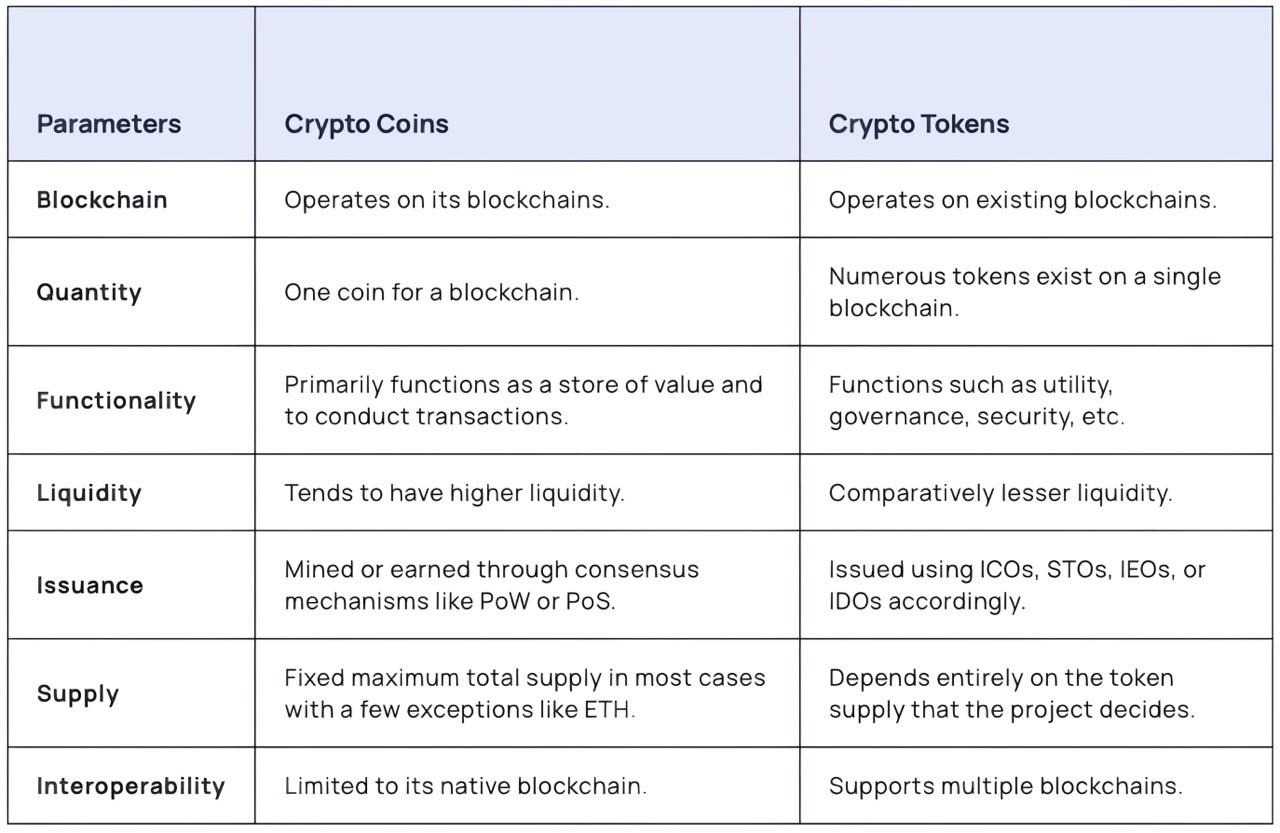

Saying all cryptocurrencies are the same is like saying every app is just “software.” Coins such as Bitcoin are the native money of their own networks — securing the chain and paying fees. Tokens ride on other chains via smart contracts and can represent utilities, governance rights, or assets.

Design goals differ, so risks do, too. Stablecoins aim for price stability (for example, $1 targets), trading off smart contract and issuer risk for predictability. Governance tokens let communities steer upgrades and treasuries. Privacy coins offer holders on-chain confidentiality via advanced cryptography.

The bottom line is that there are different architectures and use cases — some act like digital cash, some fuel the network, some give holders voting power, and some offer users dollar rails or privacy layers. Judge each asset by what it does, not what it’s called.

Conclusion

Crypto isn’t simple and settled like a spoon, but its myths don’t have to run the menu. The landscape moves fast, so the best defense is education. Every crypto user should learn how wallets and blockspace actually work. When in doubt, your first instinct should be to read the primary docs, not scroll Reddit for a hot take.

Stay open-minded, but bring a good BS filter. Give credit to real progress, like low-energy PoS and better compliance tools, while keeping the risks in view, such as scams, custody errors, or market swings.

If you’re investing, treat each network by what it actually does: its goals, trade-offs, and whether it has real users. With clear info and steady habits, the crypto carnival is less of a haunted house and more of a theme park — still crazy but safer and easier to navigate.

Disclaimer: The content provided in this article is for educational and informational purposes only and should not be considered financial or investment advice. Interacting with blockchain, crypto assets, and Web3 applications involves risks, including the potential loss of funds. Venga encourages readers to conduct thorough research and understand the risks before engaging with any crypto assets or blockchain technologies. For more details, please refer to our terms of service.