Table of Contents

You’ve surely heard that 1 Bitcoin (BTC) equals about $100,000, so now it’s too late? Is this crypto thing reserved for the big fish only? There’s no way to begin with $100k! Well, good news: you don’t need to buy a whole coin. Not a whole BTC, not a whole Ether (ETH), not a whole nothing. You can start with a really small crypto investment, $1 or even less, depending on the network and its transaction fees.

Indeed, you should start with small, and slowly. Crypto investments may be profitable and offer other advantages as well, but we need to admit that they’re not exactly the most stable thing around. Cryptocurrencies are volatile, which means their prices can be like a rollercoaster. Learn pros, cons, and tricks first!

Why Is Starting Small in Crypto a Smart Move?

Let’s imagine that a new, experimental bank opened its doors in your region. They’re promising 20% annual interest to everyone who has a savings account with them, but their app is somehow complex to handle. Would you jump into it with all your life savings, right away? If your answer is no, good for you. If you said yes, you need to engrave this mantra into your mind: DYOR —Do Your Own Research.

The promise of that hypothetical bank, even the promise of many legitimate cryptocurrencies, may be true. However, the first obligatory step is to DYOR, and then never bet something you’re not willing to lose. Let alone if you’re just getting started. You’ll need to gain some intel and experience first, discover market dynamics, and experiment with wallets, types of crypto, and resources. The last thing you’ll need in crypto is to make an impulsive decision.

Understanding the Basics of Cryptocurrency

It’s easy to feel overwhelmed when you get started, but it gets clearer fast. Do you even know what a cryptocurrency is? If you thought “it’s like PayPal,” you’ve failed the test. PayPal is a company and a platform for transacting money. Cryptocurrencies are money, themselves. Just like USD, EUR, or even gold.

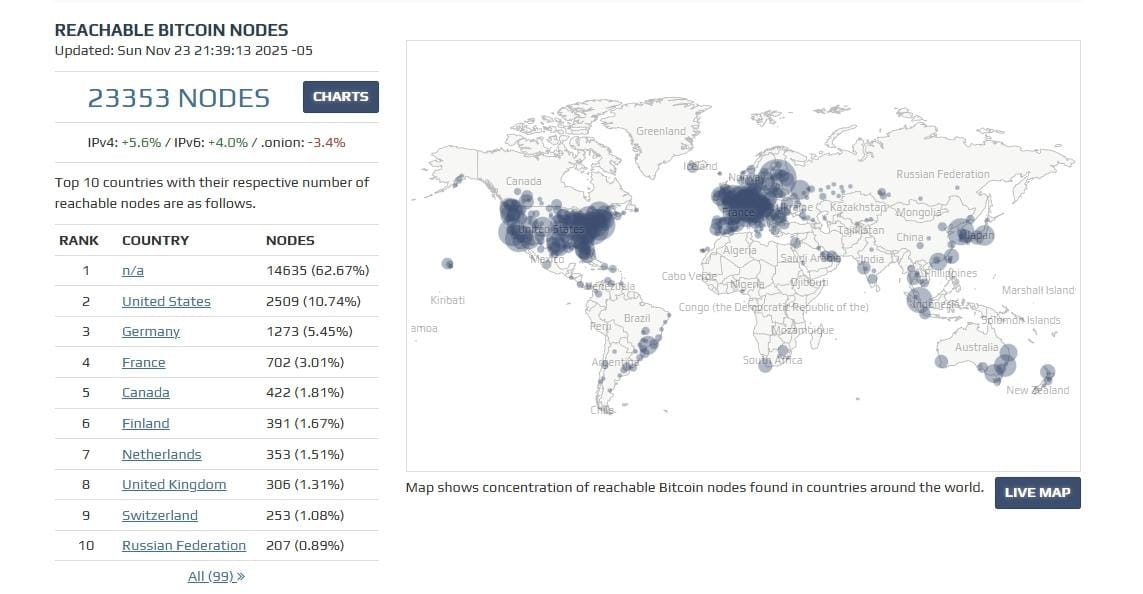

They’re digital assets secured with advanced cryptography that are created and registered forever inside a distributed ledger (blockchain). This registry is “distributed” among hundreds or thousands of nodes (computers) worldwide. Those nodes can be handled by anyone: if you want to download one, you could.

So, someone built this software to create money… but why does this money have any value if it’s not backed by any government? Well, you can consult the theory of supply and demand. But the basics are that people buy this because they’re interested in the benefits. Cryptos are a type of money without borders, decentralized, instantaneous, portable, and without access requirements. They’re also home to smart contracts designed for many applications, including investments.

Additionally, as a new kind of asset, their volatility works very well to apply some neat trading strategies.

What to Know Before You Invest in Crypto

Of course, the more you know, the better. But if you’re wondering where to start before investing in crypto, there are some essential factors you can’t overlook.

Understand Exactly What You’re Investing In

We already told you what cryptocurrencies are, but there are thousands of them around. Bitcoin isn’t the same as Ethereum, Ethereum isn’t the same as Avalanche, and Avalanche isn’t the same as Dogecoin. All of them are different not only in underlying technology, but also in development teams, goals, use cases, reputation, and communities. Before investing any amount into any coin, DYOR as much as you can about them.

A good place to start is their official websites, if they have one (Bitcoin doesn’t, by the way). Are all the links working? Do they have grammar mistakes? Who’s the team? Do they have terms of use? Potential use cases? And one important question: do they have a whitepaper?

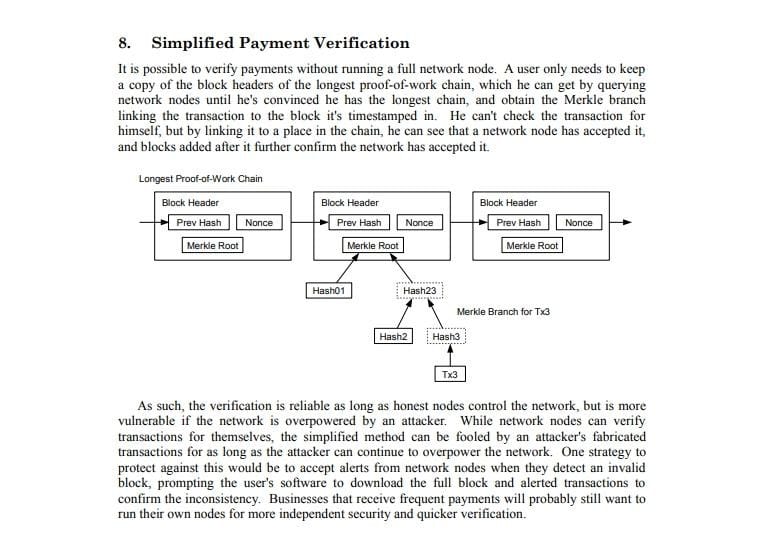

This is the founding document of most legitimate crypto networks, where everything about that ecosystem must be described in detail, from the type of distributed ledger to the tokenomics (their money rules). It’s likely that you can’t understand it to its fullest, since it’s a technical document. But know this: a lack of whitepaper, or a badly written one, it’s a huge red flag. You need to understand, at the very least, the abstract (summary) before investing.

Past Performance Doesn’t Guarantee Future Results

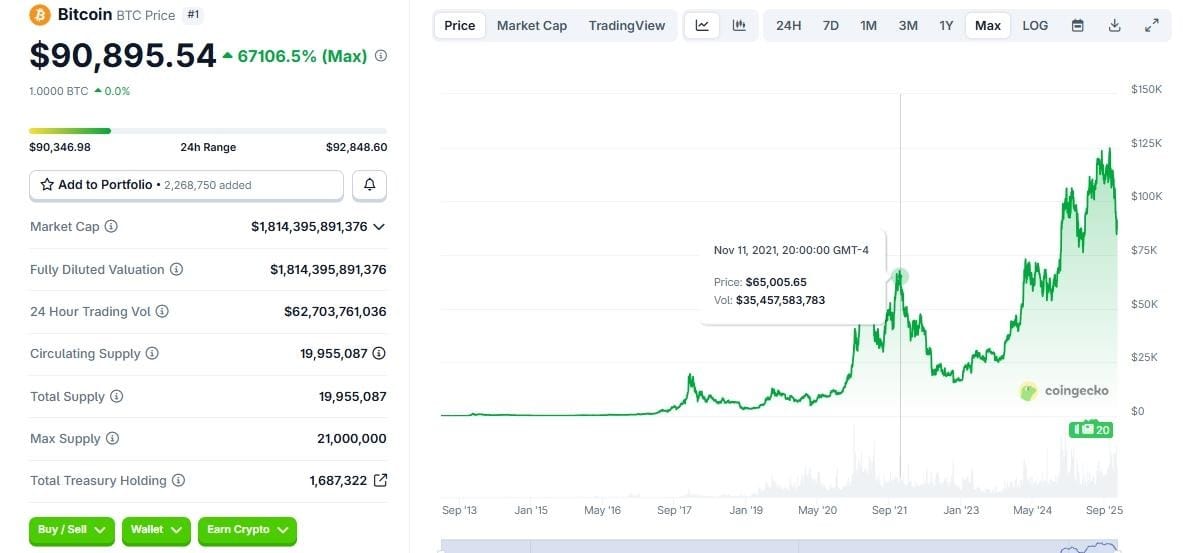

Have you heard that history always repeats itself? In crypto, you need to know that’s not always true. Things are changing constantly in this space: regulations, technological developments, investor sentiment, institutional involvement, trends, and hypes. What worked very well in the past may not work again in the future. Bitcoin is a live example of it.

If someone bought it at the end of 2013 and watched it climb for almost a decade, they multiplied their money many times over. It sounds incredible, but during those same years, Bitcoin also dropped more than 80 % from its peak at least twice.

Now, the opposite may be true as well. It’s a well-known fact that Bitcoin halvings tend to cause its price to rise eventually, as history has shown. Therefore, we can say that past performance may act as a hint, but it’s never a fact. Thread carefully!

Expect and Accept High Volatility

There’s a term in crypto slang to call investors who panic and sell at the first price dip: weak hands. In the opposite direction, there’s another term to take advantage of such a situation: BTFD (Buy the Fucking Dip). You decide who you want to be, but always keep in mind that prices are constantly changing in crypto —unless we’re talking about stablecoins.

The market is still young, global news has a significant influence, and many coins depend on hype or early-stage technology. All of this makes prices move in ways that feel intense compared to more traditional investments. When you know this ahead of time, those sudden drops or spikes feel less like surprises and more like part of how the crypto world works.

Because of that volatility, emotional control becomes one of the most valuable skills you can develop here. Buy and sell your assets not because of hype or panic, but based on rational decisions. Those are the best investments.

Learn to Identify Hype and Misinformation

An old adage applies here: all that glitters is not gold. That new trending crypto coin on social media promising “guaranteed returns” of over 40% monthly is, in all likelihood, a blatant scam. An influencer promoting a crypto project with pretty words and vague details may not even know if the team behind plans to stay or flee. Anonymous teams, lack of proper documentation, and a sense of urgency when it comes to investing (“Only a few spots left!”) are big alarm bells.

Social media, by the way, is all good and nice to start checking on a crypto project, but never trust only in it. Check external reviews, official documents, and, if you can read them, source codes on platforms like GitHub. Make sure that the sources you find aren’t sponsored (paid) by the same brand. This type of article is often identified as such at the beginning or the end.

How to Start Investing in Crypto Step by Step

Now that you have the basics in mind, it’s time to invest! But where to start?

Choose the Right Cryptocurrency for Beginners

Not every cryptocurrency is for everyone. All of them have different features, uses, and complexity levels. Not to mention price volatility: the newest assets will be the ones with more of this. Therefore, if you’re just starting, the safest bet will be long-established assets like Bitcoin or Ethereum, or just well-known stablecoins like USDT or USDC (if you’re aiming to save more than get profits).

As usual, profits are never guaranteed, and some losses are very possible —as in any other type of investment. There are fewer risks with the biggest names in crypto, though. This way, you can experiment more safely and learn more tricks before jumping into obscure altcoins.

Create a Budget and Set Realistic Goals

Think about your holdings and expenses, and decide how much you can realistically put into cryptocurrencies without touching daily needs or emergency funds. Only invest what you can afford to lose. Let’s repeat that, because it’s never enough: Only invest what you can afford to lose. We’re not stating with this that your money will vanish on the spot, but some real caution is needed anyway. For instance, a probable scenario is that volatility won’t let you withdraw the full amount you invested immediately.

Another smart thing to do is to set some short-term and long-term goals. Of course, you can’t predict where the prices will go, but you could start testing small trades, buying a bit of this coin, or learning how that other one works. In the long term, you could aim to diversify your portfolio, check what crypto to buy in larger amounts, or apply some trading habits. In any case, revisit your budget and goals regularly to make sure they still make sense for your situation.

Install and Back Up Your Cryptocurrency Wallet

Coin and budget ready, you can go and install your first cryptocurrency wallet. You need to know there are several types: cold, hot, custodial, and non-custodial. Cold and hot can overlap with custodial and non-custodial, but not between them. For example, a wallet may be cold or hot, and, at the same time, be custodial or non-custodial. Besides, it could be a multicurrency wallet or a single-coin wallet. You’ll need to pick one that supports the currency (or currencies) of your preference.

The “hot/cold” dichotomy boils down to one thing: Internet connection. A wallet is "hot" when it's connected to the Internet, and "cold" when it's designed to be offline. Hardware wallets are cold, but so can a piece of paper with a private key. Meanwhile, the issue of custody is simple: if the wallet offers you a private key (12 to 24 secret words) that only you can manage, it's non-custodial. If you only have a classic account with an email and password, it's custodial. This means that someone else (a company) is managing those funds for you.

Whichever you select, remember to back it up immediately and store this backup outside the digital world. If it’s a non-custodial wallet, write down your private keys in several places and take care of them with your life, because there won’t be any other way to access your funds.

Select a Reliable Exchange or Brokerage Platform

If you type on Google “Buy Bitcoin,” several options may appear: MoonPay, Kraken, Coinbase, Binance. Even a website promoted to the top of the results, which may or may not be a scam. So, never trust only in the list your browser (or AI) provides. The fact that a platform appears first in the results does not automatically make it trustworthy or the best option for you.

DYOR applies here as well. Check their websites, their terms of use, their fees, their teams, and external reviews. Also, check if they’re regulated, if they have had security incidents in the past, and how they handled them. Hacks on crypto exchanges are quite common, so prefer the ones that have strong security measures (like cold wallets) in place. You may also consider ease of use, as it could either help you on your learning journey or hinder it, and Venga is of the most easy and convenient app to use.

Decide Between Manual or Automated Investing

Yes, there are automated features that may help you here. Depending on the platform, tools like recurring purchases or stop loss orders may be available, not to mention crypto trading bots. They’re not always easy to use, but they can feel more practical. Bots don’t sleep, don’t panic, and they follow rules faithfully around the clock. That means they can buy small amounts every so often, or trade at the right moment, even if you’re asleep or busy.

On the other hand, manual trading gives you full control. Only you decide when and how to buy and sell. This is useful because sometimes human judgment, like reacting to a sudden regulation change or a major project update, can beat the rigid rules of a piece of code.

Manual trading can eat up a lot of time and be subject to emotion and slower reactions. Meanwhile, in automated trading, bots can fail, be unresponsive to sudden news, or may contain bugs. Nothing is perfect. In the end, the best system depends on you: if you enjoy learning, watching charts, and making hands-on decisions, manual trading is all yours. If you prefer a “set and forget” kind of strategy, automated tools might suit you better.

Start Small and Invest Consistently

When is the perfect time to invest in your favorite crypto? Maybe the best answer to that is: it doesn’t matter. Once you get started, you’ll see that small steps matter more than perfect timing. Starting small and being consistent without looking at the charts every five seconds is the easiest way to stay sane. Investing tiny amounts on an established schedule will help you learn the ropes without emotional moments. You’ll get used to the market’s ups and downs and avoid stressing over the perfect moment to buy.

A simple method anyone can apply is Dollar Cost Averaging (DCA). With this system, you invest the exact same amount at regular intervals (or a bot can do it for you), no matter what the prices are doing in those moments. It’s a way to stay consistent in the long term, learn, and avoid making decisions that you may regret later.

How to Manage Risk When Investing in Crypto

The first thing you must do to avoid risks when investing in crypto is to stay realistic. Don’t panic at temporary drops, and don’t waste all your life savings in the last hype. Always DYOR, and make decisions on real data, not on sentiment. Also, never put all your eggs in one basket. Pick several coins, investigate them, and include the most promising ones in your portfolio. If you’re using a multicurrency wallet for this, the better.

Some automated tools can help you reduce risks as well. Many crypto exchanges offer the feature of stop-loss: a safety system that automatically sells your crypto if the price drops to a level you choose. For example, if you buy a coin at $100 and set a stop-loss at $85, it will sell for you once it hits $85. For users who prefer manual trading, there are bots that will notify you about any price limits you set, so you can proceed to sell or hold by yourself.

Wallets are important, too. Crypto exchanges have their advantages (like stop-loss orders or quick liquidity), but the most advisable thing to do is to hold most of your coins offline, in a non-custodial wallet. Exchanges are considered hot and custodial —the riskiest type of wallet. They can be hacked, lose liquidity, misuse users’ funds, be sued, banned, and all that bad stuff that can happen to banks and private companies. It’s better to store your assets where you have full control of them.

Alternative Ways to Get Crypto Exposure

Or how to invest in crypto without investing in crypto. Believe it or not, there are several ways with less risk.

Crypto ETFs and Index Funds

These options are closer to traditional investments. A crypto Exchange-Traded Fund (ETF) is a product that follows the price of a cryptocurrency, such as Bitcoin, and lets you invest without holding coins yourself. You simply buy shares of the ETF, and the provider (a company) manages the underlying assets, aiming for profits. Crypto index funds work in a similar way but track a group of assets instead of just one, which gives you broader exposure.

Now, there aren't crypto ETFs or funds for every coin, nor are they available in every country. You'll need to check which ones are working in your region. If they're operating where you live, you can usually buy them through a local brokerage platform. An account, basic identity verification, and enough money to buy at least one share will be required, too. And since someone else (a company) is doing this investment on your behalf, you can expect some management fees.

Staking and Earning Passive Income

Staking happens when you lock a certain number of coins to help a crypto network keep running. It’s not exactly a ‘not-touching-crypto’ investment, because you’ll need coins in a Proof-of-Stake (PoS) blockchain, such as Ethereum, for this, but you won’t need to apply trading strategies or anything else. Your coins will sit there and work some annual rewards for you, passively.

In the same vein, you can also get some passive income by lending your tokens through certain DeFi platforms. There, you let others borrow your crypto, and you receive a determined yield over time. For example, staking Tezos (XTZ) or lending USDC on a reputable exchange can give you a steady percentage of rewards while you simply hold onto your assets; no active steps needed.

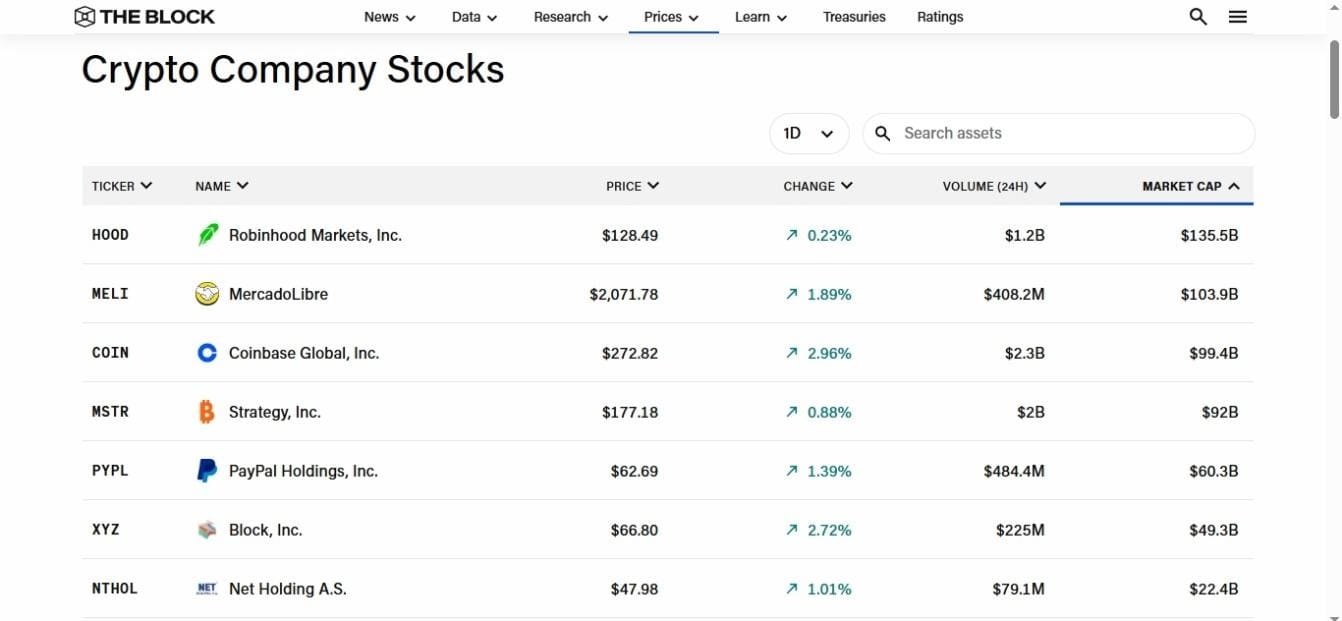

Investing in Blockchain Companies and Projects

Well, there are always the good old stocks. At this point, we likely have hundreds or thousands of crypto-related companies listed on stock exchanges worldwide. You can select some of them, DYOR (please), and buy some stocks through traditional means. Or you may as well turn to your trusted broker or investment firm for more advice. This way will let you have some crypto exposure, with a lower risk than a direct investment.

What to Do After Making Your First Crypto Investment

We can get better and better at investing in crypto, and to do that, we'll need to constantly monitor our results.

Track Market Trends and Portfolio Performance

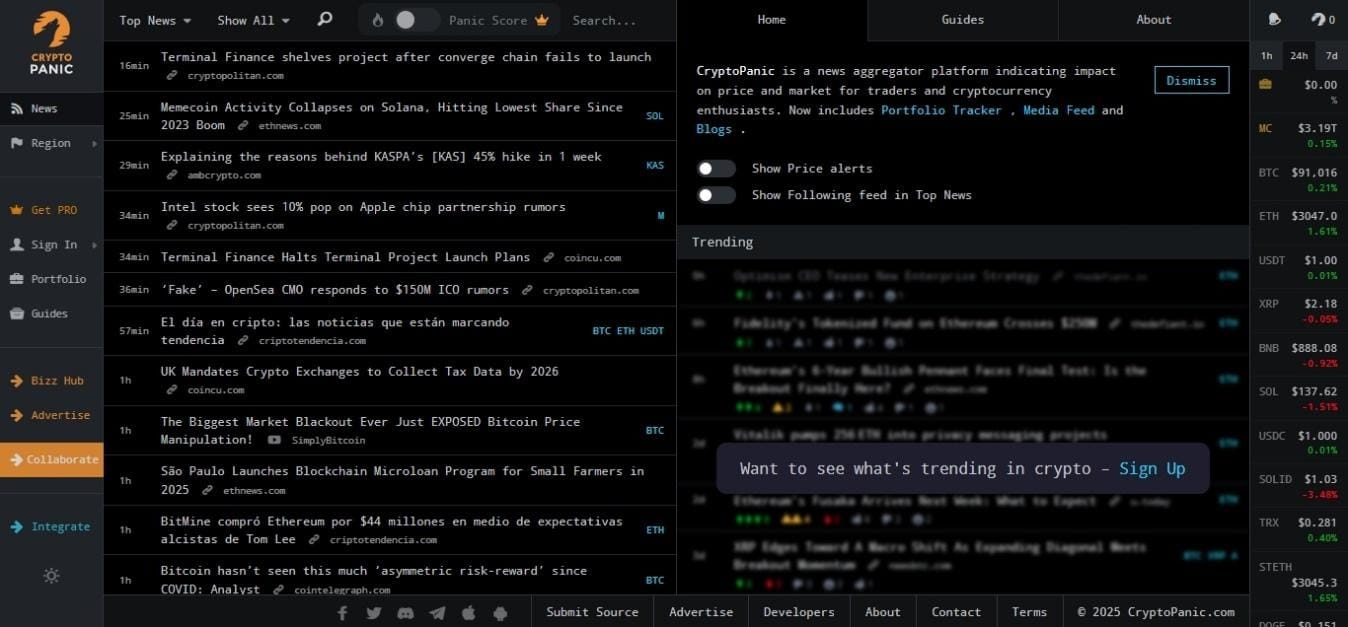

As we’ve mentioned above, some automated tools may help you in this journey. One of the most useful ones is a crypto portfolio tracker. They’re free software where you can import your wallet and check your stats at a glance, including coins and percentages, prices in real time, profits, losses, fees, and more. You can set up alerts as well. CoinGecko and CoinMarketCap offer this kind of tool.

Beyond your own holdings, make sure to monitor the news, too. Some reliable crypto-related portals include CoinDesk, CoinTelegraph, Decrypt, The Block, BeInCrypto, and Bitcoin Magazine. To see all the news gathered in one place, you could use a news aggregator like CryptoPanic.

Keep Learning About Crypto and Regulations

Crypto is an ever-changing space. There’s always something to learn, and some new developments to take advantage of. Related regulations all around the world are still evolving, so it's worth paying attention, even if it doesn't directly involve your homeland. No one can tell which country will be the next to adopt Bitcoin as legal tender, offer new crypto ETFs, or lower taxes on cryptocurrency investment and holdings.

Security alerts and new use cases are equally commonplace. One day, you might be grateful that someone warned you to withdraw your coins from a certain wallet, network, or exchange in time. As for the use cases, remember that we started with Bitcoin alone, and now we have a whole ecosystem that includes DeFi, NFTs, memecoins, stablecoins, privacy coins, identity and storage apps, and much more. Who knows what other marvelous things will be just around the corner?

Avoid Emotional or Impulsive Trading

Getting emotional is par for the course in a market as volatile as cryptocurrencies. It’s so spread that it got its own crypto slang: FOMO (Fear of Missing Out) and FUD (Fear, Uncertainty, Doubt). The first one happens when people buy just for the hype, and the second one comes when rumors (often fake) cause panic and massive sales. Don’t fall for any of them! Your trading decisions must be made with your head, not with your heart.

Success in crypto investments requires patience and discipline. Give yourself breathing room, set clear rules for when you buy or sell, and stick to them in the long term. Take breaks from charts when they start to stress you out. A calm mind always performs better than a rushed one.

Reinvest Profits Strategically

So, you got some profits? Congrats! Now, please avoid spending all of them uselessly. Reinvesting a portion of them can help your portfolio grow at a steady pace. When you take gains from a trade, you can put part of that money back into assets you consider stable or promising. It's a bit like planting seeds from your best harvest so the next season is even stronger... or because, you know, winter may be coming. This keeps your portfolio moving forward instead of letting your gains sit idle, and reduces risks in future falls.

So, we can say that starting small in crypto isn’t just safer: it keeps you from turning into the person refreshing charts at 3 a.m. with existential dread. Learn, test, adjust, and enjoy the ride. If you stay curious, patient, and mildly skeptical, your future self may thank you… preferably from a hammock and not from customer support chat.

Disclaimer: The content provided in this article is for educational and informational purposes only and should not be considered financial or investment advice. Interacting with blockchain, crypto assets, and Web3 applications involves risks, including the potential loss of funds. Venga encourages readers to conduct thorough research and understand the risks before engaging with any crypto assets or blockchain technologies. For more details, please refer to our terms of service.