Table of Contents

These past few years, crypto adoption has increased significantly, with approximately 600 million global users, or 9-10% of global adoption rate.

If you’re in the remaining majority and are yet to take your first steps in the crypto world, you’re definitely missing out. But as we say, it’s better late than never.

With plenty of crypto trading platforms existing, the question arises: which one should you pick to make your trading secure and smooth?

Why Does Choosing the Right Crypto App Matter?

The app you use acts as the bridge between you and your digital assets, so if that bridge is shaky, you’re in trouble.

A weak platform can open the door to hackers, delay your transactions, or even lock your funds when you need them most. And let’s be real, no one wants to panic every time they confirm a trade.

On the flip side, a good crypto app makes everything smoother. You can buy, sell, and track your assets with zero stress and maximum clarity.

Security, Convenience, and Long-Term Impact

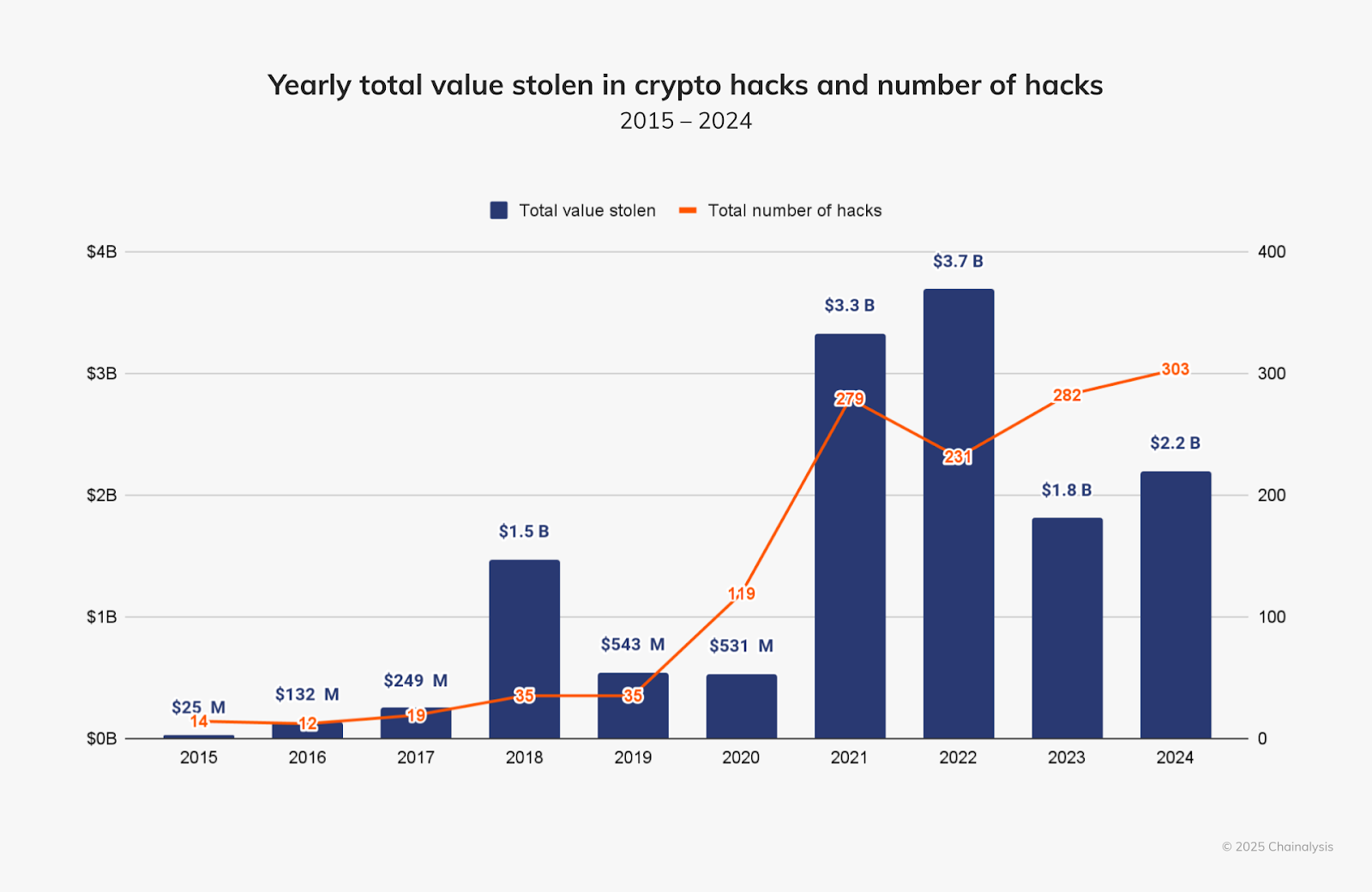

In 2024, more than $2.2 billion worth of crypto was stolen. That’s why the app you pick is more than just a tool to invest, it’s your first line of defense.

But what does a solid trading platform have?

A combination of safety, simplicity, and strategy. It’s about how effortlessly Multi-Factor Authentication (MFA) or cold storage work together. Apps like these let you focus on your investment plan, not on worrying if your wallet’s been compromised.

What Security Features Should a Reliable Crypto App Have?

In crypto, security isn’t optional anymore. The market moves fast, scams are getting smarter, and once your funds are gone, they’re often gone for good.

Let’s break down the security features you should never compromise on.

1. Two-Factor Authentication (2FA)

Want a virtual bodyguard standing between your account and cyber intruders at all times? That’s what 2FA is for.

Even if someone gets your password, they cannot log in without your secondary code. It’s usually sent via app, SMS, or email and is one of the simplest yet most effective ways to block unauthorized access.

Microsoft's own research shows that 2FA can stop up to 99.9% of automated attacks. So yeah, it’s not just nice to have, it’s non-negotiable!

2. Private Key Management and Custody Options

In crypto, your keys represent your ring of power.

Whoever controls them, controls all your underlying assets. That’s why understanding how your app handles private keys is crucial.

- Custodial apps manage your keys for you. They’re convenient and beginner-friendly since you don’t have to worry about losing access.

- Non-custodial apps, on the other hand, give you full control. You own and store your keys, which means you also bear the responsibility of protecting them.

If you’re just a beginner, a custodial app might feel easier. But as you gain experience, non-custodial options give you more autonomy and peace of mind.

3. Regulatory Compliance and Licensing

Here’s where trust meets transparency. A licensed and regulated app has to follow strict guidelines to operate, from data protection to anti-money laundering (AML) standards.

This means your funds are handled under legal oversight, which reduces the chances of shady practices or sudden shutdowns. When an app proudly displays its registration number, it’s a good sign you’re dealing with a legitimate trading platform.

How Important Is Ease of Use and User Experience?

Security might be the backbone of a crypto app, but let’s not forget user-friendliness, that’s the heartbeat. Even the most secure app in the world won’t help if you cannot figure out how to make a simple trade without Googling “how to trade Bitcoin on X or Y platform.”

Remember that when you’re dealing with money, every second counts. A confusing layouts, laggy charts, or endless verification loops can make trading feel like defusing a bomb with oven mitts. Nobody wants that kind of stress.

A good trading platform makes things easier. You open it, glance at your balance, maybe buy a little Ethereum or any other asset you planned to acquire and boom, done.

No drama, no panic clicks.

What Core Functionalities Should a Crypto App Offer?

A reliable crypto app should make your trading life easier, not more confusing. Think of it as your all-in-one station for investing, storing, and keeping an eye on your digital assets. If any of these parts are missing, the whole experience feels incomplete.

Here are the ones you need to be aware of:

1. Buying, Selling, and Swapping Assets

A trading platform should feel smooth, not stressful. The best apps let you buy and sell coins in seconds without lag or random errors. But why does that matter?

Well, it’s paramount. As a research by Pew Center in 2024 indicates, almost 63% of respondents have no confidence in the current ways of investing.

That says a lot. Nobody wants to lose money because an order got stuck mid-trade.

2. Integrated Wallet for Storage and Transfers

Your crypto wallet is your personal vault and 58% of people use their mobile wallets to handle their finances. That’s proof people want everything in one place. No one enjoys switching between devices or platforms just to check their balance or make transactions.

A great app keeps it safe, simple, and right where you need it. It should let you send and receive coins easily while protecting your private keys.

So, whether you’re holding long term or just testing the market, pick an app that makes your crypto wallet feel like second nature.

3. Portfolio Tracking and Market Monitoring

What you can’t track, you can’t prove. Sounds scary, right?

A solid trading platform help you see how your investments are performing in real time. Live charts, price alerts, and performance summaries are simple tools that make a huge difference.

If your app can show your profit, loss, and market shifts clearly, it’s doing its job. And yes, checking those green candles can actually be kind of fun.

Why Do Reputation and User Feedback Matter?

Trust isn’t given, it’s earned. You might have heard of it before as well.

In the crypto world, reputation and user feedback act like your spidey senses. They tell you whether an app is solid or risky. Most people figure out whether to use an exchange by what others say.

Checking Reviews, Ratings, and Community Discussions

If you’re considering a crypto exchange, start by digging into what real users are saying. Simply, go to the mobile stores, check the ratings and comments, look at Reddit threads or Twitter posts, etc. These places often reveal issues like slow withdrawals or hidden fees faster than any marketing page.

Here’s what data highlight: 42% of crypto users read online reviews before selecting an exchange.

This shows that reviews and trust beat fees a lot of the time, and that’s not surprising when it’s about people’s finances. So, when you run off choosing a crypto exchange, make sure to read reviews and maybe watch a couple of YouTube videos as well to see if it's the right choice.

How to Spot Red Flags in User Experiences

Sometimes feedback is a warning that something might be seriously wrong. You can find these red flags in different user stories.

Some common red flags you should be aware of are:

- Reports of Withdrawal Delays: If many users say they waited days to move funds, that’s not okay by any means.

- Hidden Fees: Users sometimes also report hidden fees popping up in unexpected places such as network costs, maintenance fees, or service charges.

- Poor Customer Support: If people say their support tickets take 24+ hours or never get responses, that trading platform may leave you hanging when you need help most.

- Unexpected Complaints: Users complaining about lost funds, unauthorized transactions, or weak security. Those are serious issues and usually show deeper trust problems.

How Do Fees and Transparency Affect Your Choice?

Every crypto app has to make money somehow, but the difference lies in how clearly they show you what you’ll pay. A CEX or a DEX breaks down trading, withdrawal, and network fees in plain sight before you even confirm a transaction.

On average, crypto trading fees range between 0.1% to 1% per transaction. That might sound small but if you’re actively trading, those fractions can pile up fast.

For instance, a trader moving $10,000 worth of crypto during the month can lose $100 just in fees if the platform isn’t cost-friendly.

Here’s what you should look for instead:

- Clear Fee Breakdowns: Every charge should be visible before confirmation.

- Consistent Rates: Avoid apps that change fees based on random “market activity.”

- No Withdrawal Surprises: Some exchanges charge extra just to move funds out.

The best crypto apps make it easy for you to see exactly where your money goes, so you can trade smarter and worry less.

Conclusion

Picking a crypto app is about finding one that actually makes you feel secure and in control. You want an app that protects your money, keeps things transparent, and makes trading feel effortless, not stressful.

Go for the one that clearly shows their fees, offers strong security like 2FA, and has positive user feedback from real communities.

Just follow this simple rule: try before you trust and you’ll never go wrong with anything.

Disclaimer: The content provided in this article is for educational and informational purposes only and should not be considered financial or investment advice. Interacting with blockchain, crypto assets, and Web3 applications involves risks, including the potential loss of funds. Venga encourages readers to conduct thorough research and understand the risks before engaging with any crypto assets or blockchain technologies. For more details, please refer to our terms of service.