Table of Contents

Do you often find yourself getting stressed out when trying to make financial decisions? Does this take the fun out of investing? You’re not alone. Many people feel this way.

However, if you keep reading you will find some helpful tips for how to manage your emotions while investing to make smarter decisions.

Complete Guide to Emotions in Investing: How to Control Them to Make Better Financial Decisions

Are you getting ready to invest? It’s important to keep in mind that emotions influence every investment decision. Learning to manage your emotions while making financial decisions can be the difference between success and failure. Don’t let your emotions cause you to lose it all and go home empty handed and crying for your toys from your childhood or a large ice cream cone to help you feel better. With a little help related to the psychology of investing, you can turn that potential frown upside down and smile the whole way home.

Why Are Your Emotions the Biggest Risk (and Opportunity) for Your Money?

When focusing on the psychology of stock investing or investing in crypto, your emotions can be your biggest risk but if you manage them correctly, they can also be the biggest positive opportunity for your money. When you manage your emotions properly, they can help you maintain your discipline and confidence. This means you can potentially turn your biggest liability into your biggest strength! How cool is that!?An article in Forbes stated the situation with emotions when trying to invest perfectly.

“We frequently make fast, stupid decisions due to our thinking, which results in subpar performance or losses. Surprisingly, most people are correct in their investment decisions, but timing, market movement, fear, and greed can ruin any sort of potential positive return.”

Or, in simpler words, don’t panic sell.

The 4 Most Dangerous Emotions That Affect Your Investments (and How to Identify Them)

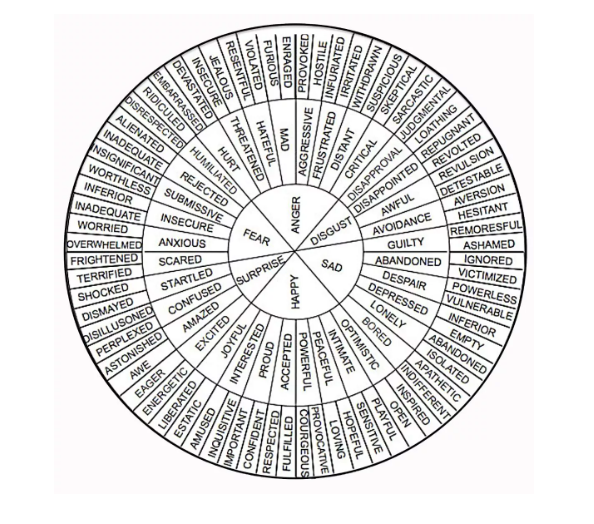

As I just mentioned, there are a number of dangerous emotions like fear and greed that can negatively affect your investments. Others include overconfidence and anxiety and finally, regret (assuming you made a BIG mistake when trying to invest and so very much wish that you hadn’t.) Using an emotions wheel like the one below can help you identify the emotions that you are feeling early on so that you can manage them effectively.

If the emotions you are feeling aren’t represented on the emotions wheel you can add them or make your own emotions wheel. Maybe you make an emotions wheel specifically for investing to help you identify your emotions before you make financial decisions.

Here’s more on the four most dangerous emotions for investing and how they relate to the psychology of stock investing, the psychology of investing in general, and the psychology of investing in crypto.

1. Fear and Panic: The Urge to Sell at the Worst Moment

When investing, fear and panic lead to massive selloffs, causing the price of the asset to drop dramatically and those fearful and panic stricken investors to lose their money. The important lesson here is to stay cool and collected while others freak out. As the famous U.S. investor and one of the richest people on the planet, Warren Buffett says, “Be fearful when others are greedy and greedy when others are fearful.” By saying this he means that you can follow this message to avoid the selloffs that many people get caught up in.

2. Greed and Euphoria: The FOMO Trap and Easy Gains

Speaking of greed though, if you have too much greed it can cause you to make bad investing decisions. FOMO, or fear of missing out, can lead to bad purchases that you may not have made if you weren’t afraid of missing the next big thing. Euphoria from slight gains can cause you to stay in an investment too long and ultimately lose money.

3. Overconfidence: When You Think You Know More Than the Market

It’s important to be confident when you invest, but not too confident. Overconfidence can lead you to take unnecessary risks that can lead to losses. People who get overconfident when investing tend to think that they will never lose and this overconfidence leads them to make risky bets or invest in get-rich-quick schemes that may not be sound investments.

4. Regret and Anxiety: Analysis Paralysis or Late Decisions

As mentioned, it’s important not to be overconfident, but the opposite, constantly doubting your decisions can prevent you from taking timely action on your investments or cause you to make impulsive decisions. People who are in doubt often choose not to make a decision or to make the decision too late because they are scared to jump in. Don’t spend so much time analysing and deciding if you will make a decision that you miss out on opportunities when they arise.

7 Practical Strategies to Become a Rational Investor (Checklist to Apply Today)

So what are some practical strategies that you can take to become a more rational investor and avoid falling into the habit of making investment mistakes? Here is a list of 7 strategies you can take starting today!

1. Create and Follow a Personal Investment Plan

By designing and following an investment plan and sticking to it no matter what happens, you can avoid letting your emotions take over. For example, if you invest a little bit of money in crypto each month and have set out specific cryptocurrencies you want to invest in, and you follow this plan, you will avoid investing in that FOMO project or get-rich-quick scheme you friend Bob just told you about. Why? Because it’s not on your investment plan and you only invest following your plan.

2. Automate Your Investments (DCA Strategy)

Dollar Cost Averaging, or putting a regular, fixed amount of money into your investments that follows a strict schedule reduces mistakes that can happen when you try to time the market. Rather than trying to guess when the market is going to go up or down, you simply put a little bit in at regularly occurring intervals. Use this psychology to win with your investments.

3. Diversify to Reduce Emotional Impact

Diversification adds stability and peace of mind to your investment strategy. If you diversify your investments, if one investment goes bad, you still have the other investments. This greatly reduces the likelihood that you “lose it all”. Diversification = never ending smiles! By spreading out the risk, you ultimately reduce the risk. Yay!

4. Set Clear Buy and Sell Rules

It’s important to highlight entry and exit points for your investments before you make any investments. Buy and sell rules that you follow will prevent you from losing everything. For example, if you have a rule that says you sell when your crypto reaches a certain value then you can sell then and avoid the possibility of greed taking over and staying in the investment for too long. You don’t want to wait too long to sell and then lose your gains when the price drops.

5. Keep an Investment Journal

Writing down the investment and financial decisions that you make when you invest and the results that you are getting can help you identify behavioral patterns. Writing down your emotions as well can help you better manage your emotions in the future and improve your overall investment psychology. Taking notes is always a good idea so you have something you can look back on and study.

6. Limit “Information Noise”

Reduce your exposure to social media and news. These often increase anxiety. If you reduce the noise you also reduce the likelihood that you are influenced by FOMO or a get-rich-quick project that has no utility that your friend posted about on Facebook. Less noise = Less likelihood of making mistakes and diverging from your investment plan.

7. Focus on the Long-Term Perspective

Day trading usually leads to losses. It’s important to think long-term with your investments to help prevent heavy losses. Most day traders lose money which is why successful investors suggest taking a long-term perspective with investing.

The Science Behind Bad Decisions: Key Cognitive Biases

A Cognitive Bias is a systematic error in thinking, affecting how we process information, perceive others, and make decisions. It can lead to irrational thoughts or judgments and is often based on our perceptions, memories, or individual and societal beliefs. Cognitive Biases have a powerful influence on how you think, how you feel, and how you behave.

A few of the most common cognitive biases include the hindsight bias, the anchoring bias, and the misinformation effect. The hindsight bias involves the tendency to see events as more predictable than they are. The anchoring bias is the tendency to be overly influenced by the first piece of information that we hear. Finally, the misinformation effect is the tendency for memories to be heavily influenced by things that happened after the actual event.

Biases Every Investor Should Know (Explained Simply)

There are a few Cognitive Biases that every investor should know. First there is the confirmation bias. This bias is the tendency to listen more often to information that confirms our existing beliefs. It means you favor information that reinforces what you already think and believe.

Loss aversion is a cognitive bias where the emotional impact of a loss is felt more intensely than the joy of an equivalent gain. Basically it’s feeling losses more intensely than gains.

Herd mentality is when people conform to the beliefs, behaviors, or attitudes of the majority in a group. This causes people to make decisions against their own individuality in favor of the group.

The Future of Investment Psychology: Trends for 2025 and Beyond

The relationship between finance and psychology is evolving due to technological advances such as developments in AI. There is also a growing focus not only on how psychological influences affect investors and their behavior but also on markets.

The Impact of AI and Algorithmic Trading on Our Emotions

Automation and the use of AI in investing reduces emotional pressure on investors. This is because the AI is able to make a lot of the investing decisions based on the data that it has and analyzes. This means that a lot less of the decision making is up to the investor. It is becoming more and more a situation where AI can make decisions and investors can sit back, relax on the beach, and let the AI make decisions about the investments. Pretty cool, right!?

Perspectives in Behavioral Finance for Retail Investors

Applied financial psychology will continue to shape retail investor decisions because we know that investors will continue to be influenced by cognitive biases and other factors. Behavioral finance will continue to be developed to better explain why investors sometimes deviate from rationality when they are making decisions on what to invest in and other investment related decisions.

Conclusion: Your Greatest Asset Is Emotional Control

If you are getting ready to invest, self-control is your most powerful tool. As far as psychology and investing goes, exercising emotional control can mean the difference between a big gain and a big loss. Don’t let your emotions get the best of you. If you need to, take a second to meditate and calm your mind before making decisions. Don’t let your emotions drive you crazy and you will thank yourself later, especially after you check your stocks and crypto and bank account in a few months. 😀

Frequently Asked Questions (FAQ) on Emotions and Investing

At this point you may be wondering, what are some of the most frequently asked questions when it comes to emotions and investing. Maybe some of these questions you are wondering about yourself. Keep reading for thoughts on some of the most common FAQs on this subject!

Is it bad to feel fear when investing?

It is normal to feel fear when investing. However, you have to manage it so it doesn’t dominate your decisions. If you are too focused on fear when you are investing, you may hesitate too much and miss out on good investment opportunities. So it’s all about managing an appropriate level of fear when making decisions on how to invest, what to invest in, or when to buy/sell.

How can I avoid FOMO (Fear of Missing Out) with trendy cryptos or stocks?

It’s important to maintain discipline and evaluate projects with rational thinking. Follow your investment plan and limit information noise as mentioned earlier to keep yourself from falling into the FOMO trap. It’s all about thinking rationally and focusing on your plan, not random new projects that others are irrationally excited about.

When is an emotion a signal to act and when is it just noise?

It’s important to distinguish between useful intuition and irrational impulses. Try thinking of someone who you know thinks rationally. Ask yourself if they would act on the particular emotion you are feeling or if they would not, considering your particular situation or circumstance. Stop and ask yourself if you feel you are thinking rationally or irrationally at the moment and use that to determine if the emotion should be acted on or if it is just noise.

Disclaimer: The content provided in this article is for educational and informational purposes only and should not be considered financial or investment advice. Interacting with blockchain, crypto assets, and Web3 applications involves risks, including the potential loss of funds. Venga encourages readers to conduct thorough research and understand the risks before engaging with any crypto assets or blockchain technologies. For more details, please refer to our terms of service.