Table of Contents

Think you missed the crypto train? Nah — the tracks just got upgraded. In 2015, it was ICO roulette and clunky wallets; in 2025, you’ve got regulated spot ETFs (exchange-traded funds), clearer rules, and a market evolving under brighter lights. The real edge isn’t nailing tops — it's having a plan.

Perfect timing is a meme; process wins. You need disciplined strategies and a healthy respect for risk while keeping a long-term perspective. Meanwhile, the rulebook and the plumbing allow for more transparent, institution-grade rails. As a result, adoption paths are widening even if the vibes cycle.

The Real State of the Crypto Market (September 2025): Beyond the FOMO

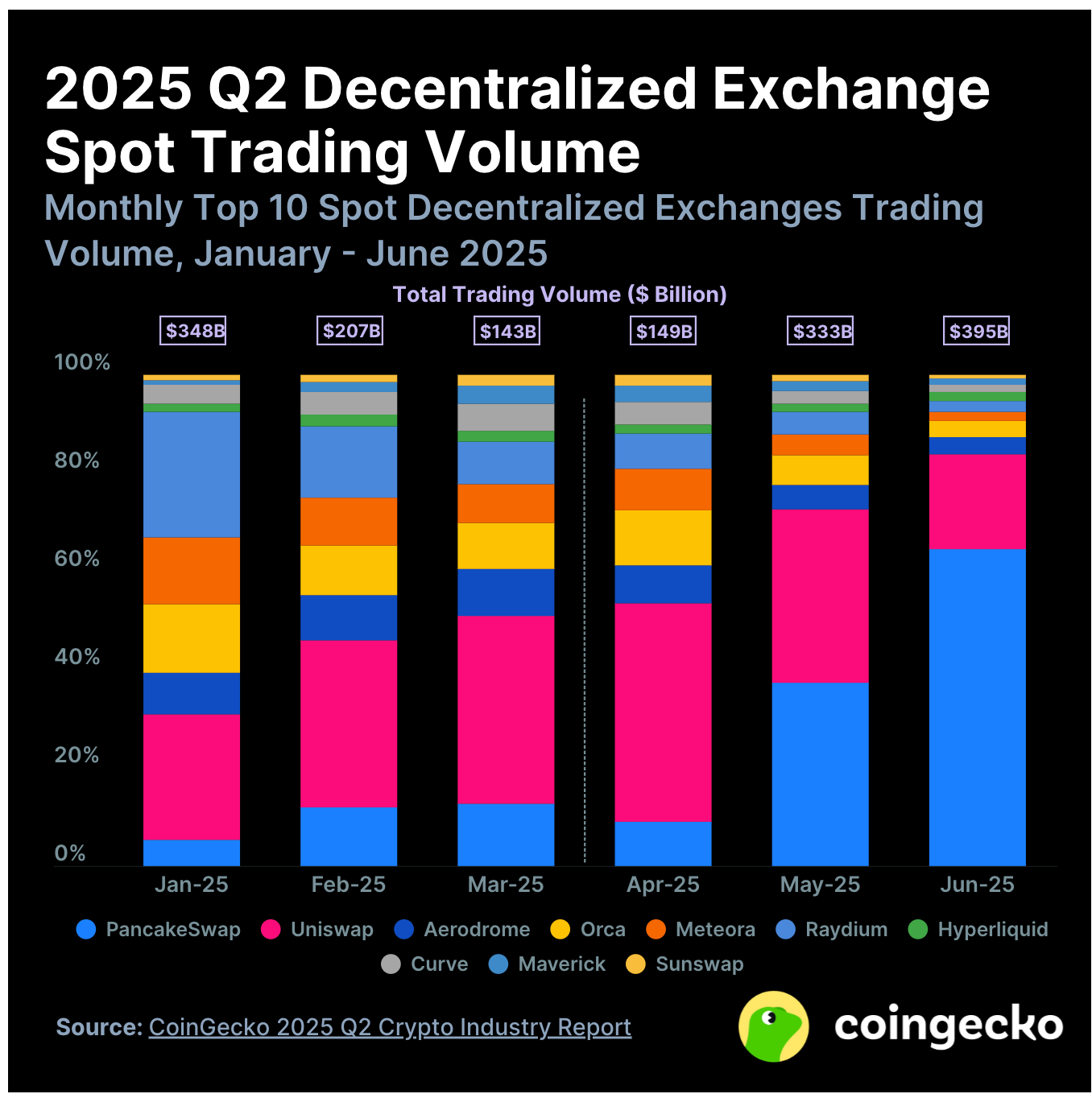

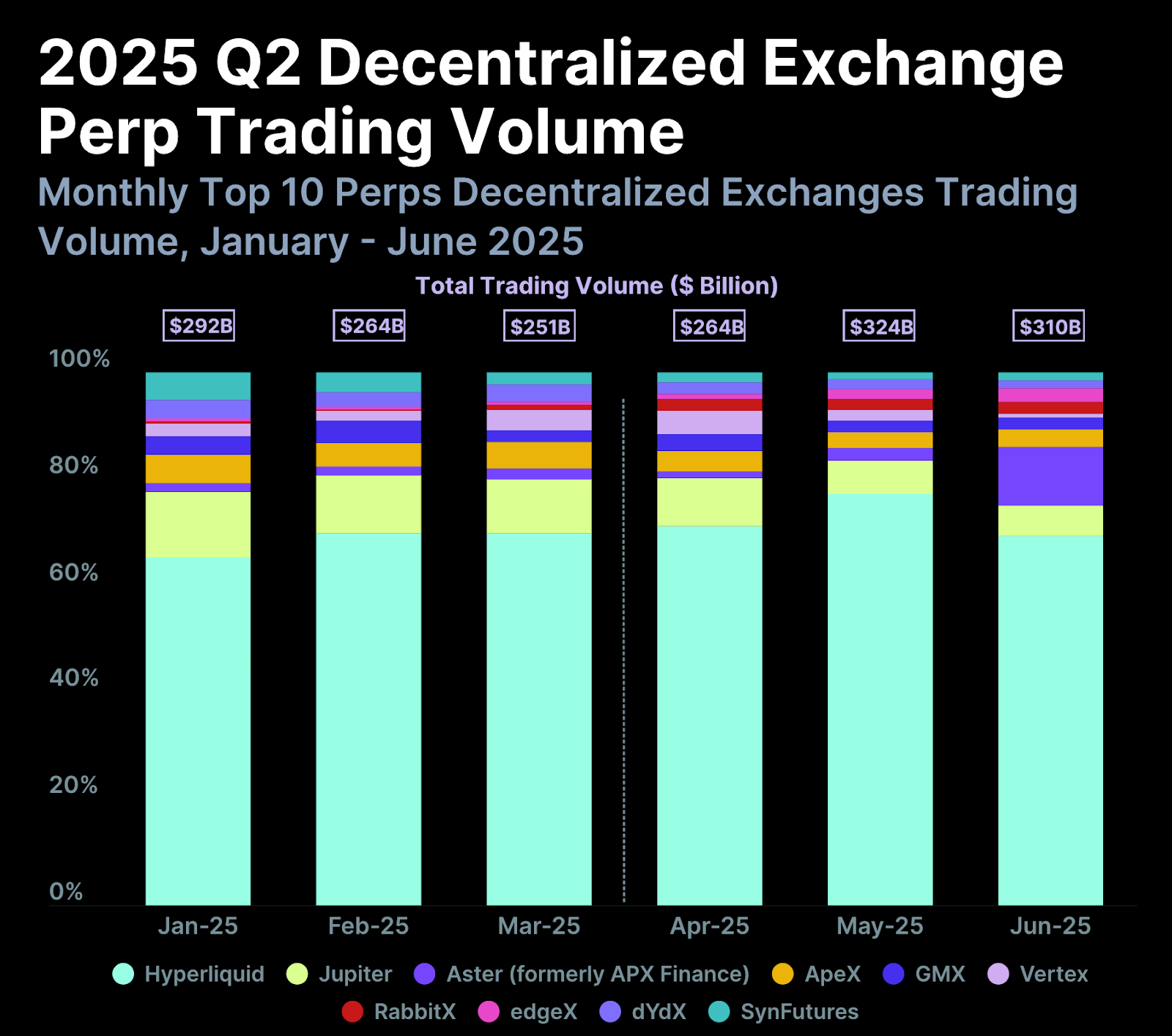

The 2025 crypto market looks less like a street fair and more like a stadium. It's still loud, but there are tickets, turnstiles, and refs on the field. There has been a lot of activity on DEXs, while centralized spot volumes have cooled. Perps on-chain have also reached new highs, which are all signs that the market is maturing toward more open and programmatic rails.

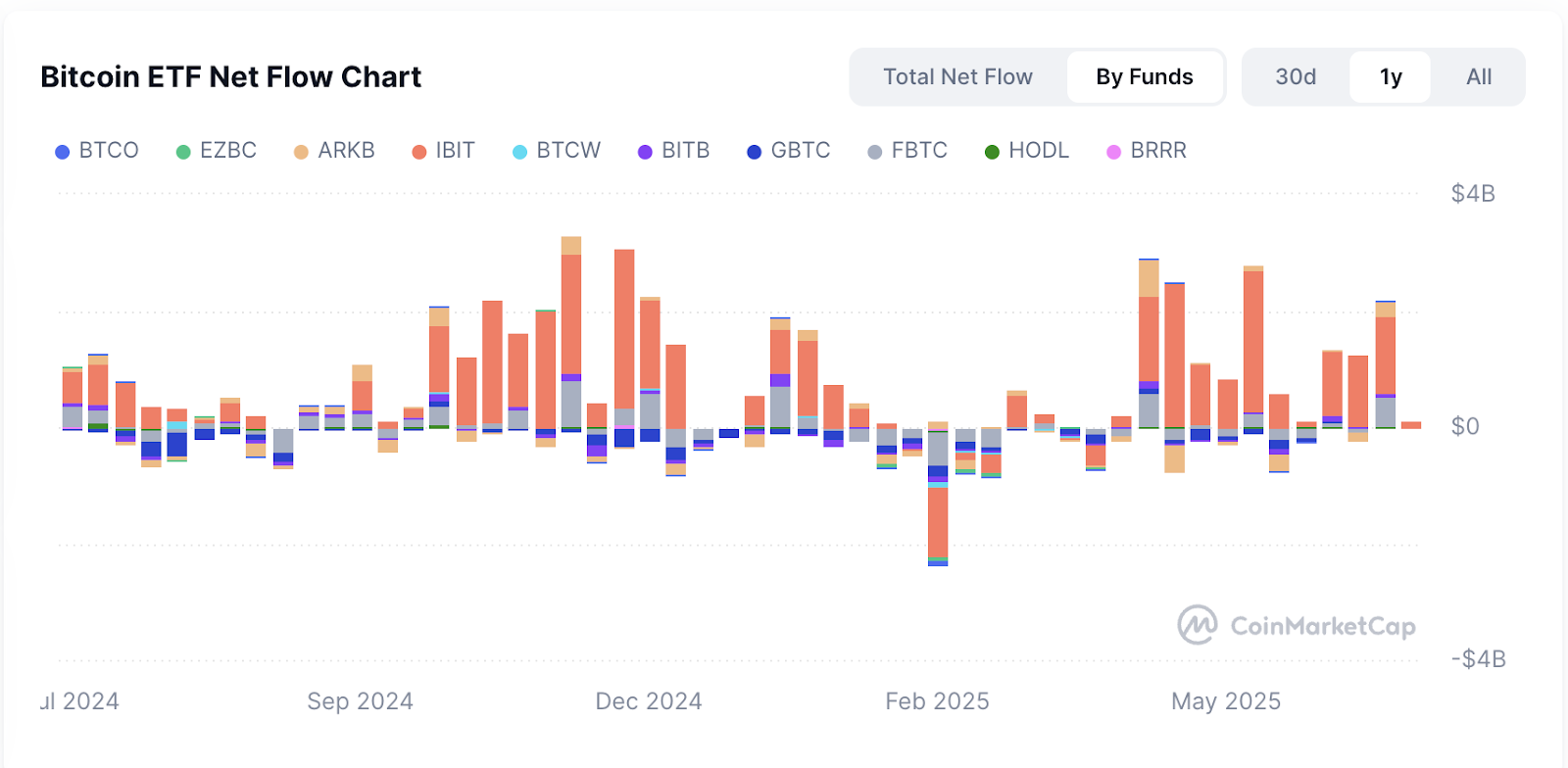

Stablecoins (usually dollar-pegged tokens) now underpin liquidity with about $300 billion in float, while spot ETFs have unlocked mainstream access and institutional flows. On the rules front, the EU’s MiCA and the U.S. GENIUS Act are converging on stricter and clearer regimes — a green light for banks, asset managers, and cautious corporations.

Understanding Market Cycles: Where Are We Now?

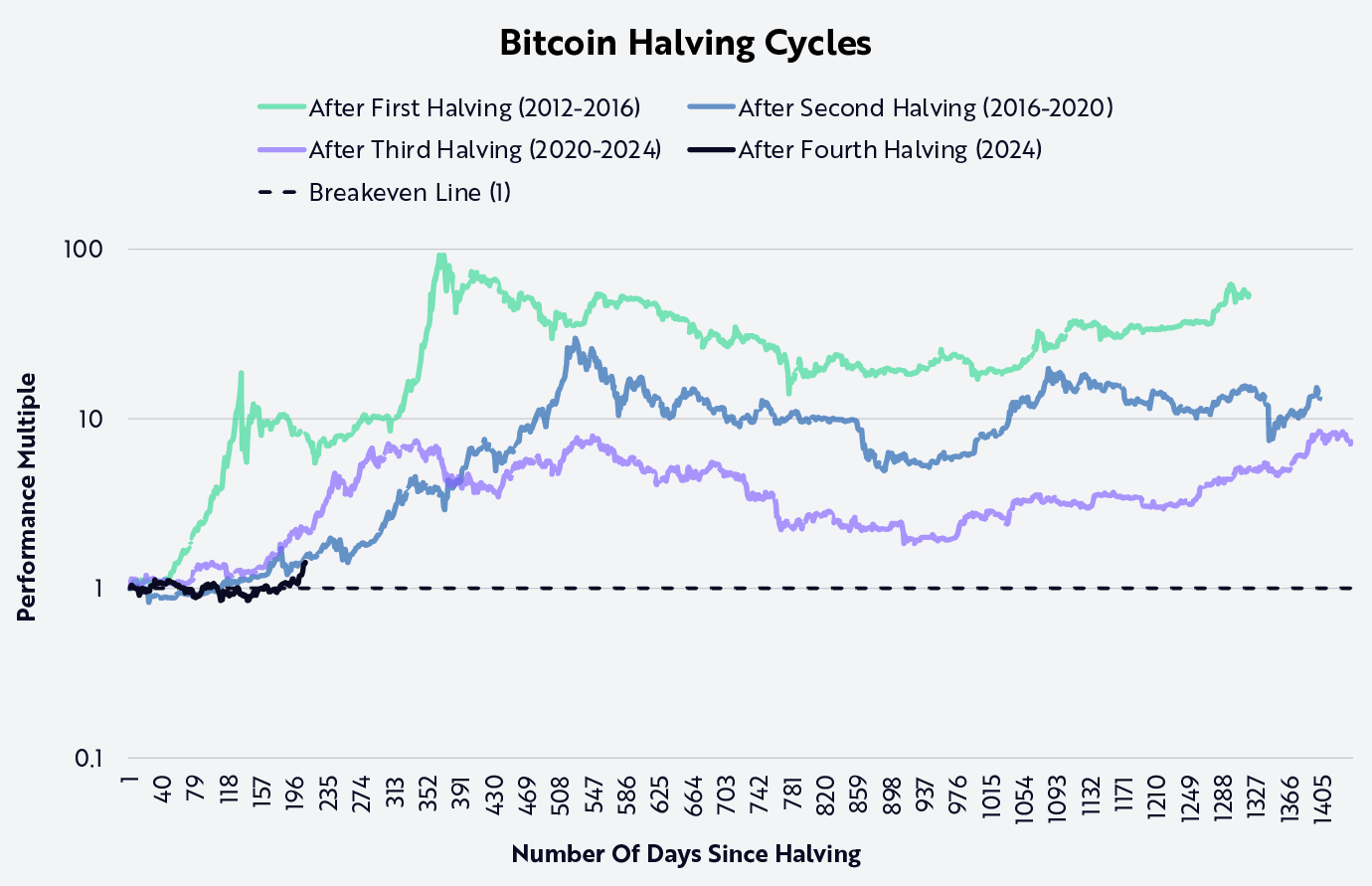

Crypto tends to move in halving-anchored cycles: accumulation (quiet buying), expansion (BTC leads), euphoria (altcoin boom), then contraction (ouch!). In late 2024-2025, Bitcoin broke into six figures and keeps ranging near new highs, while altcoin performance is selective — classic “BTC-led expansion” behavior.

Early 2025 also had “hype-driven microtrends” (AI tokens, memes) rather than a broad altseason, which often comes after BTC cools. That’s starting — but slowly — as rotation remains picky and fundamentals matter more than vibes.

In short: as of September 2025, we’re in the mid-cycle expansion phase — strong BTC leadership, improving ETH, and a cautious bid for alts with real usage.

The Impact of the 2024 Bitcoin Halving: A Year of Consequences

On April 19, 2024, Bitcoin’s block reward dropped from 6.25 to 3.125 BTC in an event simply known as the halving. It’s supply shock baked in code. A year on, price action reflected fewer new coins meeting steady ETF demand, while flows shifted across ETFs, CME futures, and on-chain venues.

Volumes changed shape, too: centralized spot activity softened; decentralized perps neared the $900 billion mark in Q2 2025 — a “grown-up market” footprint. Mining absorbed the shock via scale and efficiency: hash rate hit 1.4 ZH/s and difficulty set new highs by September 2025, accelerating consolidation among less-efficient operators.

What Does It Mean to Be “Late”? Myths vs. Realities of Early Investment

You should visualize “early” as less of a timestamp and more of an edge. In 2025, that edge comes from things like regulated access (ETFs), on-chain data, and institutional-grade custody — not just minting the first meme token. Stablecoins and tokenized assets now act as core market plumbing, creating yields and utility beyond pure speculation.

Reality check: retail-driven pockets of mania still exist, but institutions set the tone more than ever. The opportunity set has shifted from “be first” to “be selective”: focus on assets with usage, compliance, or cash-flow hooks, and treat memecoins as entertainment — not a retirement plan.

Bitcoin and Ethereum in 2025: Has the Train Passed or Is It Just Speeding Up?

Short answer: it’s speeding up. Spot Bitcoin and Ether ETFs funneled mainstream money into crypto’s blue chips. Bitcoin pushed into six figures in 2025 and has chopped around new ranges — hardly a “the story is over” vibe.

Meanwhile, ETH sits near historical highs with staking, providing a 4-5% native reward, supported by Layer-2 activity and app-layer demand.

Bitcoin (BTC): Is the “Digital Gold” Still a Valid Investment?

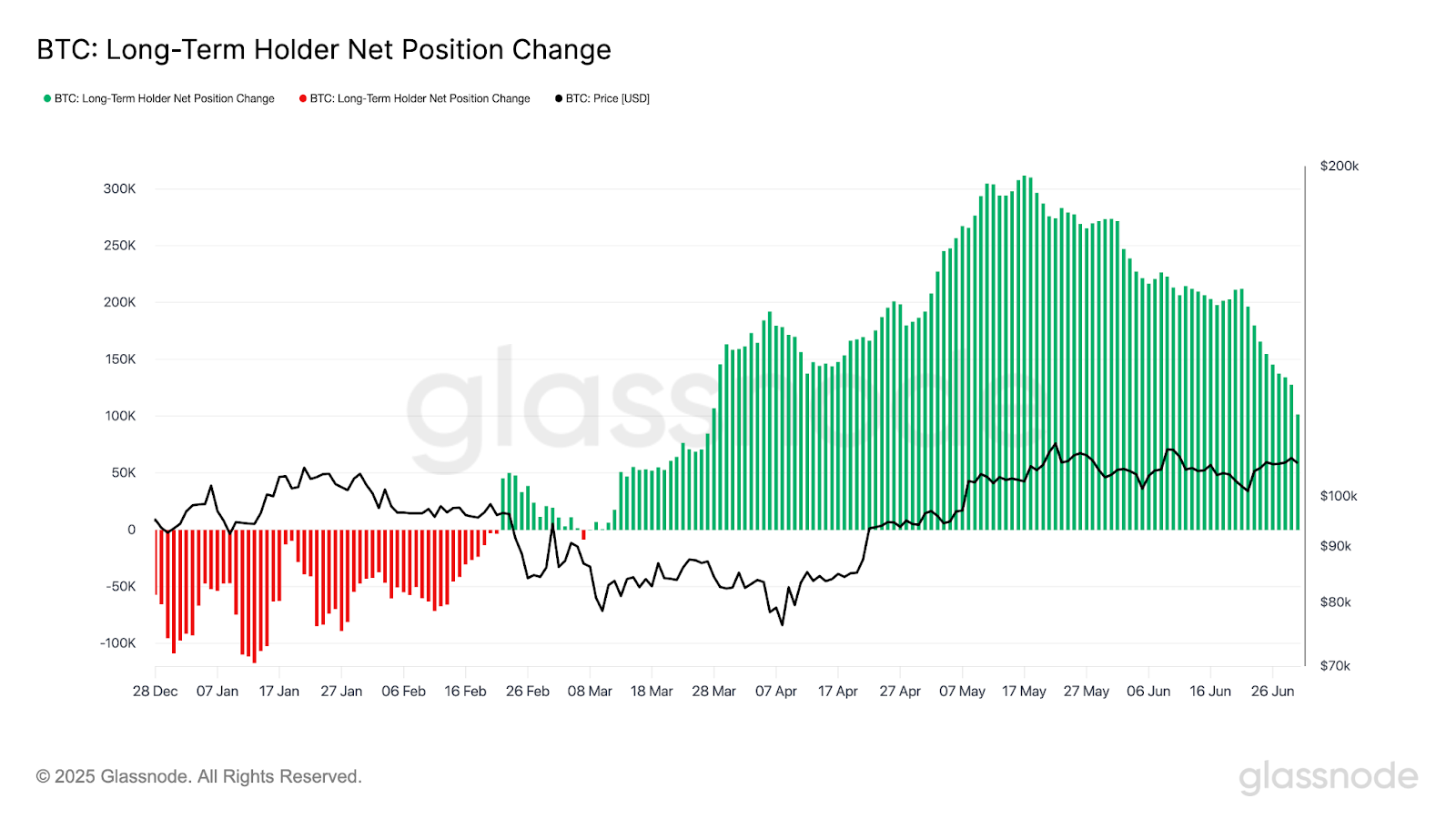

The digital-gold thesis looks more lived-in than speculative. ETFs provide institutional on-ramps and long-term holdings hit record levels, while exchange balances sit near cycle lows — a scarcity profile with transparent issuance.

Add in the halving’s reduced issuance, and the case strengthens for a durable scarcity premium. Institutions are also more public about allocating, and even corporate treasuries and sovereign funds are kicking the tires.

Of course, that doesn’t mean “number go up” is guaranteed. Volatility remains real, and position sizing still matters. But in 2025, BTC acts more and more like a macro hedge with transparent programmatic supply. It's like digital gold with deeper rails and better custody than ever.

Ethereum (ETH): Beyond Price, the Future of Decentralized Applications

Ethereum is the main way that DeFi, NFTs, and Web3 apps settle their transactions. In 2025, ETH benefits from layer-2 rollups (which speed up transactions that settle to Ethereum), sticky DeFi/NFT usage, and the arrival of spot ETH ETFs.

Staking reduces effective float while encouraging long-term alignment. There are real risks of competition and L2 fragmentation, but Ethereum’s developer base, liquidity, and network effects are still its strongest points.

The Real Opportunity in 2025: Where to Look for Exponential Growth

BTC and ETH get a lot of attention, but the upside story widens across alt Layer-1s, Ethereum Layer-2s, DeFi, and NFTs with utility. Think faster chains for consumer apps, rollups that cut fees, and cross-chain infrastructure that stitches liquidity together.

DeFi has matured from yield-chasing to rails for tokenized T-bills, invoices, and real estate; NFTs shifted from flex to function (tickets, loyalty, identity).

Promising Altcoins: Beyond the Top 10

Outside the top 10, the asymmetric upside lives where real usage meets room to run. Interoperability plays like Polkadot, aiming to stitch the multi-chain world together via parachains and cross-consensus messaging, which is exactly the kind of plumbing that compounds network effects as liquidity fragments across chains.

High-throughput L1s such as Solana and Avalanche keep courting apps that need speed and low fees; Avalanche’s more than 100 active subnets and resurgent DeFi activity are a tell that enterprise and gaming projects want custom rails without congesting a shared mainnet.

On Ethereum’s layer-2s, such as Arbitrum, Optimism, and Polygon, 2025 total value locked (TVL) hovers around $12 billion, making rollups one of the most direct bets on mainstream app adoption.

Infrastructure is where the “picks-and-shovels” alpha hides. Chainlink’s CCIP connects over 60 chains and is being piloted by SWIFT for bank-to-blockchain messaging. This is evidence that cross-chain is more enterprise plumbing than a degen dream.

Meanwhile, new L1s like Sui, Aptos, and TON are small but swinging at huge addressable markets thanks to high-throughput DeFi and Telegram-scale socials. This makes them a regular in “beyond BTC & ETH” conversations.

When the cycle heats up, altcoins with real product-market fit often outrun BTC (but with bigger drawdowns), so your sizing is your seatbelt.

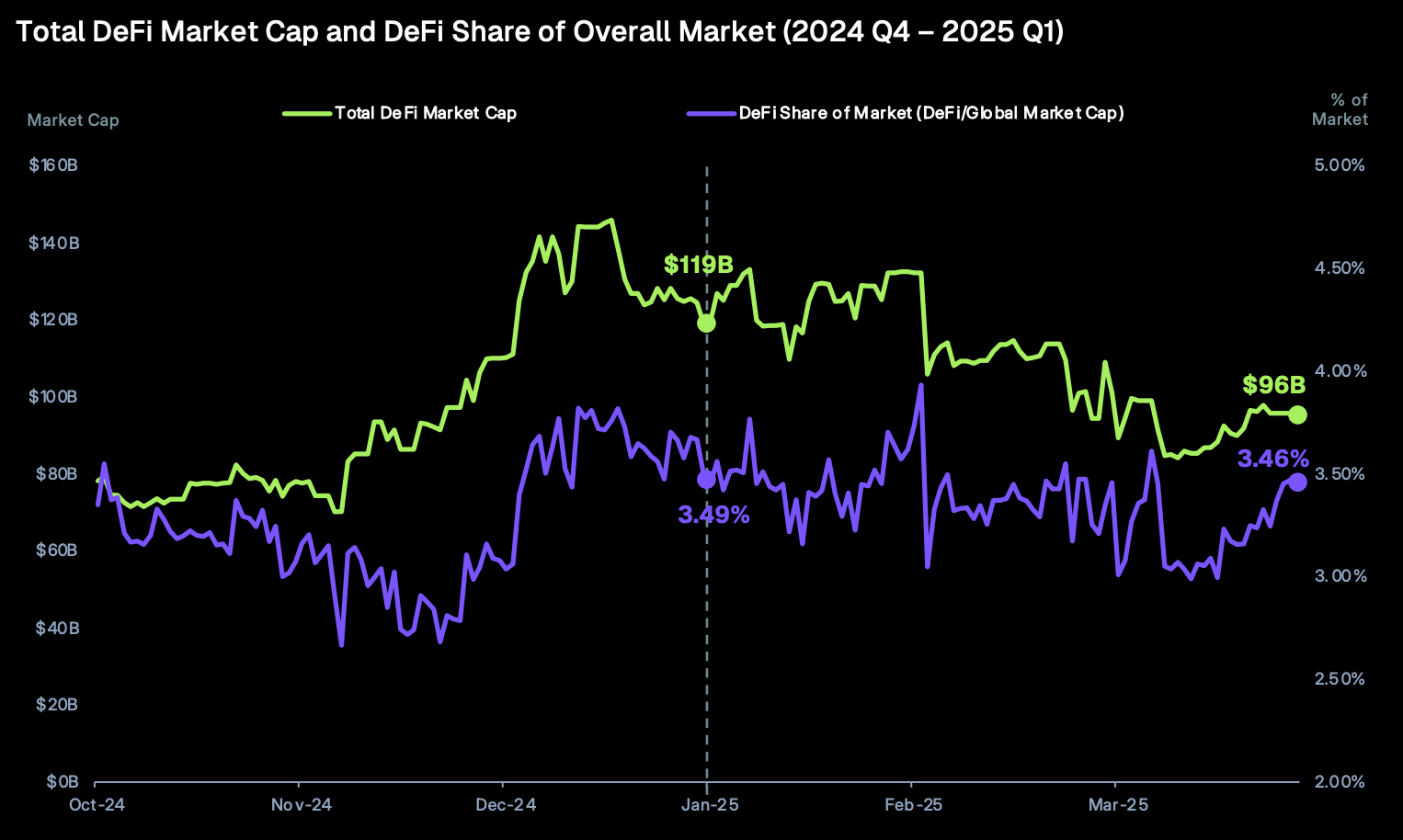

The Revolution of Decentralized Finance (DeFi) in 2025

DeFi shed the “summer fling” label and turned into infrastructure. After peaking in 2024 and retracing into early 2025, the froth washed out, and sturdier primitives remained. A new trend, real-world assets (RWA), emerged from the tide. Tokenized T-bills, invoices, and property bring off-chain cash flows on-chain.

Scaling made it usable. Layer-2 rollups plus cross-chain bridges let liquidity move with fewer clicks; automated market makers (AMMs) and lending feel closer to Web2 in speed while staying open and composable. Institutions are customizing DeFi — permissioned pools, audits, and better custody/insurance — nudging it toward a compliant hybrid model. The next step will introduce L2-native “super-apps” that abstract wallets, AI-assisted risk engines, and RWA collateral as a standard primitive.

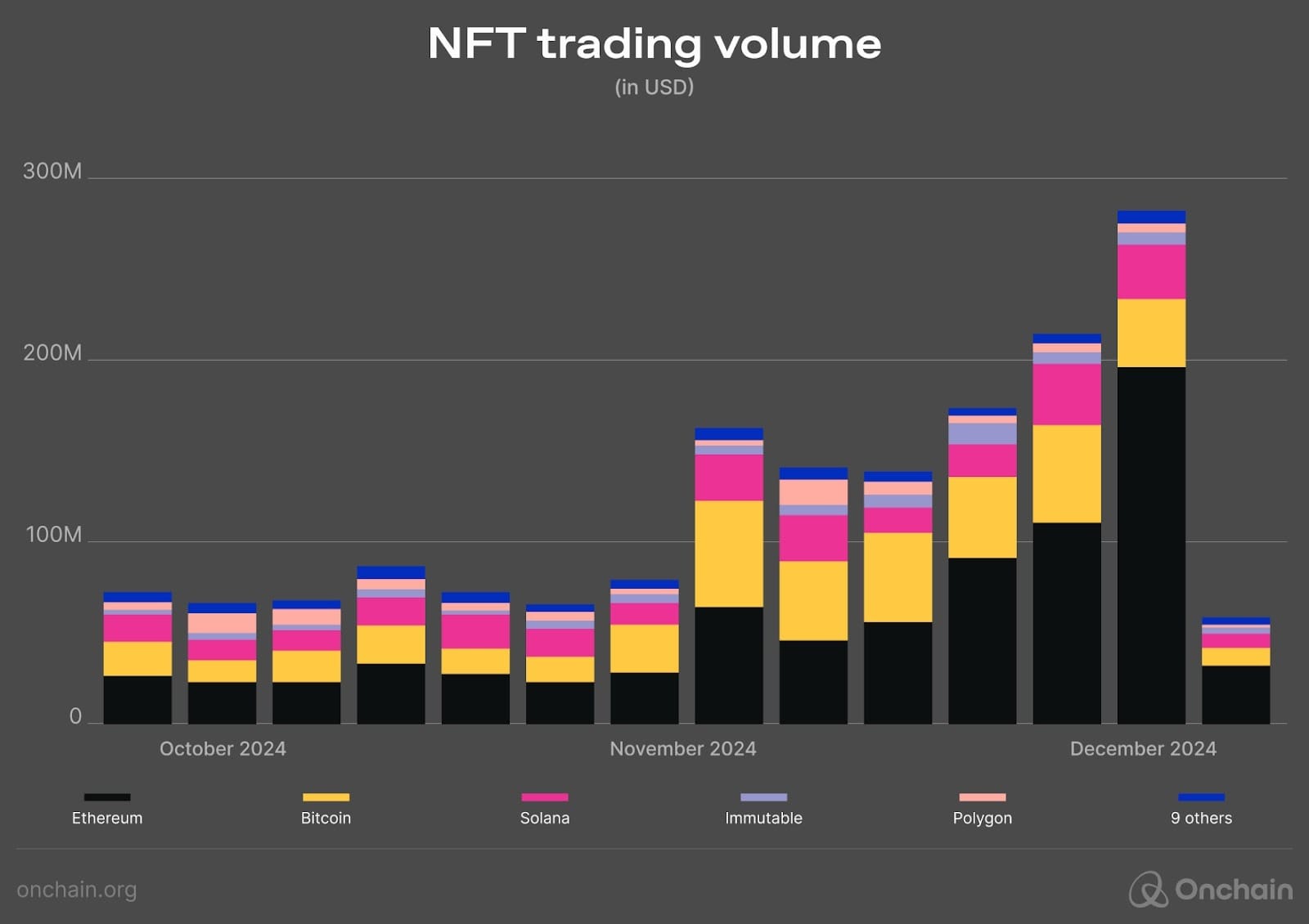

NFTs and Web3: Passing Fad or Structural Trend?

The mania cooled, but the utility stuck. In 2025, NFTs show up as fraud-resistant tickets with post-event perks, loyalty and membership keys, and creator monetization rails. They have become digital access devices.

Gaming studios test tradable in-game items and cross-title inventory, while brands experiment with “phygital” drops and supply-chain authenticity. ENS-style names and early decentralized IDs (DIDs) turn NFTs into reusable credentials for login, KYC, or proof-of-skill. All in all, NFTs graduated from hype to infrastructure for ownership and access.

Investment Strategies for the “Late Investor”

You’re not late to invest — you’re just joining a busier market. In 2025, smart strategy beats lucky timing: diversify across crypto and non-crypto assets, automate contributions, and pick a time horizon measured in years. Regulators are tightening guardrails, and the market’s plumbing is maturing (tokenization, stablecoins), so the play is disciplined, not YOLO.

Diversification: How to Balance Risk and Reward

Diversification is your seatbelt. Your exposure should be split between a core asset, such as BTC and/or ETH, cash-like ballast (stablecoins), and satellites — L2s, DeFi, niche plays. Rebalance quarterly or semi-annually so winners (or losers) don’t hijack the portfolio.

“Owning many coins” does not mean being diversified. During risk-off episodes, crypto often moves together and in sync with equities, so you need non-crypto assets in your basket as well.

Stablecoins can steady daily P&L and fund buys on dips, but they carry issuer, reserve, and regulatory risk — scrutinize attestations, backing quality, and jurisdiction.

Dollar Cost Averaging (DCA): Advantages in 2025

DCA simplifies investment: set amount, set schedule, no vibes required. In volatile markets, regular buys reduce timing risk — more units when prices dip, fewer when they rip — and they’re realistic for people investing from income. Yes, lump-sum often wins on paper because money is invested sooner, but DCA can win behaviorally by keeping you invested through scary drawdowns.

Make it boring (the good kind) via weekly or biweekly contributions, pre-committed amounts, and a quarterly check that your allocation still fits your goals. If you want an extra nudge, pre-authorize a small “buy the dip” tranche on big drawdowns — rules written when calm beat decisions made mid-panic.

Time Horizon: Think in Years, Not Weeks

Crypto rewards time in the market. Prior cycles had brutal drawdowns and multi-year recoveries; a 3-5 year lens helps you survive the ride and benefit from compounding. Since 2020, correlations with equities have spiked during stress, which is another reason to avoid short fuses that force selling at the worst moment.

Set a minimum hold period for each thesis. For example, re-evaluate annually; don’t judge within 90 days, keep dry powder for rebalances, and document exit rules before emotions take over. Your future self will thank you.

From Doubt to Action: How to Start Investing Safely in 2025

Step one isn’t “buy” — it’s plan. Decide whether you want price exposure via regulated ETFs (due to familiar brokerage and simpler taxes) or to hold coins directly on a licensed exchange or wallet. Rules are more straightforward, too. MiCA’s EU playbook and U.S. listing standards for crypto ETPs, so you can pick regulated rails that fit your region.

Next, plan for security and taxes before you fund your account. You need to have a clear understanding of the security best practices and your local tax obligations before you invest. Start small, automate your contributions, and revisit your plan as your time in the market grows.

6 Key Considerations Before Investing Your First Dollar

1. Know your why: Are you buying BTC/ETH as core long-term holdings, or experimenting in DeFi/NFTs for higher risk? Write the thesis, time horizon, and conditions that would make you exit.

2. Size for sleep: Budget what you can leave untouched through big drawdowns. Decide an initial split between ETFs (simplicity), spot coins (control), and stablecoins (buffer — with issuer/regulatory risk).

3. Pick your rails: Choose regulated providers, check local registries, and prefer platforms that publish security controls and audits.

4. Research your assets: Before buying anything beyond Bitcoin or Ethereum, learn how to screen for quality. Prioritize projects with active development, visible usage, robust token design, and deep liquidity. Remember, higher potential returns come with much higher risk.

5. Plan for taxes: Track cost basis and every transaction. U.S. 1099-DA and global CARF rules mean good records save headaches.

6. Secure first: Turn on passkeys/hardware-key multi-factor authentication (MFA) and avoid SMS; it’s the cheapest insurance you’ll ever buy.

Recommended Platforms and Exchanges (Updated 2025)

The simplest path would be ETFs. Use your regular brokerage to buy spot Bitcoin/Ether ETPs (e.g., iShares IBIT, Fidelity FBTC). These sit in standard accounts, with in-kind creations/redemptions reducing operational frictions. Fees and tracking error still apply.

When holding coins directly, favor long-running security-first exchanges with clear licensing and proof-of-reserves. Examples many investors use:

- Coinbase: qualified custody, cold-storage architecture, hardware-key support.

- Kraken: public proof-of-reserves verification, strong security program, FIDO2 passkeys.

- Bitstamp: among the first to secure a MiCA CASP license in 2025 — useful for EU residents seeking passported services.

- Venga: of course don’t forget us, the first ever crypto app natively available in Catalan, English and Spanish with a team filled of crypto-professionals and a compliance first approach.

Always verify the platform you plan to use in your local regulator’s register (e.g., FCA in the U.K.). When using the actual app or platform, don’t forget to enable phishing-resistant MFA.

Quick Tutorial: Account Creation and Your First Safe Purchase

- Open your account at a regulated brokerage (for ETFs) or a licensed exchange (for spot).

- Verify your identity (KYC). Complete ID checks per local rules.

- Harden security first. Before depositing funds, enable the strongest MFA available (passkeys or hardware keys) and set withdrawal alerts.

- Fund carefully. Start with a small deposit.

- Make a test buy (tiny BTC/ETH). For ETFs, use a limit order to control slippage.

- Set your investment plan. Automate your DCA or schedule weekly/biweekly buys and review quarterly.

- Record everything. Keep a clean record of your transactions (date, amount, fees) from day one to simplify tax reporting.

- Optional: when comfortable, move long-term holdings to self-custody — practice with tiny amounts first.

Conclusion: It’s Not Too Late, It’s Just Different. Your Next Move.

The window to invest isn’t closed. In 2015, crypto meant hobby mining and wild ICOs; in 2025, you’ve got regulated ETFs, audited custody, and faster, cheaper settlement layers. That shift rewards process over bravado.

Start with intent: are you buying BTC/ETH as core or exploring DeFi/NFTs for higher risk? Pick rails that match your risk (brokerage ETFs vs. spot coins), secure your account, and keep clean records for tax. Then keep it boring… in a good way. Automate contributions, diversify, and rebalance on a schedule. Expect volatility and policy headlines, but remember: a long horizon + disciplined rules beat perfect timing.

You’re not too late to invest; you’re entering a more mature market with better guardrails and clearer playbooks. Move deliberately, size positions for sleep, and let compounding (and real network usage) do the heavy lifting. Your next move: create and secure the account, define your strategy, execute and stick to it.

Disclaimer: The content provided in this article is for educational and informational purposes only and should not be considered financial or investment advice. Interacting with blockchain, crypto assets, and Web3 applications involves risks, including the potential loss of funds. Venga encourages readers to conduct thorough research and understand the risks before engaging with any crypto assets or blockchain technologies. For more details, please refer to our terms of service.