Table of Contents

Cryptocurrencies are free of banks! They can be traded peer-to-peer and stored in a self-custodial way. That’s true, but there’s a catch: if you want to ever exchange them for traditional money, you’ll have to use a cryptocurrency exchange. And they have their own rules to list or delist coins. Once listed, they can also delist a coin at any given time, for several reasons —no matter if the coin seems to be too big to fail.

A case in point is Terra. Back in early 2022, the whole Terra (LUNA) ecosystem, including its own stablecoin (UST), was a hit. Billions were poured into it by individual investors and companies all across the world, and both coins were listed in major exchanges like Binance and OKX. Then, in May, barely a few days after its major crash, several exchanges started to delist them. Swiftly, and just like that.

A major crash isn’t the only potential cause behind this decision, though. Let’s see more of it.

Why Do Tokens Get Delisted?

Many reasons, really. Most of them have to do with convenience: for users and for exchanges themselves to avoid certain problems. Sometimes, the teams behind the listed cryptos willingly choose to get delisted. In the majority of cases, though, it’s the exchange taking that decision because of safety, performance, or legal pressure.

They want pairs that feel healthy, useful, and trouble-free. When a token stops meeting these expectations, it becomes a candidate for removal. Now, that doesn’t mean the token itself is doomed… at least, not all the time. You must always consider the whole context to reach a real conclusion.

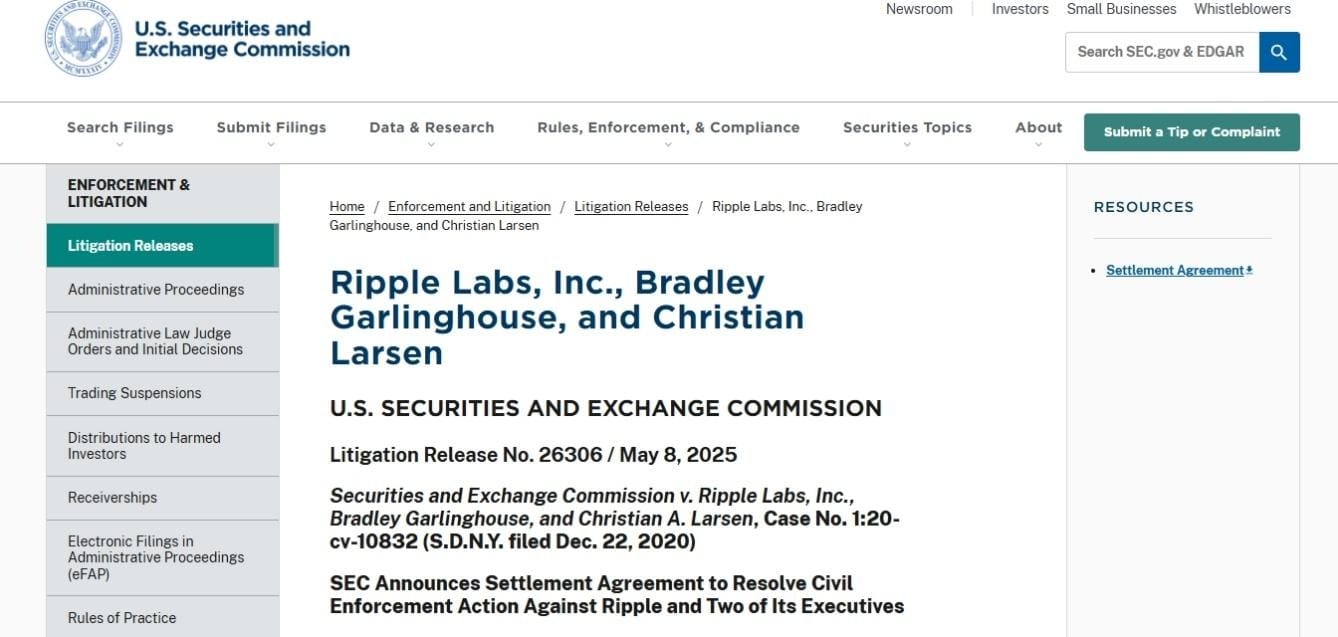

Regulatory Non-Compliance

Legal pressure is always a big deterrent or inducement in every industry, and here it’s no different. Cryptocurrency exchanges are mostly regulated companies, so they pay close attention to the authorities. When agencies like the US Securities and Exchange Commission (SEC) hint that a token might be an unregistered security, platforms often step back ASAP. No one wants surprise lawsuits! And, at this point, the SEC has sued everyone. Well, not everyone-everyone, but over 150 crypto brands.

Beyond the US, a well-covered example is Kraken and Binance ending support for Monero (a privacy coin) in certain regions after regulators increased scrutiny. These decisions may feel sudden, but they follow long regulatory conversations behind the scenes. Companies do it to stay safe and to keep users out of trouble. Against all odds, Monero is still traded in other places and remains strong.

Low Trading Volume or Liquidity Issues

Trading is like Tinker Bell: it needs attention to stay alive. When almost no one trades a token anymore, there come slow trades, wide price gaps, expensive swaps, and difficulty in entering and exiting positions. By seeing the trading volume, exchanges analyze if the token still deserves a spot. Low volume also makes price manipulation easier, so platforms prefer to avoid that kind of mess.

Many newborn digital assets and meme coins have followed this path. They explode for a week, fade just as fast, and eventually disappear because the excitement is gone, there’s no liquidity anymore, and the charts get too quiet.

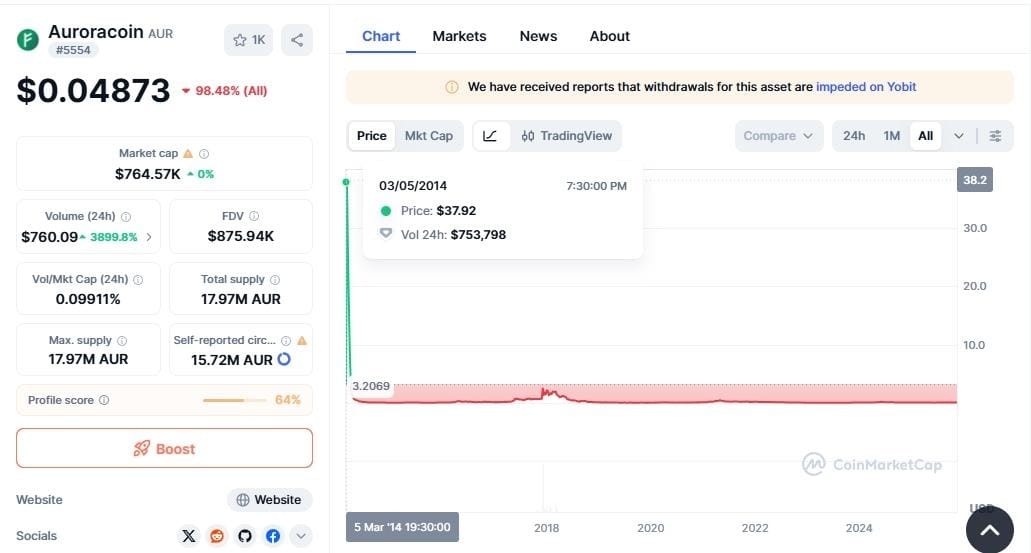

Project Abandonment or Team Inactivity

Crypto moves fast, so when a team suddenly goes silent, people notice. If months pass with no updates, no roadmap news, and no community talk, exchanges start treating the project as abandoned. A dead coin, some may call it, that must be delisted.

Take Auroracoin, which started strong in 2014 with an active community and frequent updates. It was in the top ten by market cap that year. Over time, the team and community lost faith in it and moved to other projects. The chain never fully stopped, but the silence around it grew. Several exchanges eventually removed it because there was no clear roadmap or long-term activity.

Security Vulnerabilities or Scams

Besides regulations, nothing scares exchanges more than weak smart contracts, ledger exploits, and fraud. If a crypto ecosystem keeps attracting hacks or shows signs of shady behavior, exchanges seek to dispose of its associated tokens. They prefer to protect users rather than wait for disasters.

BitConnect (BCC) was a big example of it. After the project collapsed and was exposed as a Ponzi scheme in 2018, exchanges began dropping its token quickly. By the end of that year, no exchange traded it anymore. Users tend to welcome these removals because no one wants their digital assets caught in the next scandal.

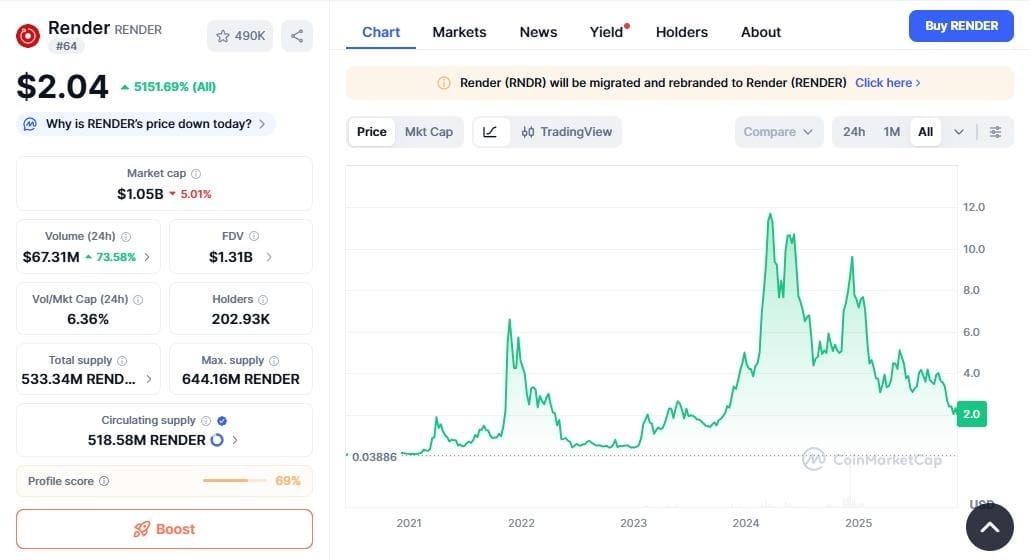

Techy or Corporate Reasons

Sometimes, the reason is less dramatic and more strategic. Remember that exchanges are companies, so they may reorganize their listings to highlight their own products or remove competitors. One famous example is Binance removing several external stablecoins in 2022 while promoting its preferred options.

On the other hand, tokens are also delisted when they upgrade to a new version, and the old coin becomes outdated. This happened to the Render Network when they upgraded from its old ERC-20 token (RNDR) to a new Solana-based token (RENDER). It's part tech housekeeping, part business move. But again, it’s about convenience for everyone involved.

What Are the Consequences of a Delisting?

We’re not going to lie here: a delisting shakes things up quickly. Prices often drop because there are many people selling in panic and few holding or buying. Liquidity thins out, so trading in any direction becomes harder. Access to that token also takes a hit, since the asset disappears from a familiar exchange and may only remain on smaller platforms —if any at all.

Many users then need to move their tokens to external wallets or find another place to trade, which can feel stressful if the timeline is short. For the broader market (including other currencies), delistings sometimes trigger short-term fear for everyone. However, seasoned traders view them as routine cleanup that removes weaker or inactive projects.

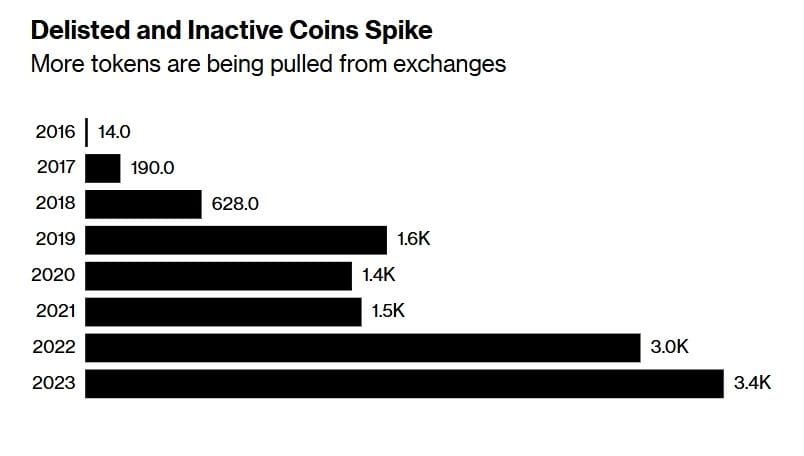

How Often Do Exchanges Delist Cryptocurrencies?

It really depends on the market conditions. Back in 2023, the delisting pace was wild amid the bearish market: over 3,445 tokens were delisted from exchanges like Coinbase and Binance, even up to 100 per month. It’s not always like that, but anyway, delistings are more common than most beginners realize.

Big exchanges like to do regular checkups to see which tokens still make the cut. They look at things like activity, transparency, how healthy the community feels, and whether everything lines up with regulations. When the market turns bearish, these reviews usually get tougher because weaker projects start running out of money or steam.

A lot of small networks can’t keep updates flowing, so exchanges prefer to remove the tokens instead of hosting assets that have basically flatlined. After a while, most investors get used to this cycle and learn that, every now and then, something is going to disappear from the listings.

How Can Investors Mitigate the Risks of Delisting?

Crypto moves fast! You need to keep an eye on it every day, and if you want to avoid risks, choose the oldest and strongest projects around. Staying informed about the health of your tokens, the exchanges you use, and the projects you support makes a big difference. Investors who spread their holdings across solid platforms and active projects tend to feel more secure. A few small habits can help as well.

- Monitor exchange announcements and compliance news: Follow official updates on blogs and social media accounts, and also subscribe to receive emails from exchanges and crypto networks. You could literally be an email away from losing your funds.

- Diversify across reliable exchanges: Don’t rely on a single trading platform. Verify yourself on several of them, so at least you’re ready to use them without waiting periods.

- Evaluate project activity and transparency: Look for active development and communication. On GitHub and GitLab, you can find most updates about cryptocurrency source codes, while platforms like Discord and X (Twitter) will tell you what the community is saying in real time.

- Avoid low liquidity or suspicious tokens: They face delisting more often. Check their volume and community sentiment on websites like CoinMarketCap or CoinGecko.

Not every cryptocurrency will be delisted. Happy trading!

Disclaimer: The content provided in this article is for educational and informational purposes only and should not be considered financial or investment advice. Interacting with blockchain, crypto assets, and Web3 applications involves risks, including the potential loss of funds. Venga encourages readers to conduct thorough research and understand the risks before engaging with any crypto assets or blockchain technologies. For more details, please refer to our terms of service.