Table of Contents

One thing is for sure, if you are seeing this, it is because you have been rolling with crypto and now wondering "do I need to declare my cryptocurrencies?" The simple answer is Yes! The tax authorities around the world have been increasingly looking into cryptocurrency.

Yes! They know, and Yes! They might be on your tail if you do not declare your cryptocurrencies. This guide gives you a clear and practical playbook on what to declare, how to declare your cryptocurrency with tips on managing your taxes in 2025. Read it, bookmark it and follow it.

Most tax authorities (if not all) treat cryptocurrencies as assets, not cash. What does this mean? Gains and losses from crypto are taxable. Not reporting? That can lead to fines, audits, and a not-so-fun call from the tax agency. Filing your crypto taxes correctly saves you from nasty surprises. Follow up and see how you can do this.

What Are Cryptocurrencies from a Tax Perspective and Why Must They Be Declared?

Dealing with cryptocurrencies puts you in a position far beyond just holding it. You need to look at it through a tax lens to guarantee you are not waging war with the tax authorities. What then do we see through these lenses?

Cryptocurrencies are usually treated as capital assets or intangible property and not a legal tender (Fiat currency). That means when you sell, swap, stake or use crypto in ways that change its economic position, a taxable event may occur (a gain or a loss) which you must report to the tax authorities.

Why declare them?

- Fiscal transparency: tax authorities want to see where gains/income come from.

- Avoid penalties: failing to declare can mean interest, fines, or serious sanctions.

- Global reporting is improving: rules and data-sharing frameworks are making it easier for authorities to spot undeclared crypto.

Example: the EU’s DAC8 and the OECD’s Crypto-Asset Reporting Framework push for cross-border exchange of crypto data.

Treat your crypto like a prized collection, keep an eye on every coin, track every trade, record the dates, note every gain or loss, and make sure you report it properly. Staying on top of it now keeps the taxman happy later.

Which Types of Crypto Transactions Generate Taxable Gains or Losses?

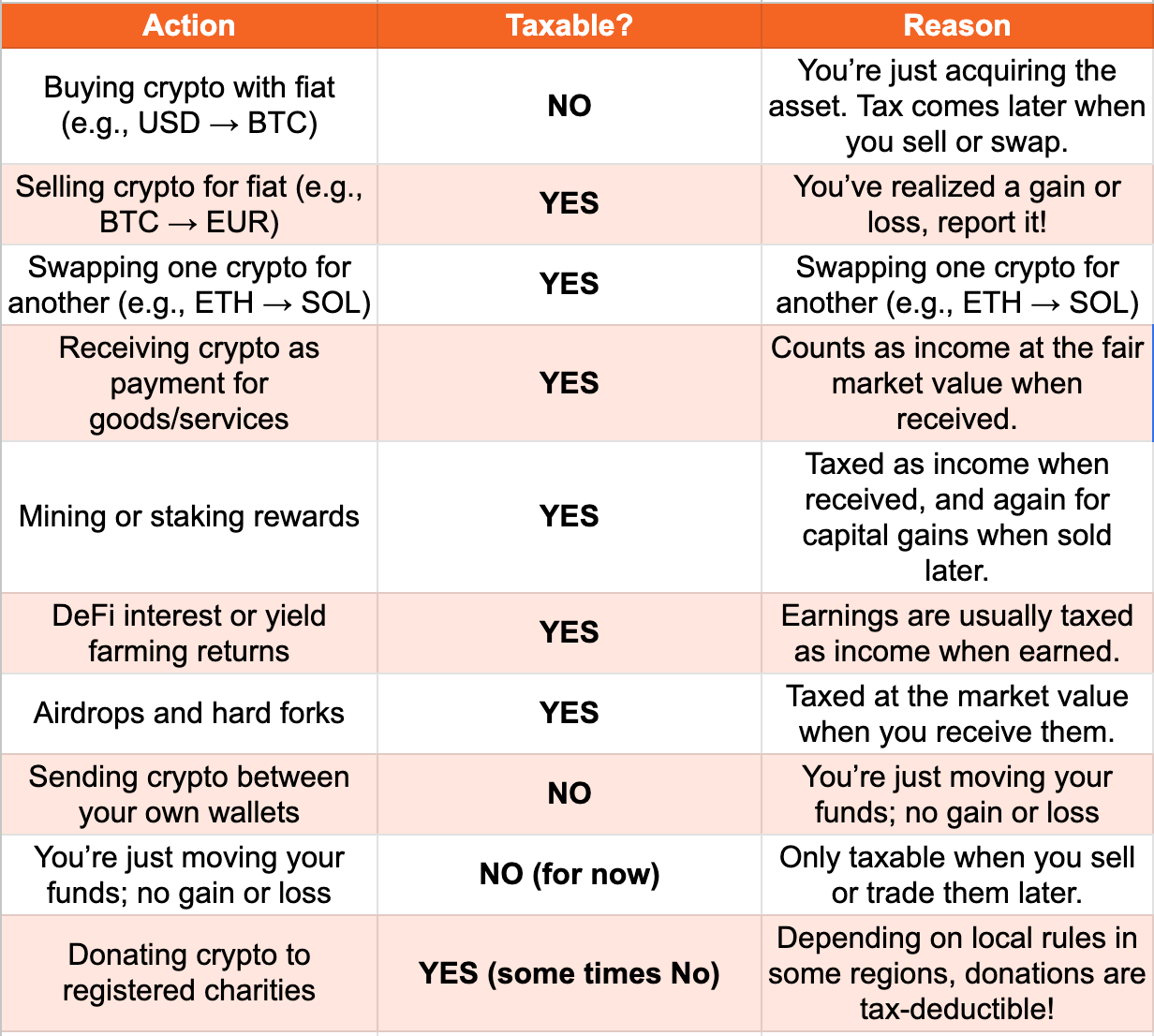

Before diving in, remember crypto isn’t just “buy it, forget it, hope for the moon.” You’ve got to keep tabs on every move. Taxable actions on cryptocurrencies are much more than a simple “I sold BTC for fiat.” Basically when Cryptocurrency is moved in a way that changes its economic position ( selling, buying, swapping, stalking etc) it becomes subject to tax, whether these actions incurred a loss or a gain, reporting needs to be done. Let’s look at these cases and more.

Buying and Selling Cryptocurrencies

When you use fiat to buy crypto or sell crypto for fiat (e.g., EUR for BTC or XRP for USD), it can result in either a gain or a loss. The calculation is simple:

Your gain (or loss) = Sale price − purchase price − fees

Keep track of the dates, amounts, and fees for each transaction so your records are solid and reporting stays stress-free.

Exchanging One Cryptocurrency for Another (Swaps)

Swapping BTC for ETH isn’t “free”, it's treated as selling your BTC. It is typically treated as a taxable disposal of the first asset followed by the acquisition of the second. That means you realize a gain or loss at the moment of the swap, and your new ETH is recorded at that same fair market value.

Don’t snooze on crypto-to-crypto trades, they're fully taxable events.

Income from Mining or Staking

Mining or staking rewards usually count as ordinary income when you receive them, based on their fair market value at that moment. Think of mining or staking like a crypto paycheck. When those rewards hit your wallet, they count as ordinary income at their fair market value. But the story doesn’t end there. If you sell or trade them later, you might also face capital gains or losses.

Basically, the tax man wants their slice twice, once when you earn it, and again if you cash out. Keep your records tight, or those “free coins” can turn into a headache.

DeFi Yields, Airdrops, and Forks

Airdrops, hard forks, and DeFi yield (e.g., interest from lending pools) are commonly taxable the moment you receive them, based on market value at that moment. Again think of them as surprise gifts, fun when you get them, but the taxman sees them as income the moment they hit your wallet.

Later, if you sell or trade those tokens, you might face capital gains (or losses). So, keep track of dates, amounts, and values of your future self and your accountant will thank you.

How Are Crypto Gains and Losses Calculated?

Here’s the tea. Figuring out your crypto gains is basically Sale Proceeds − Cost Basis − Fees. Easy, right?

This is what it means:

A tricky point here: if you’ve been buying the same coin at different times, things get spicier. Each purchase is considered a separate “lot”, and your gain or loss depends on which lot you’re selling.

For example: say you bought 1 BTC in January for $20k and another 1 BTC in June for $30k. If you sell 1 BTC in December for $40k, the gain is different depending on whether you sell the January lot ($40k − $20k = $20k gain) or the June lot ($40k − $30k = $10k gain). That’s why FIFO (First In, First Out) and LIFO (Last In, First Out) matter. They determine which coins the tax authorities treat as sold first.

With FIFO being the fan favorite. Keep your lots organized and your math tight otherwise, you might end up dancing with the taxman when you didn’t plan to.

What Do You Need to Prepare Your Crypto Tax Return?

If you want to keep the taxman smiling, meticulous record keeping is your BFF. For every crypto move, make sure you track:

- Date and time: When did it happen?

- Type of transaction: Buy, sell, swap, staking, airdrop… you name it.

- Quantity: How many coins or tokens?

- Fiat value at the time: What was it worth in dollars, euros, etc.?

- Fees: Platform or network fees count too!

- Platform or wallet used: Keep track of where it all happened.

Pro tip: Use your bookkeeping skills or crypto tax knowledge to stay organized. Screenshots of transactions, exported CSVs from exchanges, and keeping a simple database or spreadsheet can make life way easier.

Even better, apps like Venga have enhanced the history and transaction log features that consolidate your records in one place, making it simple to track every transaction clearly and accurately. Basically, if it moves your crypto around, log it all.

Gathering Information and Documentation

Before you even think about filing, you need all your crypto receipts in one place. Essential documentation includes:

- Exchange CSVs (Comma-Separated Values): Exports from every platform you’ve used.

- On-chain transaction histories: Proof of transfers, swaps, and DeFi activity.

- Self-custody wallet records: Keep logs of all coins stored outside exchanges, including staking or airdrop receipts.

Collecting this information upfront makes calculating gains and losses a breeze and keeps you safe if the taxman ever comes knocking.

Helpful Tools and Software

Don’t let crypto taxes turn into a nightmare . Using crypto tax software that syncs with your exchanges and wallets can automatically generate reports, track gains and losses, and save you hours of tedious manual work. Many tools even categorize transactions, apply the correct cost-basis methods, and help you stay audit-ready.

If your portfolio is complex, think multiple wallets, DeFi lending, staking rewards, airdrops, or forks, consider hiring a crypto-savvy tax professional. They’ll make sure all your numbers are accurate, compliant, and aligned with the latest regulations across regions.

Plus, they can give you tips on record-keeping and software optimization so you’re not scrambling at the last minute.

The best part? With the right tools and guidance, you can spend less time crunching numbers and more time focusing on your crypto strategy, holding your assets, and enjoying the gains stress-free.

What Are the Most Common Mistakes When Reporting Crypto and How to Avoid Them?

Tax management has never been a fun activity for anyone, even seasoned holders can trip off when it comes to crypto taxes . Here’s the lowdown on the most frequent mistakes and how to dodge them:

- Omitting DeFi or wallet transactions and crypto-to-crypto swaps: Every move counts, not just selling for fiat. Keep a full record of swaps, staking, airdrops, and DeFi activity.

- Miscalculating gains due to the wrong cost-basis method: Pick a method (FIFO, LIFO, or specific identification) and stick with it. Switching mid-way can create messy calculations and trigger audits. FIFO is the more common and more advisable.

- Forgetting activity across platforms and wallets: Export CSVs, log wallet activity, and consolidate records so nothing slips through the cracks. Use reliable wallets and software.

- Ignoring that crypto is a taxable asset class: This is not even a mistake to joke about. Even if you’re just “playing around” with coins, gains and income are reportable. Treat it like any other investment to avoid surprises.

By this point, you already know the drill , accurate records, reliable software, and a good tax professional if it's overwhelming to do it yourself.

Final Tips for an Accurate Tax Return

I'm going to repeat it again: The secret to a smooth crypto tax season? Start early and stay organized. From day one, make planning part of your crypto routine, record every move, label every transaction, and store everything in one place.

Use specialized crypto tax software to automate reports and spot discrepancies before they become problems. And if things get complex (DeFi, staking, multiple wallets, or cross-border trades), you would want to bring in a tax professional who understands digital assets. They’ll make sure your filing is clean, compliant, and stress-free.

Believe me when your records are tight and your tools are right, tax season won’t even make you flinch. It's just another flex in your crypto game. File it, smile it, and get back to chasing those moonshots.

Disclaimer: The content provided in this article is for educational and informational purposes only and should not be considered financial or investment advice. Interacting with blockchain, crypto assets, and Web3 applications involves risks, including the potential loss of funds. Venga encourages readers to conduct thorough research and understand the risks before engaging with any crypto assets or blockchain technologies. For more details, please refer to our terms of service.