Table of Contents

Bitcoin was the first successful decentralized digital currency that worked at a global scale without a central operator. When Bitcoin was created in the year 2008, its whitepaper offered something the internet had never had: a scarce and programmable money system that anyone could verify and nobody could unilaterally control.

Not only did this development create a new asset, but it also changed how we think about trust, ownership, and settlement in a world that runs on software. The charts get the attention, sure, but the deeper story is how Bitcoin fused computer science, economics, and game design into a network that’s run nonstop for years.

It seeded an industry, rewired debates about inflation and sovereignty, and inspired whole categories of technology. You don’t have to be a miner or a coder to feel the effects.

Cheaper cross-border payments, 24/7 markets, new rails for savings, and a vocabulary that moved from forums to finance desks are all put into practice throughout our daily routines. To showcase its evolution and answer the “why,” below we’ll trace the road that led to Bitcoin from early e-cash ideas to a network people now price into markets and policy.

What Existed Before Bitcoin? The Road to Digital Money

Before Bitcoin, people kept trying to bring “cash-like” qualities to the web. Those early experiments weren’t wasted. They taught hard lessons that set the stage for the decentralized system we use today.

Early Attempts at Digital Cash and E-Money

In the 1990s, cryptographer David Chaum tried to build a private bank-mediated e-cash system with DigiCash. It used clever cryptography so a bank couldn’t see who was paying whom, but it still relied on a central company to issue and redeem notes.

Later came e-gold, a popular internet money backed by gold reserves. Users loved the idea of quick online transfers, but again, there was a central operator in the middle.

Around that time, cypherpunks sketched out or popularized tools that later became a part of Bitcoin. They promoted digital signatures, public-key cryptography, and proof-of-work, including Hashcash by Adam Back in 1997, to fight spam. Others proposed blueprints for decentralized money that never fully launched: Wei Dai’s b-money and Nick Szabo’s bit gold. These ideas formed conceptual scaffolding for Bitcoin. None of these pieces alone solved digital cash. Together, they pointed in a direction.

Why Previous Systems Failed

Centralization didn’t hold up well in the wild. Companies could be shut down, banked off the grid, or compromised from the inside. Add rising legal pressure and periodic fraud scares, and momentum faded.

Adoption also stalled because users needed their counterparties, and sometimes their governments, to trust a single entity. The result was good ideas, brittle systems. The missing piece was a way to keep the ledger honest without a single party in charge.

How Was Bitcoin Born?

Bitcoin didn’t launch with a hype video or a roadshow. It appeared as a short paper in a cryptography mailing list, written by “Satoshi Nakamoto,” a name with no face attached.

The paper reads like an engineer’s memo. It specifies a timestamped public ledger, a peer-to-peer relay for transactions, and a proof-of-work lottery to select the next block. Incentives do the heavy lifting: the reward structure makes honest behavior the winning strategy.

Then the software arrived. On Jan 9, 2009, Satoshi released the first public client, open-source and ready to run. On Jan 12, Satoshi sent 10 BTC to Hal Finney — the first recorded transaction.

Through 2009-2010 Satoshi answered questions, shipped fixes, and slowly stepped back so no single person could be “in charge.” What they left behind was a leaderless protocol and a community built to carry it forward.

Who Is Satoshi Nakamoto?

We still don’t know. Satoshi Nakamoto could be one person or a small group using a shared pen name. What we do have are posts, emails, and code commits that show a builder with a clear purpose: release working software, answer technical questions, and gradually step away so the network could speak for itself.

The 2008 Whitepaper That Started It All

On October 31, 2008, Satoshi shared a nine-page paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” The big idea explained in the whitepaper was an online money that doesn’t need a bank because the network itself acts as the timekeeper and referee.

Participants broadcast transactions; miners bundle them into blocks; a proof-of-work lottery determines whose block is accepted; the longest valid chain becomes the record.

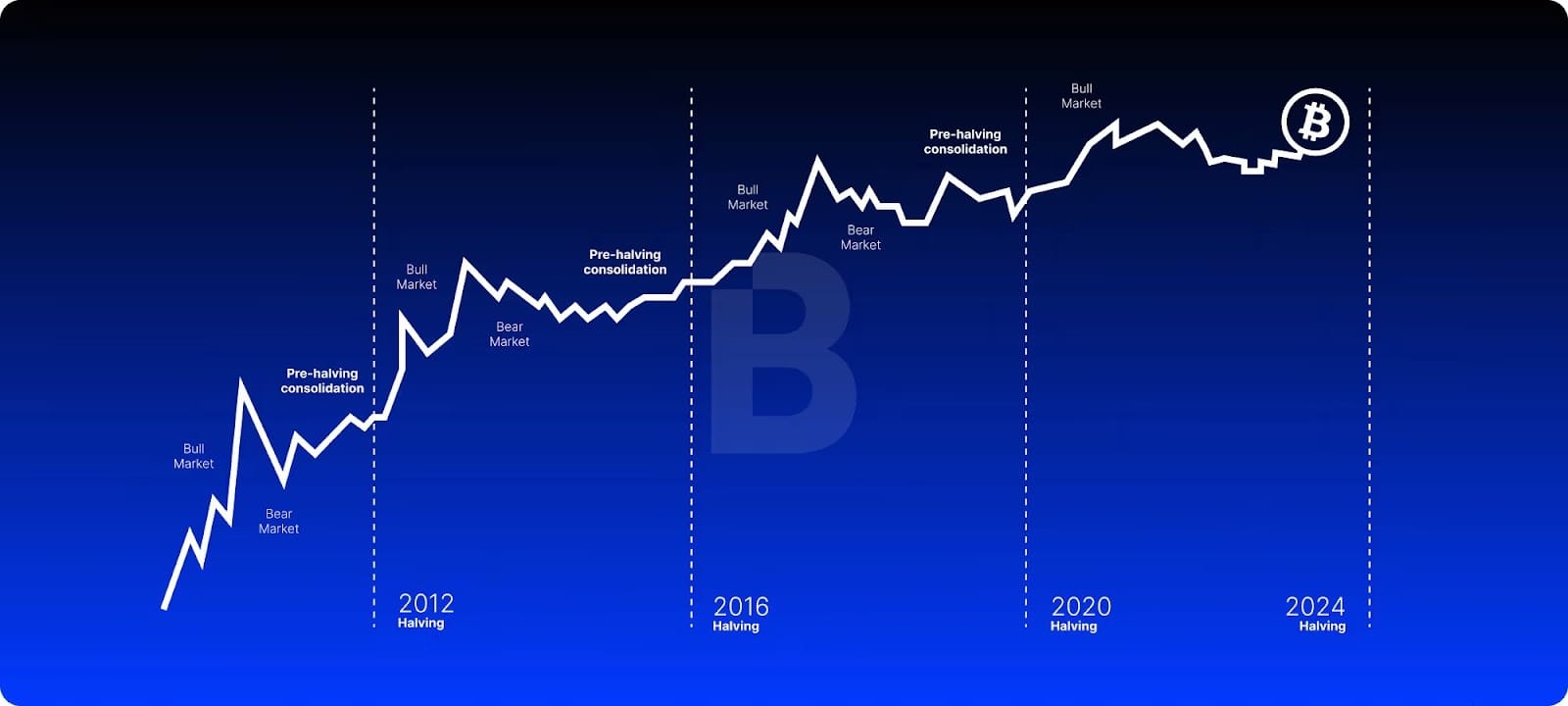

Two breakthroughs stand out. First, double-spend prevention without a central clearinghouse. Second, a built-in issuance schedule: Miners earn new Bitcoin as block rewards, and that reward halves about every four years in the Bitcoin Halving. The supply is capped at 21 million.

The Genesis Block and First Transactions

On January 3, 2009, Satoshi mined Block 0, the Genesis Block, embedding a newspaper headline inside: “Chancellor on brink of second bailout for banks.” It read like a timestamp and a thesis.

Days later came the first transactions, including one to developer Hal Finney, who famously tweeted “Running Bitcoin” as he booted up the software. In those quiet early weeks, the network felt like a small workshop — few users, low difficulty, and an open invitation to tinker.

How Did Bitcoin Gain Its First Users?

At first, it was tiny with a handful of tinkerers compiling the client, posting logs, and sending coins back and forth to see if the thing held up. Threads on forums filled with how-tos, scraped-together guides, and the first wallets.

Someone set up a faucet that gave away a few BTC to strangers so they could try a transaction. A coder paid for two pizzas; a hobbyist booted a miner on a spare PC; a blogger wrote a skeptical piece and then installed the client anyway. That’s how it spread. Small experiments, quick feedback, and an expanding circle of people saying, “Okay, that actually worked.”

The Creation of Early Bitcoin Exchanges

Bitcoin price discovery needed a place to happen. Early peer-to-peer trades soon gave way to the first exchanges, most memorably Mt. Gox, which began in 2010. It started as a scrappy marketplace and quickly became a hub where dollars met BTC.

Liquidity and volatility arrived together. For the first time, anyone could buy or sell in minutes, instead of days. That access was a blessing… and a risk. Mt. Gox would later implode from security failures, cementing one of Bitcoin’s earliest cautionary tales: “Not your keys, not your coins.”

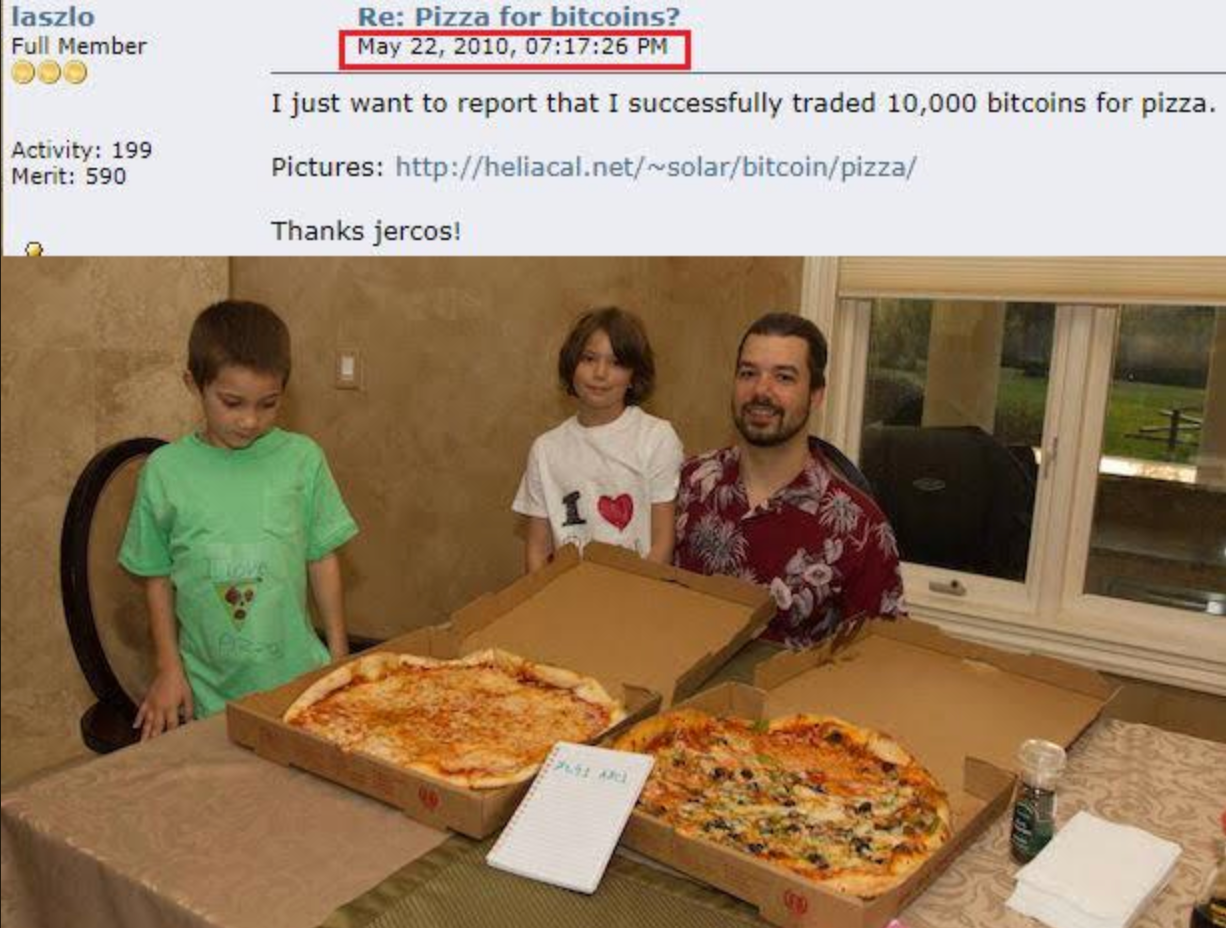

The First Real-World Purchase: Bitcoin Pizza Day

On May 22, 2010, programmer Laszlo Hanyecz paid 10,000 BTC for two pizzas. At the time, it was a fun stunt that proved Bitcoin could pay for real goods. In hindsight, it’s widely recognized as the first documented real-world purchase using Bitcoin. Today, Bitcoin Pizza Day is celebrated as the moment internet money bought dinner.

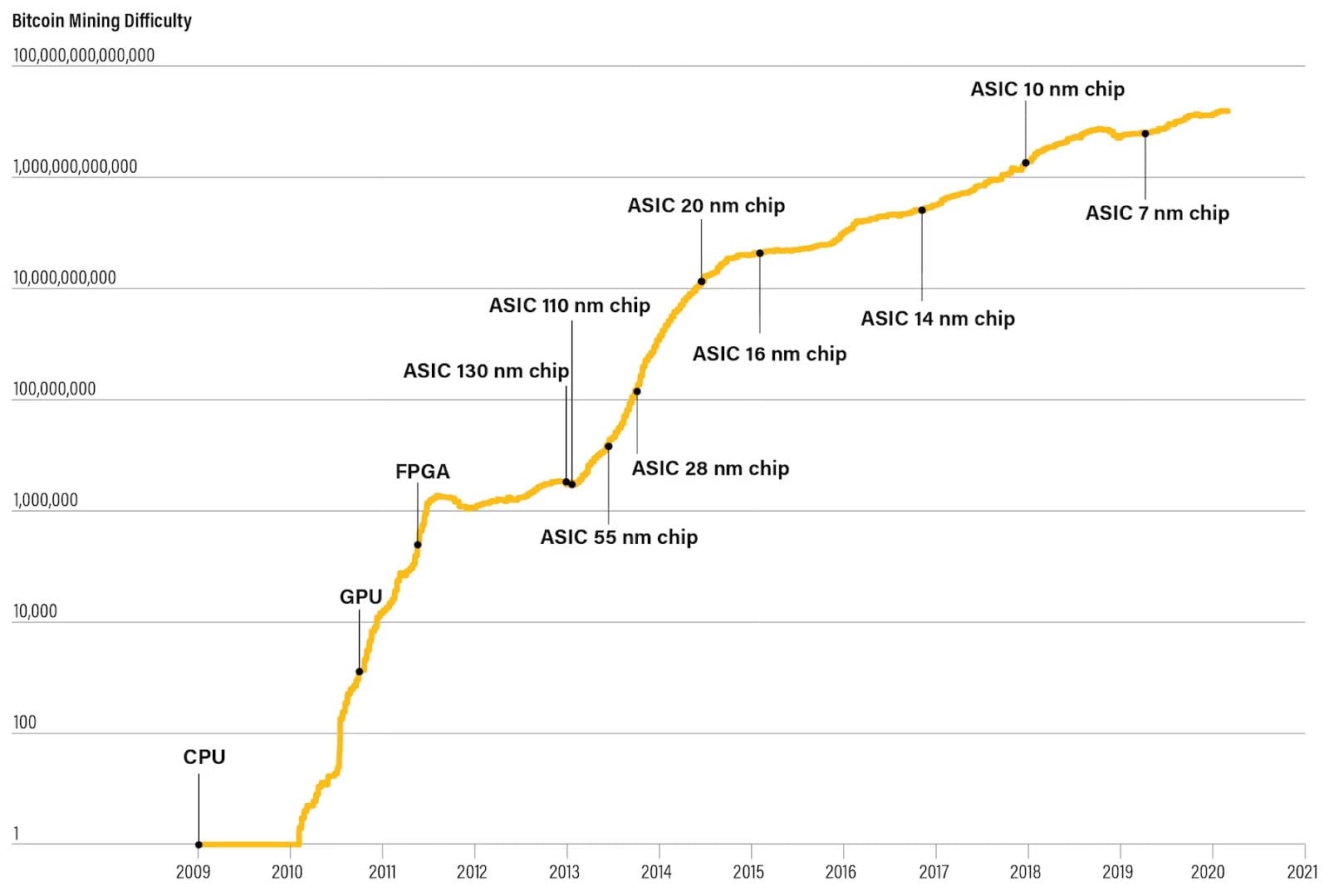

Mining in the Early Years

Back then, you could mine Bitcoin on a laptop CPU. Soon after that, hobbyists shifted to GPUs for more hashing power, then to specialized ASIC machines as difficulty climbed.

What started on bedroom PCs grew into large operations, then into industrial data centers sited near cheap power and cool climates.

When Did the Cryptocurrency Ecosystem Start Growing?

Bitcoin lit the fuse for something bigger than “internet coins.” Once an open network proved money could run on public rails, builders and entrepreneurs poured in. What began as a niche experiment turned into a global scene: tinkering became startups, meetups became conferences, and small tests became products with real users.

Different teams explored new trade-offs and designs, and local needs shaped adoption while better tools made getting started less intimidating.

From Bitcoin to Altcoins and Beyond

Developers began launching altcoins — alternatives to Bitcoin — with tweaks to block time, supply, or features. Some were experiments, some were memes, and a few solved new problems. A major leap came with programmable blockchains.

With Ethereum’s 2015 launch, that idea took root. Once smart contracts could execute on-chain, the ledger became a place to run apps. Trading and lending arrived first, then community raises and NFTs. From there, the scene branched out with DeFi platforms, layer-2 networks that compress transactions to lower fees, stablecoins for predictable payments, and privacy options when discretion matters.

The Rise of Wallets, Exchanges, and Communities

Better tools made crypto less intimidating. Wallets became mobile and user-friendly. Exchanges matured into globally accessible venues with fiat on-ramps, order books, and compliance teams.

Communities moved from forums to Reddit, Twitter/X, Discord, and Telegram, where tutorials and memes live side by side. Regional scenes blossomed, each mapping Bitcoin and broader crypto to local needs.

What Are the Key Milestones in Bitcoin’s History?

We can map Bitcoin’s journey through a few landmarks. Early surges stress-tested the rails. Policy frameworks matured in parallel and gathered pace after those cycles. Institutional access arrived stepwise: first trusts and futures, then corporate treasuries and payment apps, and finally the ETF era.

Major Price Surges and Market Crashes

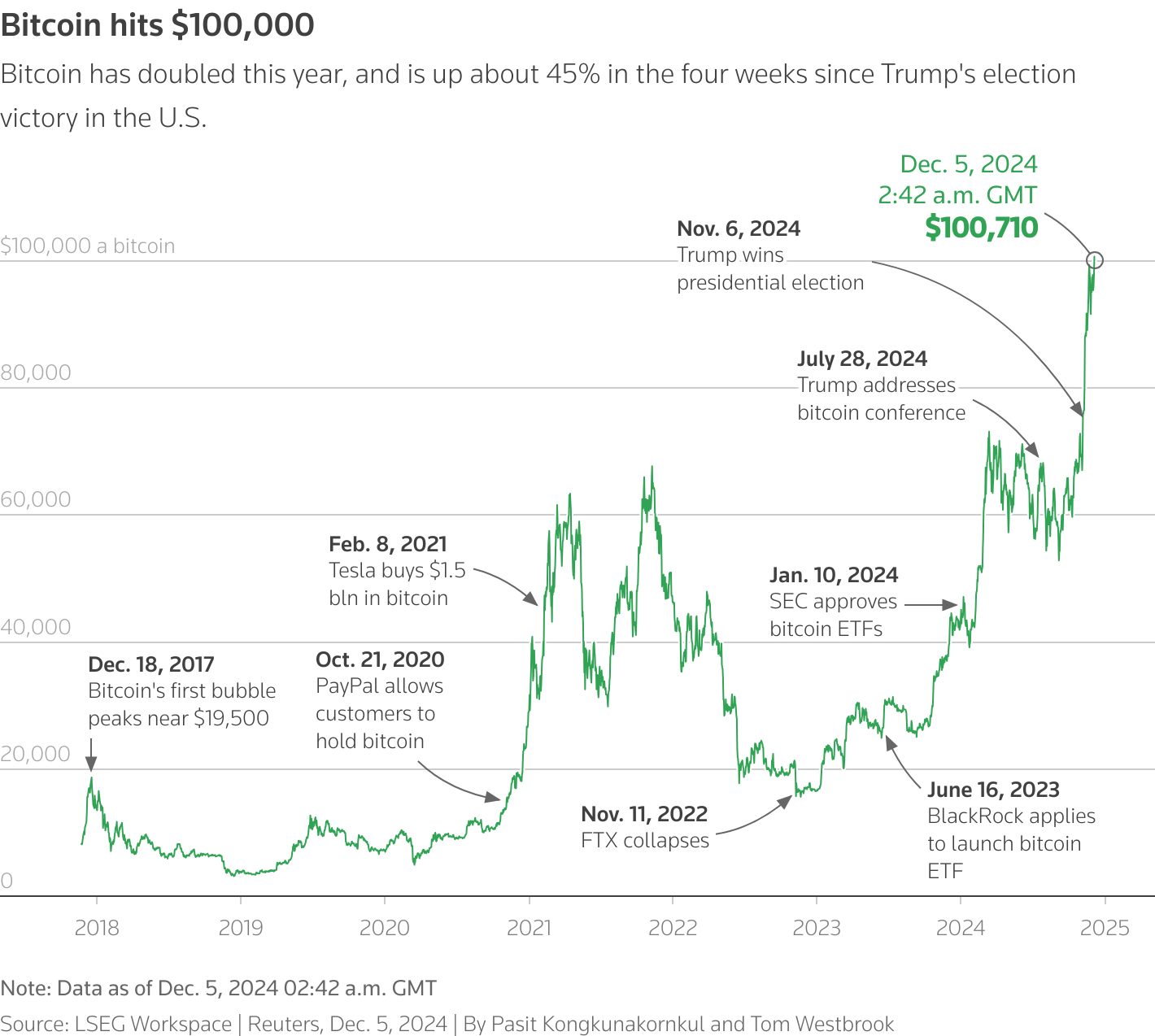

2013: Bitcoin’s first big breakout. It raced from tens of dollars to over $1,000 and then cooled off as policy headlines arrived, most notably China’s central bank telling banks and payment firms to stay out of Bitcoin services.

That moment put volatility on display and made exchange resilience a front-page topic. The following months (early 2014) underscored operational risk when Mt. Gox halted withdrawals and later went offline.

2017: The first truly global bull market. Retail investors poured in and ICOs mushroomed as BTC neared $20,000. The 2018 comedown was steep, but the network kept running, developers kept shipping, and long-term holders grew.

2020-2021: A new type of demand surfaced with public companies, hedge funds, and payment apps. PayPal added crypto buy/hold/sell for U.S. users in October 2020, MicroStrategy kicked off the corporate-treasury playbook, and Tesla disclosed a $1.5 billion purchase in February 2021.

The May 11, 2020 halving set the monetary backdrop. Momentum carried Bitcoin to repeated records — first clearing $20,000 in December 2020 and later topping $60,000 in 2021 — before a typical cycle pullback.

2024-2025: Spot Bitcoin ETFs in major markets lowered the barrier for traditional investors. Prices swung, as they do, but access improved, and Bitcoin’s market structure inched closer to mainstream finance.

Global Regulatory Responses Over Time

Regulators took the scenic route. Early on, many agencies watched from the sidelines. Then came guidance on KYC/AML for exchanges, tax treatment for gains, and rules for custodians. Some jurisdictions leaned in with licenses and sandboxes, others imposed strict limits or outright bans.

Common themes stood out: apply the same consumer-protection rules to crypto services as to banks and brokers (“same risk, same rules”), spell out what qualifies as a digital asset, and coordinate across borders so enforcement is real while useful innovation can still ship. Countries won’t move in lockstep and details will keep evolving, yet the direction is clear — early curiosity gave way to scrutiny, and scrutiny is maturing into formal rulebooks.

Institutional Investment and Mainstream Adoption

Mainstream access now looks like compliant custody, audit-ready accounting, broker connectivity, and risk frameworks integrated with existing ops. What began as a geek project became a macro asset. Pension funds, endowments, and corporate treasuries explored small allocations. Payment companies added buy/sell buttons and, in some regions, merchant acceptance.

What Is Bitcoin’s Legacy in Modern Finance?

Look past the chart and you’ll hear the choices that made Bitcoin… Bitcoin. A verifiable fixed supply and halving schedule; a difficulty adjustment that steadies block timing; and a conservative, open-source governance ethos. Keys you can hold yourself, which flip custody from a service to a skill.

That design sets the ground rules. It shapes how people save and self-custody, how companies account for holdings and design controls, and how regulators write their playbooks. Price grabs attention; architecture sets habits. A fixed supply anchors expectations, the difficulty mechanism keeps the clock dependable, and open governance builds trust. That kind of structure outlasts any single price swing.

How It Inspired the Cryptocurrency Industry

Bitcoin proved that a public, permissionless network could coordinate strangers with code and incentives. That template spun out into a thousand directions. Programmable chains built application layers; privacy and scaling research expanded the design space — much of it inspired by Bitcoin’s template.

Even outside crypto, industries borrowed the idea of tamper-evident logs and programmable settlement to audit supply chains, timestamp research, or coordinate marketplaces. Not every offshoot adds lasting value, but the reason so much experimentation exists is simple: Bitcoin opened the door.

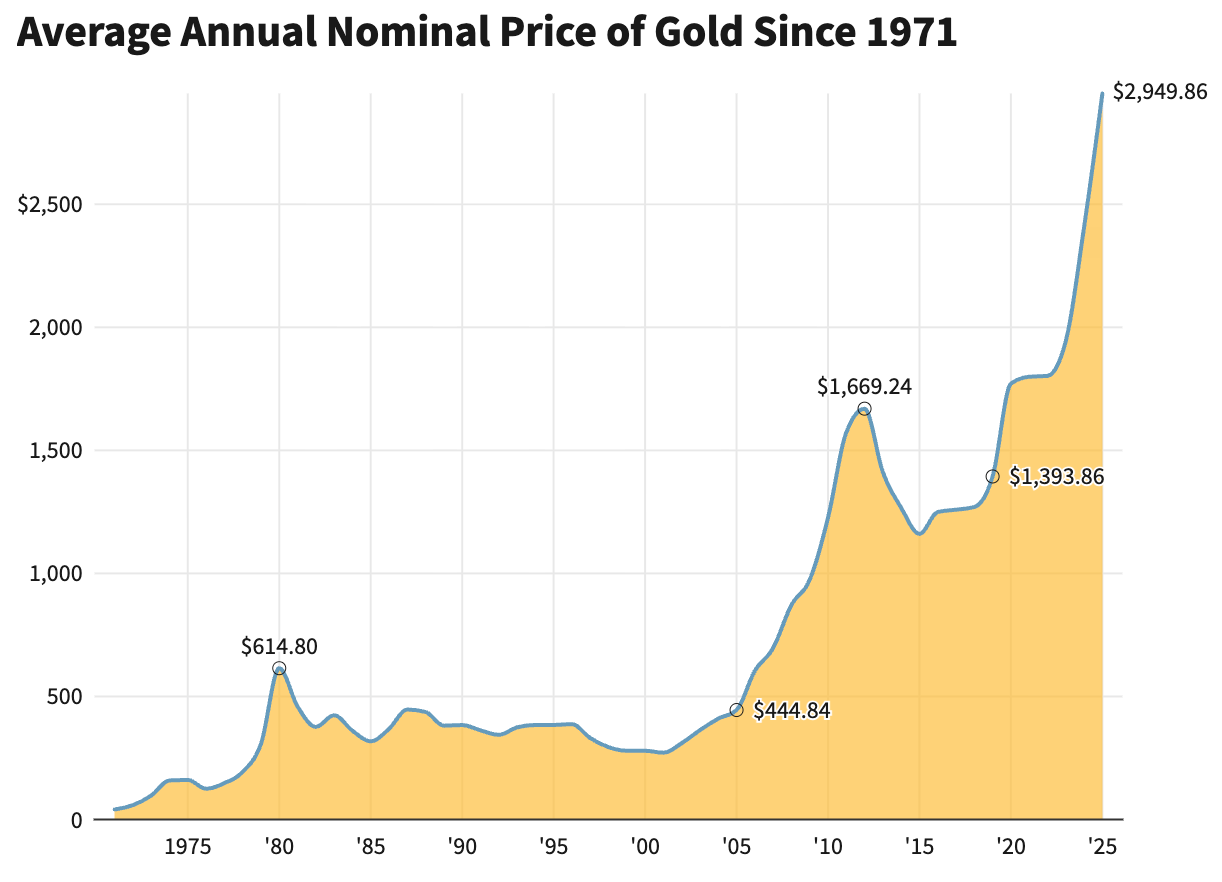

The Role of Bitcoin as Digital Gold

Over time, many investors stopped treating Bitcoin as internet cash and started treating it as “digital gold.” The case rests on three pillars: verifiable scarcity, credible issuance, and portability across borders.

In places dealing with high inflation or tight capital controls, that combination shows up in daily life when moving savings across borders, paying freelancers, or parking value between paychecks. In developed markets, Bitcoin more frequently plays the role of a small diversifier: a hedge against monetary experiments and a bet on the staying power of an open network.

Does that make Bitcoin risk-free? Of course not. It’s volatile and narrative-driven. But so was gold at the dawn of free-market trading. Bitcoin offers optionality and gives savers and institutions a new knob to turn.

Conclusion: From Experiment to Global Phenomenon

Bitcoin started as a nine-page idea and a handful of computers talking to each other. No marketing department. No customer support line. Just code, incentives, and a group of people curious enough to press “run.”

Since then, it has weathered scandals and skepticism — and still managed to bend finance around it: markets that never sleep, settlements that clear in minutes, custody that lives on your key instead of at a counter, and an asset with a known long-term supply.

It also sparked a wave of building that goes far beyond one coin: programmable money, decentralized markets, new payment rails, and a generation of developers who think in open protocols first.

You can cheer or critique from your seat, but the scoreboard is clear. A niche experiment became a global reference point. Whether you call it digital gold, an internet reserve asset, or just “Bitcoin,” the world now prices risk and opportunity with this network in mind. That’s a new chapter in financial history, and it’s still being written.

Disclaimer: The content provided in this article is for educational and informational purposes only and should not be considered financial or investment advice. Interacting with blockchain, crypto assets, and Web3 applications involves risks, including the potential loss of funds. Venga encourages readers to conduct thorough research and understand the risks before engaging with any crypto assets or blockchain technologies. For more details, please refer to our terms of service.