Table of Contents

Imagine placing a small bet – not just on a football match or a horse race – but on whether the Fed will hike rates next month, if Ethereum hits $5K before the year’s out, or whether Kanye will run for president again.

Now imagine doing that on-chain. No bookies. No permissions. Just you, your conviction, and a decentralized platform where the odds are set by collective belief – not backroom algorithms.

Welcome to the weird, wild, and quietly revolutionary world of prediction markets.

At first glance, they might look like just another crypto casino. But under the hood, they’re one of the most powerful mechanisms we have for surfacing truth – not by asking people what they think, but by making them put money on it.

In this guide, you’ll see what prediction markets are, how they work, and why they might reshape everything from governance to journalism.

What Are Prediction Markets?

Prediction markets are platforms where people can buy and sell shares in the outcome of a future event.

Each “share” is a bet on whether something will or won’t happen. If you think ETH is going to flip BTC? Buy “yes” shares. If not? Go short. Simple.

But this isn’t just about gambling. The real value here is crowdsourced forecasting.

The price of a share reflects what the market thinks the odds are. If “YES” is trading at $0.60, the collective wisdom says there’s a 60% chance that outcome will happen.

But unlike traditional betting platforms:

- The goal isn’t just entertainment – it’s insight.

- These markets surface real-world probabilities, not just profit.

In fact, prediction markets are sometimes called information markets or future markets – because they crowdsource collective intelligence in real-time.

How Do Decentralized Prediction Markets Work?

While the basic idea mirrors traditional betting, DeFi prediction markets are built on smart contracts and blockchain rails. That makes them:

- Trustless (no central authority setting odds)

- Transparent (you can audit outcomes and trades)

- Borderless (anyone can jump in)

- Permissionless (no account needed – just a wallet)

Here’s a simplified version of how a decentralized prediction market works:

1. A Market Is Created

Anyone can spin up a new question, like:

- “Will the UK have a general election before June 2025?”

- “Will Solana hit $150 by Q4?”

You spell out how the market will settle (what source counts), pick an oracle, and set an end date.

2. Liquidity & Trading Begins

Traders buy “YES” or “NO” shares depending on their belief. If YES trades at $0.60, the implied market probability is 60%.

- Prices move as people trade

- The final price is the market’s live consensus

3. Outcome Is Resolved

Once the event concludes, an oracle (more on this later) provides the final outcome.

- Winning shares you redeem for $1

- Losing shares are worth $0

And just like that, the market closes – offering both financial rewards and a snapshot of what people believed.

Why Prediction Markets Actually Matter

Decentralized prediction platforms aren’t just another speculative casino. They provide real value in areas where truth is hard to know ahead of time. They might even be one of the most underhyped forecasting tools in the world right now. Here’s why:

Crowd > Pundits

Prediction markets harness the knowledge of many. Traders who are confident and well-informed are financially incentivized to share their beliefs. The result? More accurate forecasts than pundits or polls.

In multiple studies, prediction markets outperform expert analysts at forecasting elections, interest rate decisions, and even the Oscars.

Censorship Resistance

You don’t need approval to trade on-chain. That makes these markets incredibly valuable in countries where state-run media dominates and betting is banned.

When truth is dangerous, prediction markets become a backdoor to reality.

Incentive Alignment

Unlike polls (where people just click buttons), prediction markets demand real commitment. Want to skew the odds? It’ll cost you.

It’s not about popularity. It’s about being right.

Real-Time Feedback Loops

Because prices fluctuate with new information, prediction markets act as live dashboards of global sentiment.

Want to know if the market believes a war will escalate?

Want to gauge the odds of a DAO proposal passing?

There’s likely a market for that. Think of it as a live dashboard for collective confidence.

Skin in the Game vs Opinion Polls: Why Prediction Markets Are More Honest

While prediction markets and opinion polls might seem similar – they’re not even playing the same game.

Polls ask people what they think might happen. Or worse: what they want to happen. But prediction markets demand skin in the game. If you want to “vote” on an outcome, you have to back it with money.

This one change flips everything.

- In polls, you get bias: wishful thinking, tribal loyalty, bandwagon answers.

- In prediction markets, you get filtered belief – what people are confident enough to bet on.

That distinction matters. It’s why markets often outperform polls in forecasting elections, referendums, and other uncertain outcomes. They strip away noise and surface conviction.

Think of it this way: anyone can shout on Twitter. Prediction markets force you to shut up and trade.

Where Are Prediction Markets Being Used?

Prediction markets are already powering DeFi bets, governance models, and speculative experiments across the ecosystem. Here are just a few use cases:

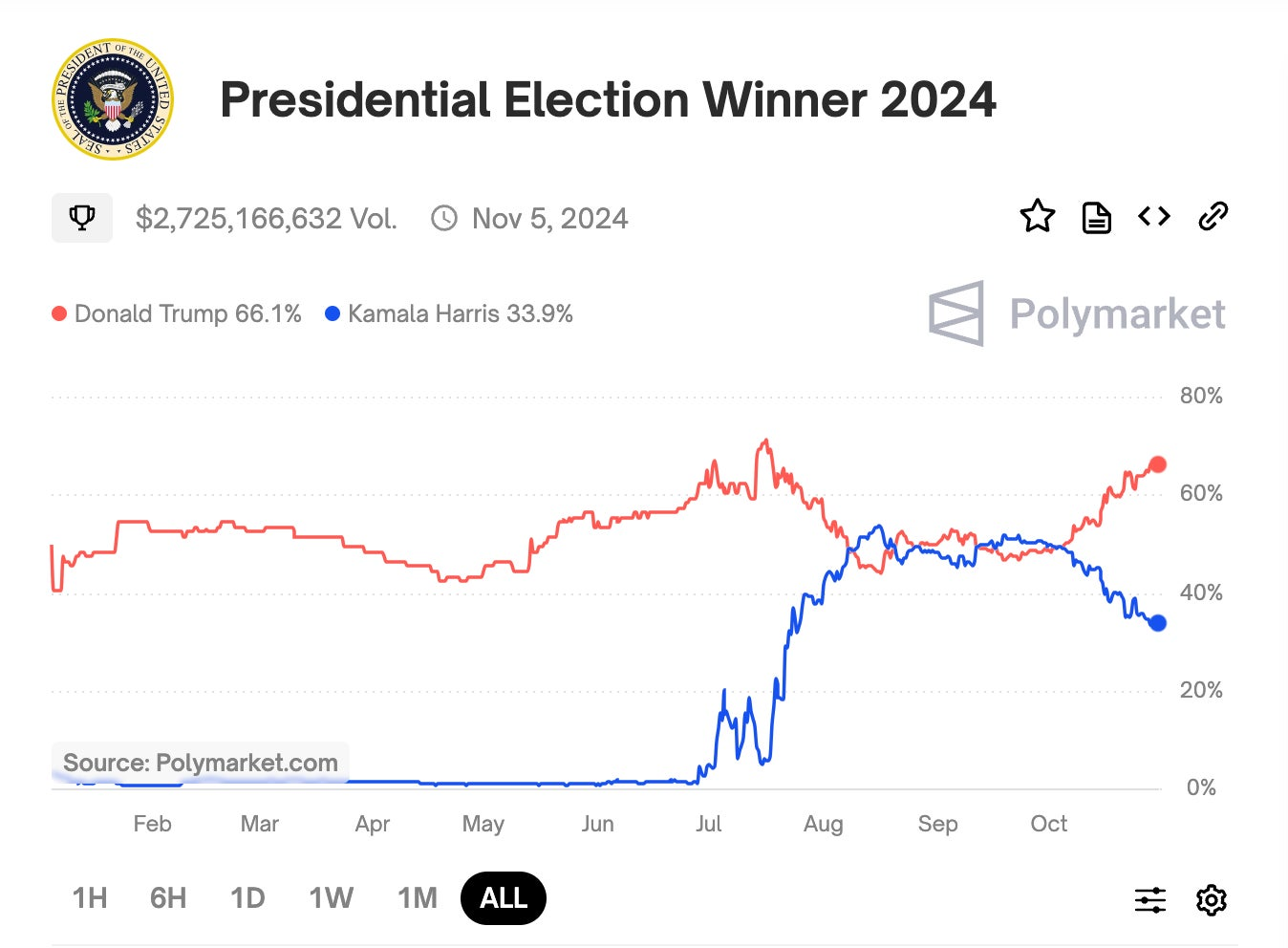

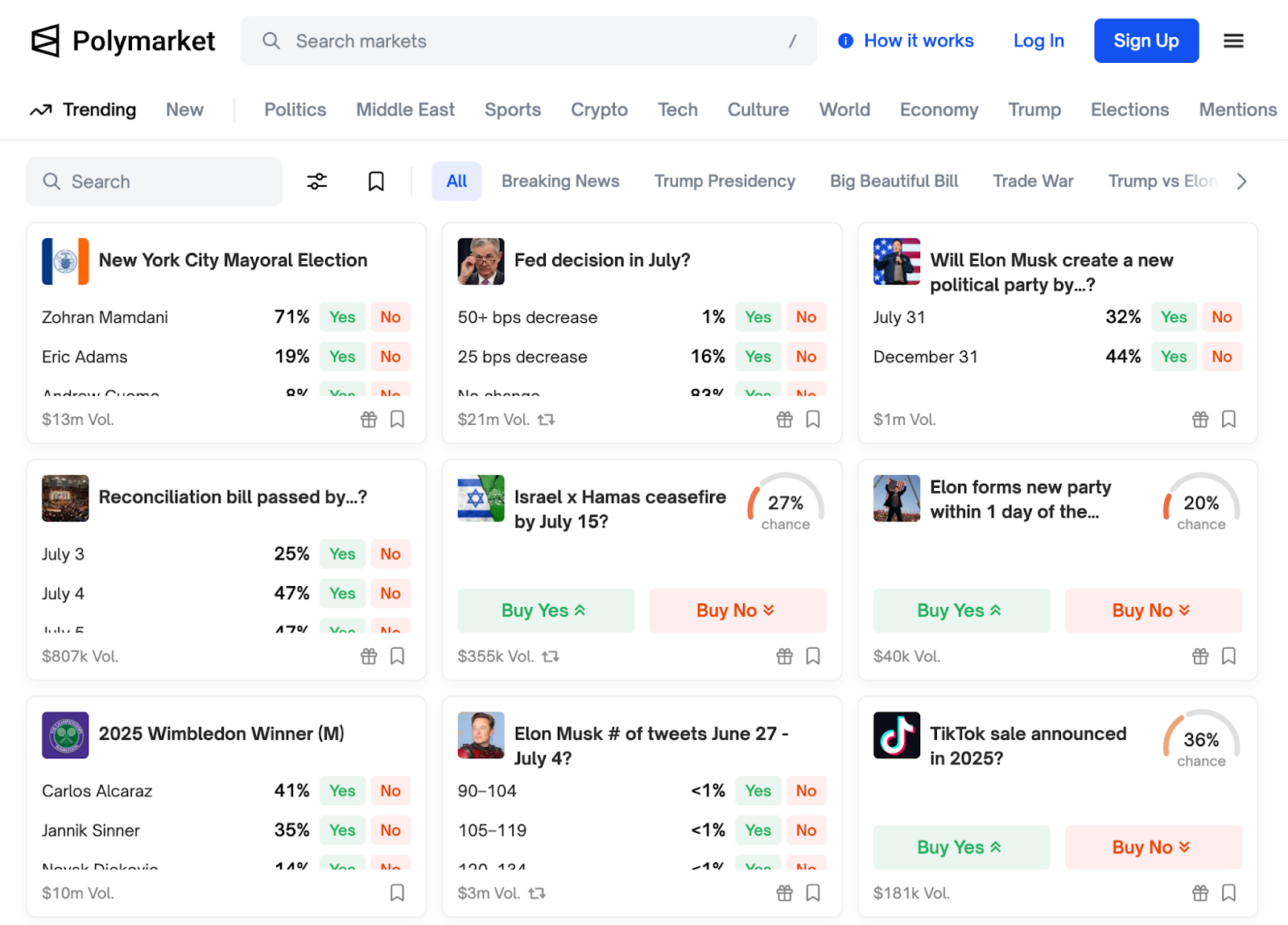

Elections

This is the classic one. Markets have been shockingly accurate at predicting U.S. elections, referendums, and global races – sometimes better than traditional polls.

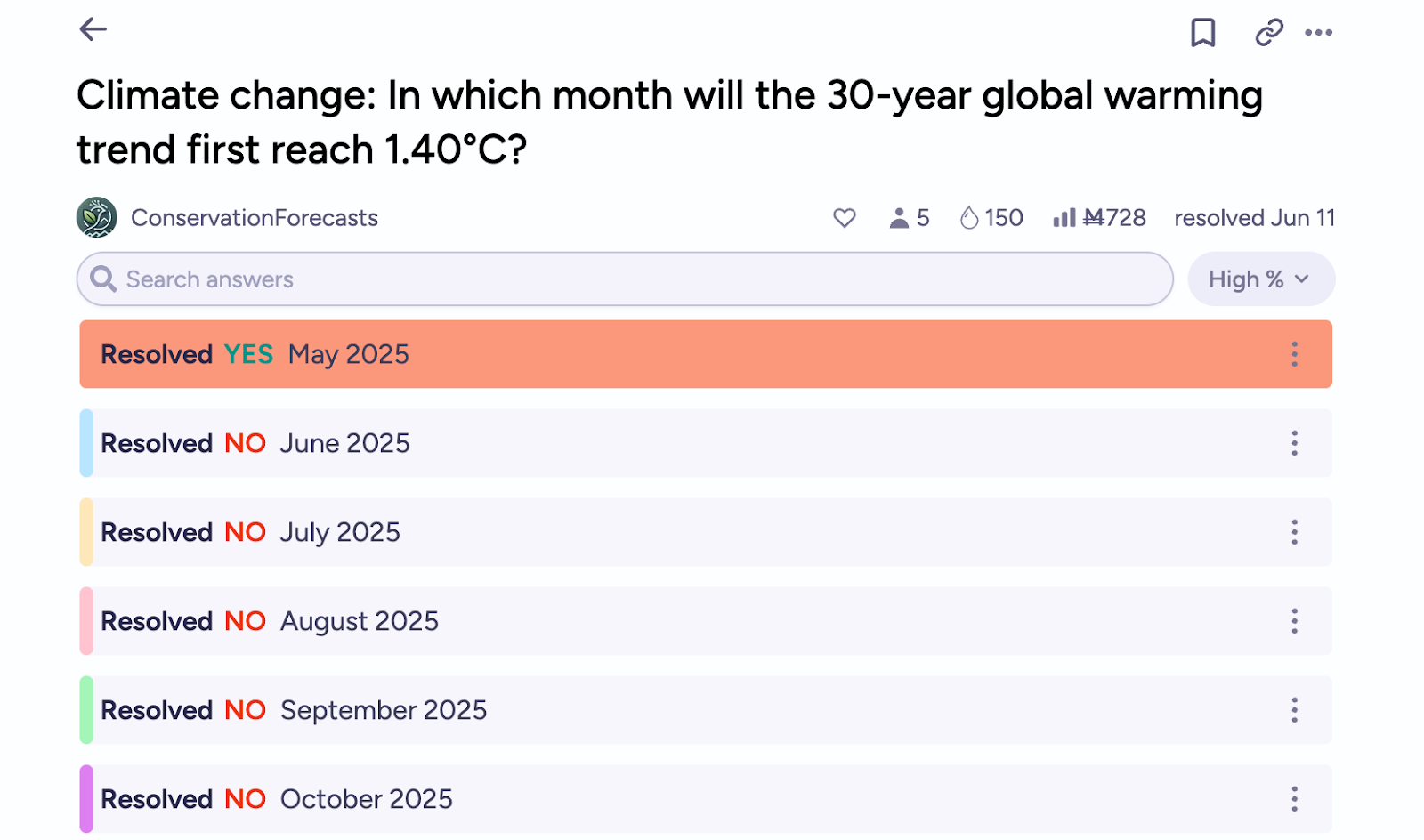

Public Forecasting

Platforms like Manifold or Metaculus let people bet on timelines for AI development, climate change, pandemic response, or space missions.

This isn’t gambling – it’s long-range public forecasting, funded by curiosity and incentives.

Sports & Entertainment

These exist, but they’re not the main DeFi use case. That said, they’re great for onboarding normies who don’t care about governance but do want to bet on Eurovision.

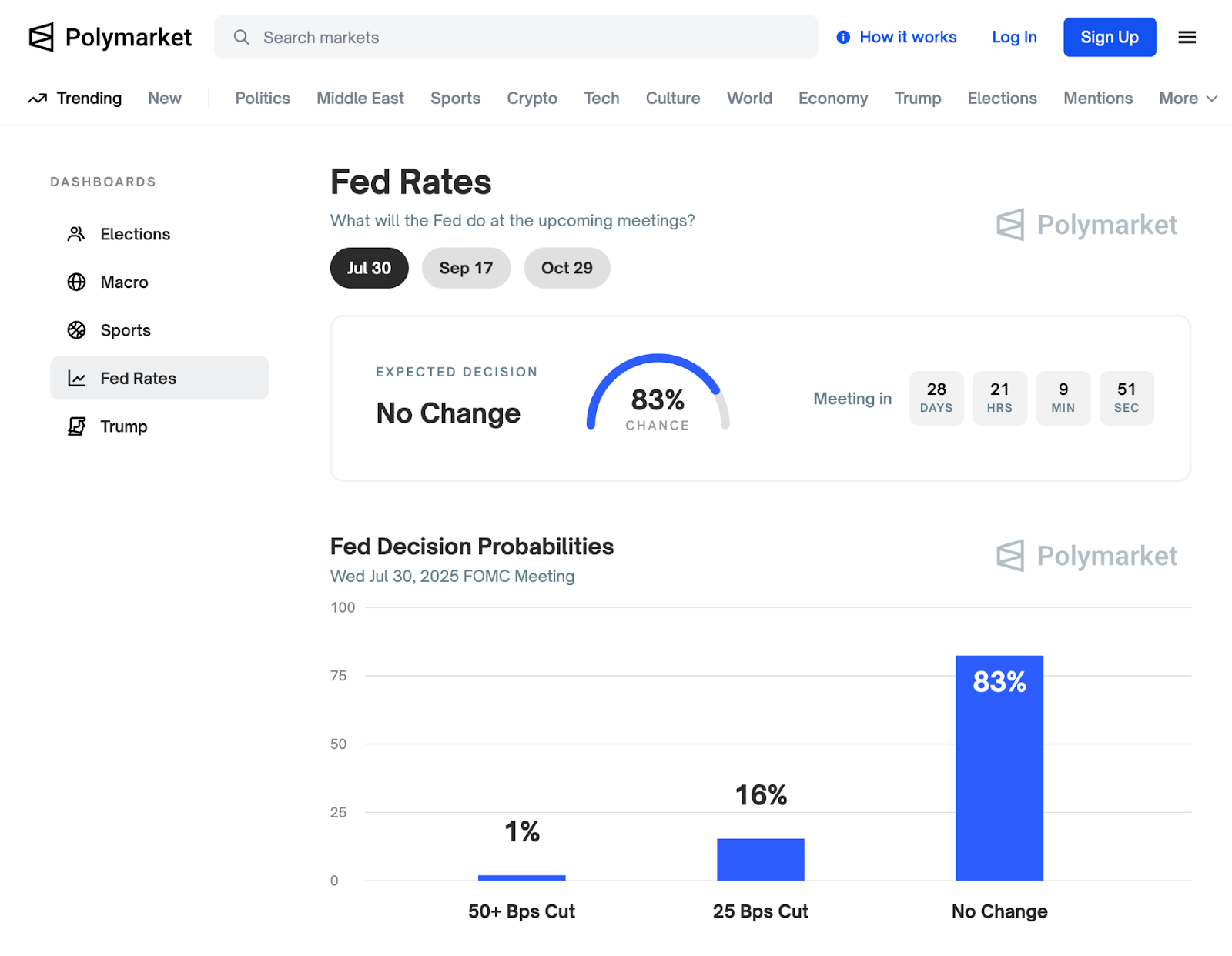

Economic Indicators

Markets already exist for things like:

- Fed interest rate decisions

- Recession probability

- Inflation numbers

Useful for macro traders, analysts, and meme economists on Twitter.

Crypto Events

Want to bet on when Dencun rolls out? Or whether Bitcoin hits $100K this cycle? These niche markets are where degens go to flex their alpha.

Key Prediction Market Platforms to Know

While the space is still emerging, several prediction market platforms are gaining traction. Here’s the quick tour – start with one, then try the rest as you get a feel.:

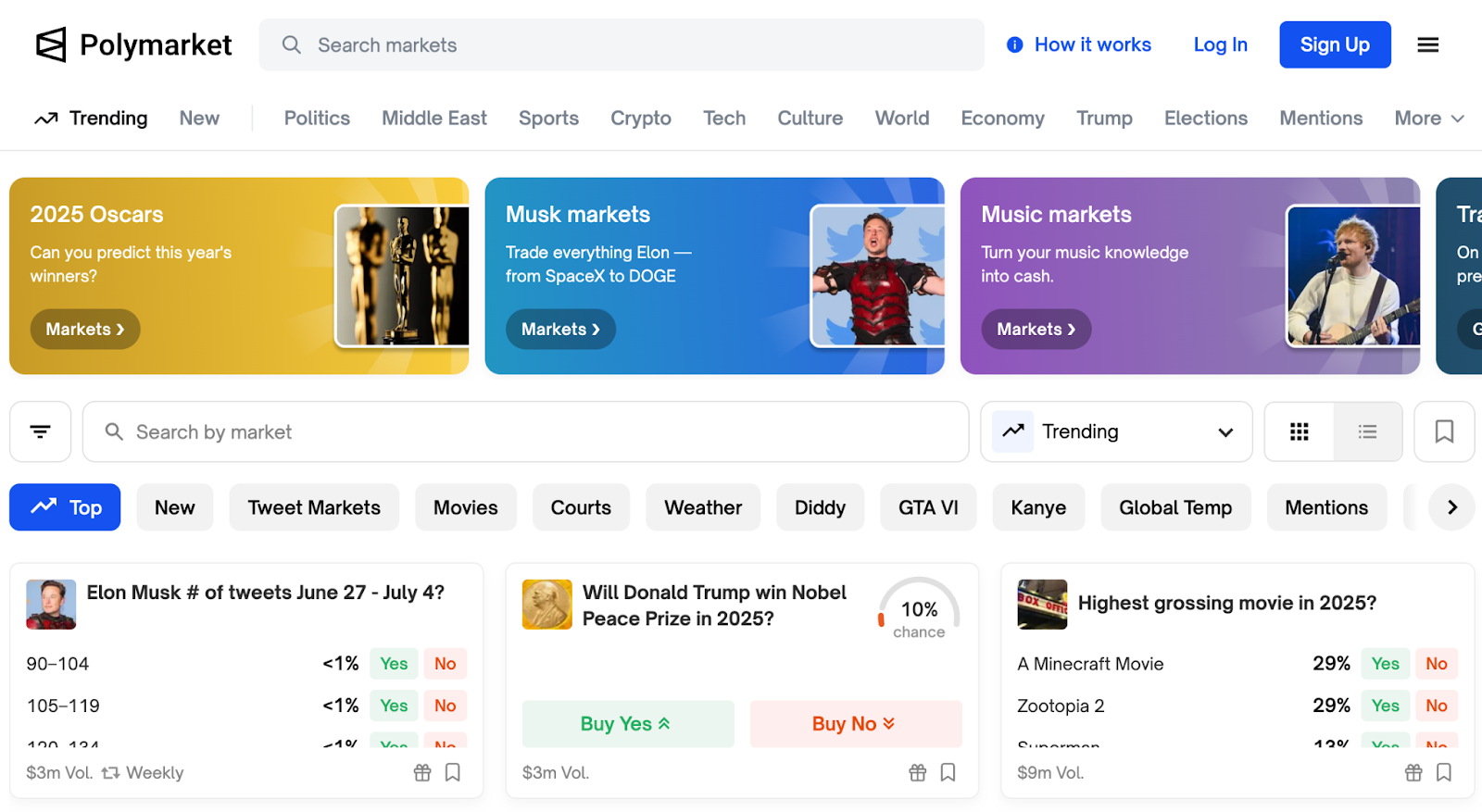

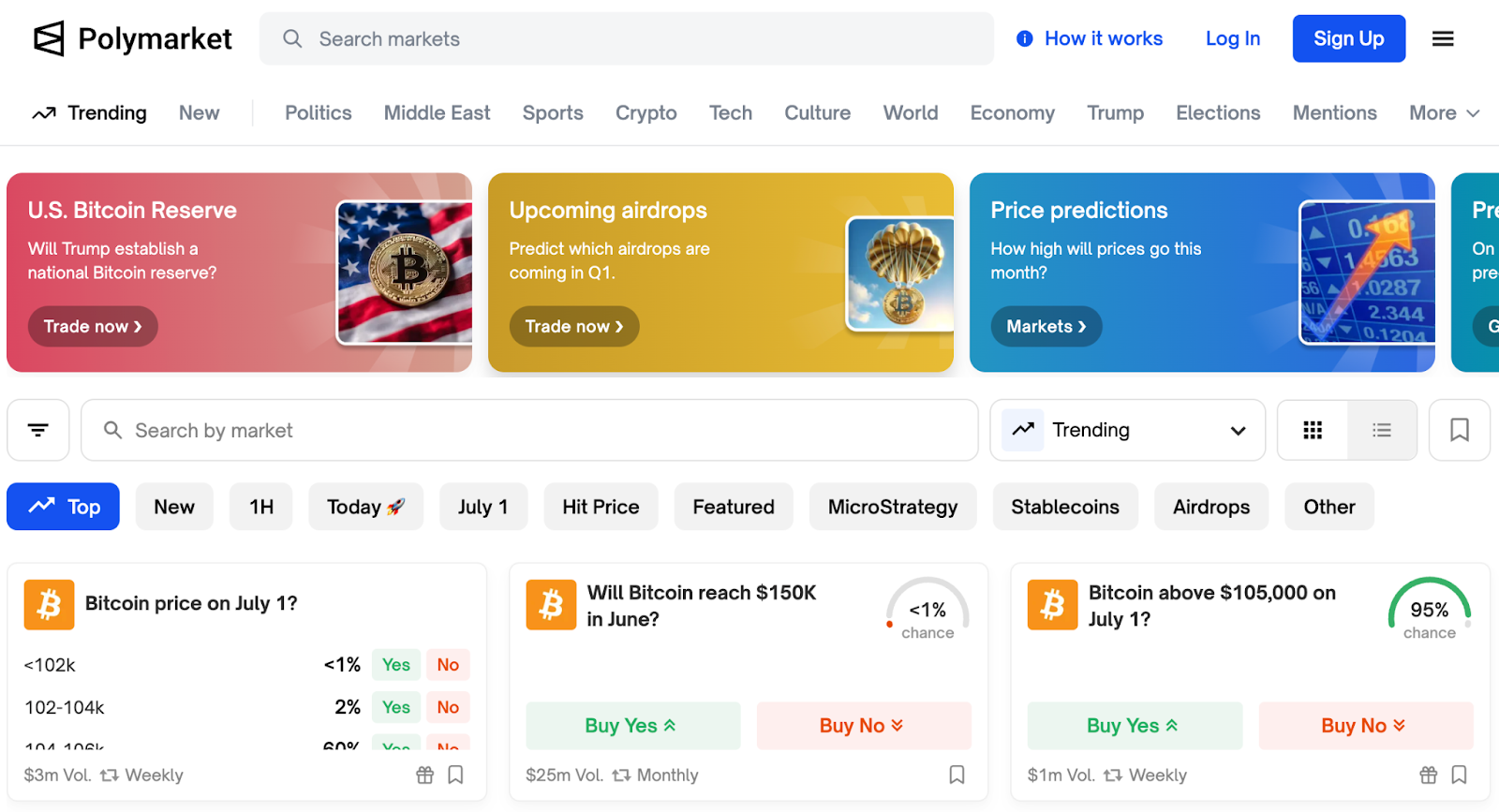

Polymarket

The most active and well-known decentralized prediction platform.

- Built on Polygon

- Clean UI, easy onboarding

- Regulated under a U.S. CFTC no-action letter

- Big range of markets – from U.S. politics to pop culture

Best for: general forecasting, political markets, economic events.

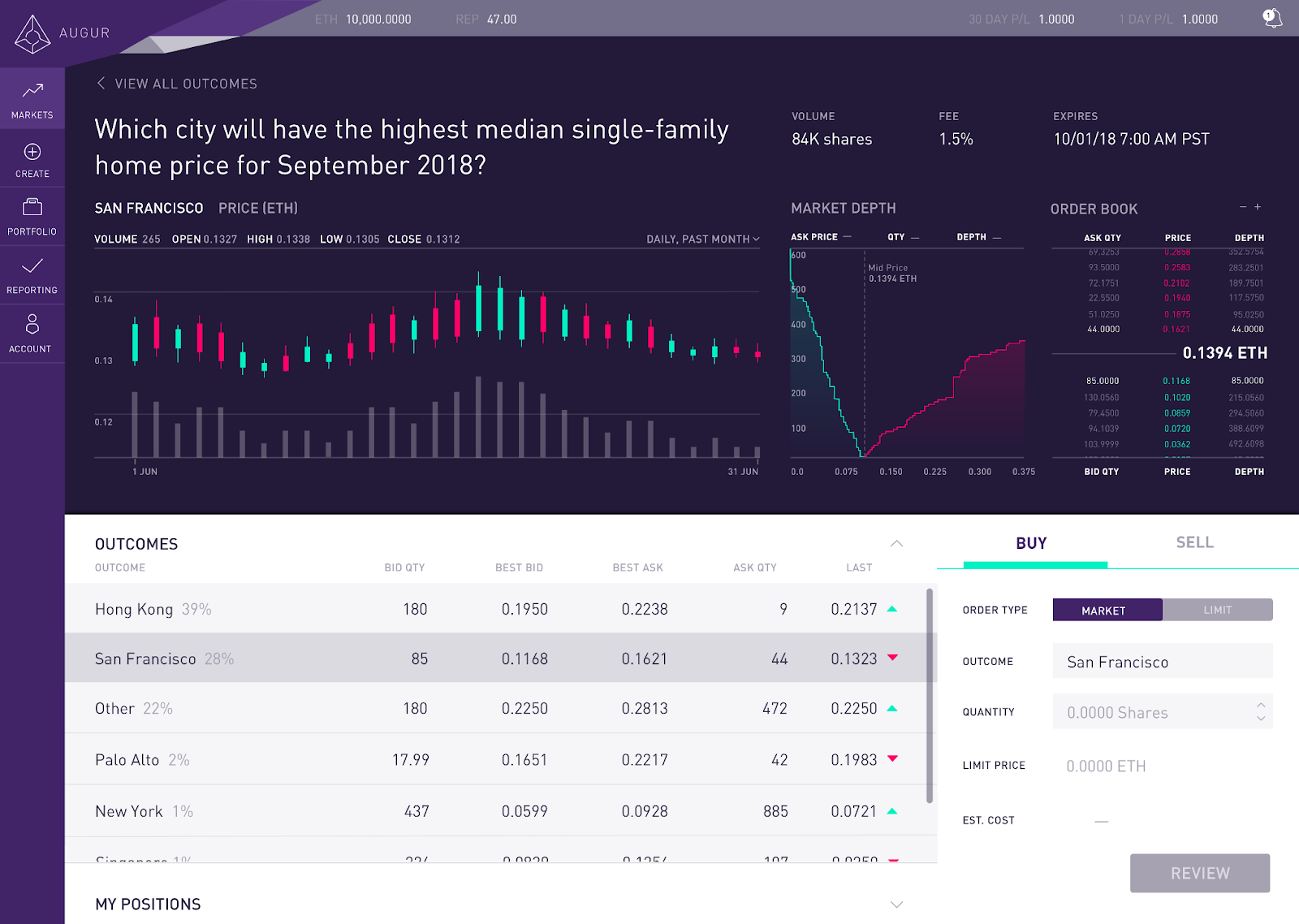

Augur

One of the earliest Ethereum-based prediction protocols. It’s fully decentralized, but with a clunky UX and high gas fees (thanks Ethereum).

Best for: technical users and experimental markets, not beginners.

Zeitgeist

A prediction market protocol built on Polkadot.

- Optimized for governance, DAOs, and custom market creation

- High customization options for resolution mechanisms

Best for: Web3-native projects integrating prediction markets into governance.

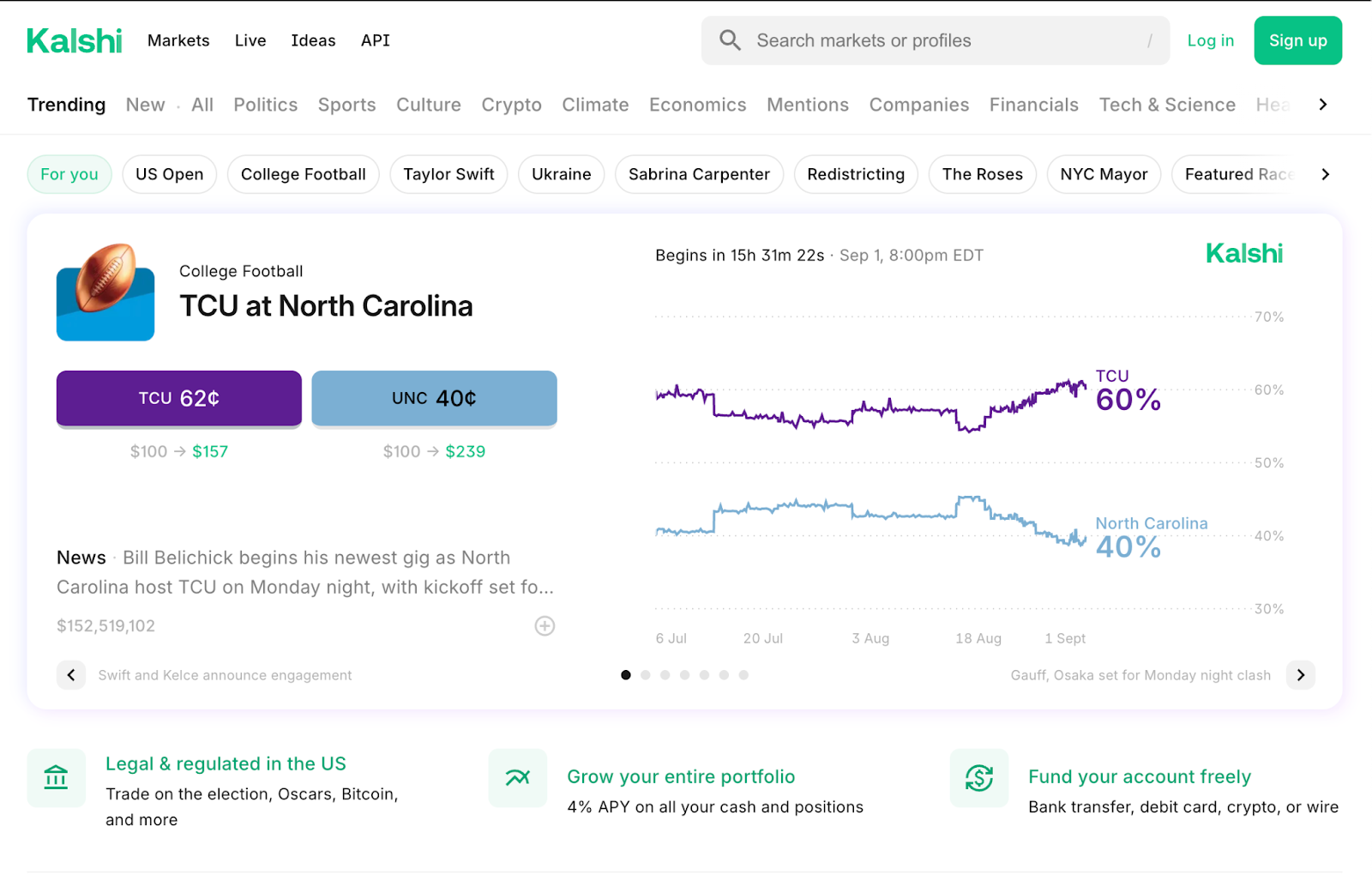

Kalshi

A federally regulated event-contracts exchange in the U.S. (fiat/KYC; not decentralized). Focused on macro/economic releases, policy outcomes, and real-world events.

Best for: U.S. users who want a compliant, real-money venue for event trading.

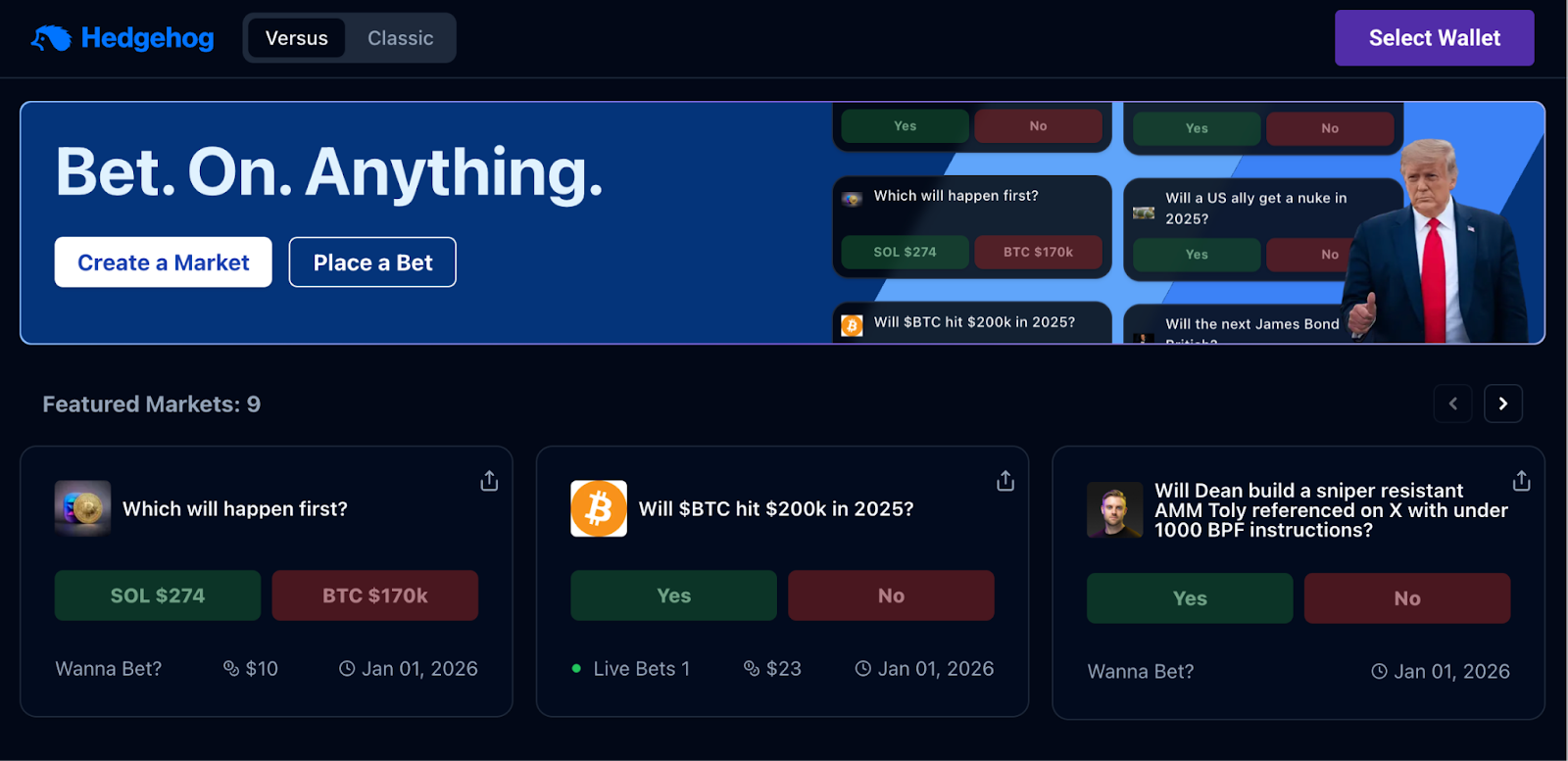

Hedgehog

A decentralized prediction market built on Solana. Offers low fees and fast finality with permissionless market creation and trading.

Best for: Web3 users seeking on-chain, low-cost markets on Solana.

Projection Finance

An early-stage Web3 forecasting/prediction app with strategy-simulation tools. Has a multi-chain footprint (e.g., Ethereum, Polygon, Optimism) with evolving feature set.

Best for: users who want to model scenarios and forecasts before committing capital.

Risks, Limitations & Challenges

Let’s not sugarcoat it – this space has real challenges. A few key risks include:

Low Liquidity

Smaller markets often suffer from limited participation. Without enough volume, odds can become skewed or gamed.

Oracle Risk

If a market resolves incorrectly – due to a bad or manipulated oracle feed – users lose faith. And unlike “Will ETH hit $5K?” some outcomes are fuzzy. (“Did this event really happen?” can get messy fast.)

Manipulation (Whale Games)

Whales can manipulate low-volume markets to influence public sentiment – or simply profit from chaos. This is particularly concerning for political or financial forecasts that ripple beyond the chain.

Where the Rules Get Messy

Prediction markets sit in a regulatory gray zone.

- In the U.S., most markets are restricted unless granted specific no-action relief from agencies like the CFTC (as Polymarket has for limited markets).

- In the EU, regulation is more fragmented – some jurisdictions treat them like betting, others like derivatives.

- Globally, enforcement is inconsistent, creating both opportunity and uncertainty.

As decentralized prediction tools grow in power and influence, regulators may clamp down – especially if they begin to rival polling firms, news outlets, or traditional betting operators.

The Future of Forecasting

Prediction markets might still be niche, but their upside is massive. It’s likely they will play a key role in the next phase of Web3.

Governance Forecasting

DAOs can use prediction markets to model outcomes before voting. For example: What’s the likelihood this treasury proposal bankrupts our protocol within 6 months?

AI + Markets

Pair GPT-style models with prediction markets, and you get hybrid intelligence – models generate the forecasts, humans bet on outcomes, and the system learns in real-time.

Media & Journalism

Instead of pundits and clickbait, future newsrooms might display market-based odds as editorial signals. For example: “96% chance the Fed raises rates next quarter” hits very differently than a CNBC panel saying “maybe.”

How to Get Involved with Prediction Markets

Interested in forecasting crypto events, exploring DeFi bets, or testing your predictive edge? Here’s how to start:

Step 1: Pick a Platform

For beginners, Polymarket is the easiest to try. Just connect a wallet and start browsing.

Step 2: Add Funds

Most platforms require USDC, ETH, or native tokens (e.g. REP for Augur). Use a DeFi wallet like MetaMask or Rabby.

Step 3: Buy a Position

Pick a market and choose your side. In binary markets you buy Yes or No. In multi-outcome markets (e.g., an election), you can buy a specific outcome/candidate. Prices are dynamic; your cost reflects the market’s implied odds.

Step 4: Watch & Adjust

Track your market as news and updates change sentiment. You can sell early or hold until resolution.

Step 5: Explore Market Creation

Some platforms let you create your own prediction markets. You define the rules, liquidity, and oracle – great for DAOs or content creators.

Conclusion: Betting on Truth

Prediction markets offer more than just a novel way to gamble. They represent a decentralized intelligence layer – where incentives drive truth, not just noise. By aligning skin in the game with open forecasting, DeFi prediction tools have the potential to transform:

- How communities make decisions

- How public sentiment is measured

- How truth is surfaced in complex, chaotic systems

As these platforms grow, the real winners won’t just be the best forecasters. They’ll be the communities, DAOs, and protocols that use the data to make smarter decisions. In a world of noise, prediction markets are a quiet bet on truth.

Disclaimer: The content provided in this article is for educational and informational purposes only and should not be considered financial or investment advice. Interacting with blockchain, crypto assets, and Web3 applications involves risks, including the potential loss of funds. Venga encourages readers to conduct thorough research and understand the risks before engaging with any crypto assets or blockchain technologies. For more details, please refer to our terms of service.