Table of Contents

Regular apps work like this: you place an order, someone behind the scenes processes it, and you cross your fingers that nobody screws it up between Point A and Point B.

dApps flip that model. Instead of trusting a kitchen staff you can't see, you're working with a recipe that's literally set in stone – visible to everyone, executable by anyone, with every single step logged in permanent ink.

There's no manager's office to schmooze your way into. No back door to exploit. Just transparent code, network consensus, and your wallet.

That's what dApps promise: apps living on blockchains rather than corporate infrastructure, following smart contract rules instead of executive whims, open to anyone who can get online.

Here's the catch, though: "decentralized" is a spectrum, not a binary. Some dApps really are bulletproof. Others? They have admin keys, pause buttons, and centralized front ends that can vanish overnight.

In this guide, we're breaking down what dApps actually are, how they work under the hood, where they deliver real value, and – critically – how to use them without getting wrecked.

What Are dApps, Really?

A dApp runs on blockchain infrastructure instead of traditional servers. Your data isn't sitting in some AWS data center – it's spread across thousands of nodes that continuously verify they're all seeing the same thing.

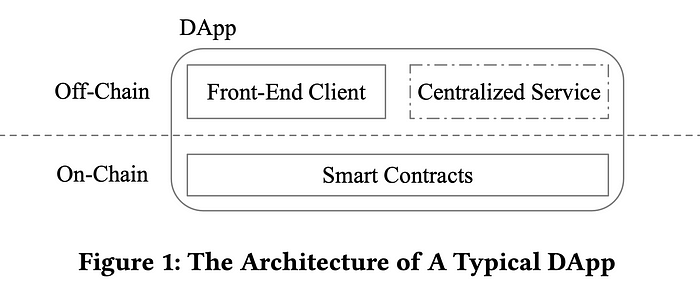

Here's the part that surprises people: most dApps are hybrids. They straddle two different universes.

The Front End (Off-Chain)

This is what you see and click on. The website, the buttons, and the slick interface. It's usually hosted on a regular server, IPFS, or a content delivery network. This part often feels like any other app you use daily.

The Back End (On-Chain)

This is the smart contract – the executable code living on a blockchain like Ethereum, Solana, or Arbitrum. When you "swap tokens" or "deposit collateral," you're not asking a company to do something for you. You're triggering a smart contract that automatically executes your request according to its programmed rules.

This doesn’t require a human intermediary or "account manager." It’s simply code that does what it says it will: every time, for everyone.

On-Chain vs Off-Chain: The Storage Split

Not everything can live on-chain. Blockchains are expensive and slow compared to traditional databases. So dApps make tradeoffs:

- On-chain: Token balances, transaction history, contract logic, core state

- Off-chain: User profiles, images, metadata, analytics, UI assets

For example, when you buy an NFT, the ownership record lives on-chain. But the actual image? Usually hosted on IPFS or a centralized server. If that server goes down, you still own the NFT – but good luck showing it off.

This mix of on-chain and off-chain is where "decentralized" gets murky. A dApp can have bulletproof smart contracts but a fragile website. Or vice versa.

How dApps Actually Work

Let's walk through what happens when you interact with a dApp like Uniswap or Aave.

Step 1: You Connect Your Wallet

Your wallet – MetaMask, Rainbow, whatever – is your blockchain passport. It stores your private keys and handles transaction signing. When you "connect" to a dApp, you're essentially flashing your address. Think of it like showing ID at a bar, except the bouncer gets cryptographic proof instead of just looking at your face.

Step 2: You Initiate an Action

Say you want to trade ETH for USDC on Uniswap. You punch in the numbers, hit "Swap," and your wallet immediately asks: "You sure about this?"

Step 3: Your Wallet Signs the Transaction

Your private key cryptographically signs off on the transaction, proving this is really you. That signature gets broadcast to the network.

Step 4: Validators Process It

Nodes pick up your transaction, validate it, and include it in the next block. The smart contract executes your swap automatically.

Step 5: State Updates On-Chain

Once confirmed, the blockchain's state updates. Your ETH balance drops. Your USDC balance rises. Everyone's copy of the ledger reflects this change.

The whole process is trustless. You didn't need to trust Uniswap the company. You trusted the code, which is public, auditable, and unchangeable (in theory).

The Role of RPCs, Nodes, and Oracles

A few other components keep the machinery running:

- RPC Providers: Your wallet doesn't talk directly to the blockchain. It goes through RPC (Remote Procedure Call) middlemen like Infura, Alchemy, or Quicknode.

- Nodes: These are the computers actually running the blockchain. Full nodes validate transactions and store the entire ledger.

- Oracles: Oracles pipe real-world data into smart contracts, letting them respond to things happening outside the blockchain.

If any of these pieces break, the dApp can struggle… even if the smart contract itself is perfect.

Why dApps Matter: The Real Benefits

So why deal with all this extra complexity? What's the actual payoff compared to normal apps?

1. Transparency

Pop open Etherscan and you can literally read what a smart contract will do before you touch it. No hidden surprises.

2. Portability

Your assets live in your wallet, not in some company's database. If a dApp shuts down tomorrow, you still own your tokens. You can take them to a competing protocol instantly.

3. Composability

Smart contracts can talk to each other like LEGO bricks. A lending protocol can plug into a DEX, which connects to a yield aggregator, which feeds into a DAO treasury. This "money LEGO" effect lets developers build incredibly complex financial products by stacking existing protocols.

4. Censorship Resistance

There's no kill switch. No one can freeze your assets, block your swap, or undo what you've done.

5. Global Access

Wallet plus internet connection equals full access. No credit history required, no forms to fill out, no bank manager to convince. This matters enormously in places where the local financial system is either broken or actively hostile.

The Dark Side: Risks and Limitations

Before you get too excited and assume dApps have solved everything, we need to talk about the ways they can absolutely wreck you – because they can, and they will if you're not careful.

Admin Keys and Pause Buttons

Many "decentralized" apps aren't actually unstoppable.

Protocols often launch with admin keys – these are private keys held by the founding team that let them upgrade contracts, pause operations, or drain funds in emergencies. The idea is to fix bugs quickly or respond to exploits.

The problem is that those admin keys are a single point of failure. If the team goes rogue – or gets hacked – they can rug pull the entire protocol.

Enter Multisigs

The slightly better approach: multisig wallets. These require multiple people to sign off on admin actions: say, 5 out of 9 keyholders need to agree.

Better than one person with god mode, sure. But it's still not fully decentralized because if the multisig members collude or get compromised, users are at risk.

The most mature protocols eventually move toward full decentralization – handing control to a DAO or making contracts immutable. But that takes time, and it's surprisingly rare.

Paused Contracts and Kill Switches

Some dApps have pause functions baked into their smart contracts. In an emergency – like an active exploit – the team can freeze all activity to prevent further damage.

Which means the protocol isn't as censorship-proof as advertised. If they can freeze your withdrawals, you're hoping they'll play nice.

Oracle Risk

Remember oracles? They feed external data to smart contracts. If an oracle goes down, reports false data, or gets manipulated, the dApp can malfunction spectacularly.

Flash loan attacks often exploit oracle vulnerabilities – manipulating price feeds to drain funds from lending protocols. It's not the smart contract's fault. It's the data source.

UX Friction

Let's be honest: using dApps is still clunky.

You need a wallet. You need to understand gas fees. You need to manually approve token allowances. You need to wait for transactions to confirm. And if you fat-finger a transaction or send funds to the wrong address? There's no customer support to call.

For normal people who just want things to work, this stuff is a nonstarter. Things are getting better, but let's not pretend we're anywhere close to mainstream-ready.

Common dApp Types and Real Examples

dApps show up in all kinds of forms. Here's what dominates the DeFi landscape:

Automated Market Makers (AMMs)

AMMs let you swap tokens without an order book. Liquidity providers deposit token pairs into pools, and traders swap against those pools using algorithmic pricing.

- Uniswap: The OG Ethereum DEX

- Curve: Specialized for stablecoin swaps

- PancakeSwap: Dominant on BNB Chain

Lending Protocols

Borrow or lend crypto without a bank. Smart contracts automatically manage interest rates, collateral, and liquidations.

- Aave: Borrow against your crypto holdings

- Compound: Earn interest by supplying assets

- Maker: Mint DAI stablecoin using ETH as collateral

NFT Marketplaces

Buy, sell, and trade NFTs – from art to in-game items to digital collectibles.

- OpenSea: The largest NFT marketplace

- Blur: Built for pro traders

- Magic Eden: Leading marketplace on Solana

Perpetual Exchanges

Trade leveraged futures without expiration dates – all on-chain.

- GMX: Decentralized perps with real yield, offering up to 50x leverage on select assets

- dYdX: High-performance derivatives trading

- Gains Network: Leveraged trading on multiple assets

Games and Metaverses

Play-to-earn games and virtual worlds where the assets actually belong to you and not the game studio.

- Axie Infinity: Creature battler with an economy (think Pokemon meets capitalism)

- Decentraland: Own virtual land, build weird stuff

- Illuvium: High-budget RPG running on Ethereum

How to Use dApps Safely: A User's Guide

Using dApps means you're your own bank, tech support, and fraud department. Here's how not to lose everything:

Watch Out for Phishing and Spoofed Sites

Scammers love cloning popular dApps to harvest your funds. Triple-check:

- The URL (seriously, "unisawp.com" is not Uniswap)

- SSL certificate

- Bookmark the real sites

And for the love of god, never click mystery links that slide into your DMs on Discord, Telegram, or Twitter.

Understand Token Approvals and Allowances

First time using a dApp? You'll probably need to approve it to spend your tokens – basically giving the smart contract permission to move stuff from your wallet.

The trap: these approvals are usually unlimited by default. Meaning a malicious or compromised contract could drain you completely.

The move: Tools like Revoke.cash let you audit and revoke old approvals. Only approve what you're about to use, nothing more.

Be Careful What You Sign

Not all signatures move funds. Some just prove you own an address. But shady dApps can disguise wallet-draining requests as innocent signature prompts.

If something feels off about a signature request, abort mission.

Check Contract Addresses

Before you interact with any dApp, look up its contract address on a block explorer like Etherscan. Confirm it's legit and has been audited.

Look for:

- Verified source code

- Recent activity

- Audits from firms people actually trust

Gas Fees, Latency, and Transaction Finality

One of the most confusing parts of using dApps is understanding why transactions take time – and cost money.

Why Transactions "Hang"

When you submit a transaction, it enters the mempool – a waiting area for unconfirmed transactions. Validators prioritize transactions with higher gas fees.

If you set your gas too low, your transaction can hang for minutes or even hours. If the network is congested, it might never confirm at all.

How to Speed Things Up

Most wallets let you adjust gas fees. Pay more, get confirmed faster. Some wallets also offer "speed up" options that resubmit your transaction with a higher fee.

Finality: When Is It Really Done?

Ethereum transactions become permanent after roughly 15 minutes – the time needed for network-wide consensus. Until then, there's a microscopic chance of reversal.

On other chains, finality can be achieved in seconds (Solana: ~5-13 seconds), or take much longer (Bitcoin: several hours)

Layer 2 Considerations

Layer 2 options like Arbitrum and Optimism handle transactions off Ethereum mainnet, making them faster and cheaper. But they add a withdrawal delay – usually 7 days – when you want to move funds back to Layer 1.

This tradeoff is important to understand before bridging assets.

The Future of dApps: What's Coming Next

dApps are still early. The UX is rough. The risks are real. And they're improving steadily: faster, smoother, more intuitive with each generation.

Account Abstraction

This tech lets smart contracts act as wallets, enabling features like:

- Social recovery (recover your wallet without a seed phrase)

- Gas-less transactions (someone else pays your fees)

- Batch multiple actions into one click

Account abstraction closes the UX gap between dApps and traditional apps, without compromising on security.

Session Keys

Imagine signing in once and then using a dApp for hours without constant wallet pop-ups. Session keys let you grant temporary, scoped permissions to a dApp.

Like giving someone your car key but not your entire keyring.

Intents and Solvers

Rather than manually routing transactions yourself, you specify the outcome you want ("swap ETH for USDC, best execution") and a solver figures out the optimal path.

Less complexity for you, better results overall (particularly for things like MEV protection).

Mobile-First UX

Most crypto activity happens on phones now. Wallets like Coinbase Wallet, Rainbow, and Phantom are finally building interfaces that don't feel like punishment.

Conclusion: Your First dApp in 10 Minutes

dApps have obvious flaws. They're clunkier than normal apps. They require more technical knowledge. And they come with risks that can't be ignored.

But they deliver something centralized apps fundamentally can't: actual ownership, genuine censorship resistance, and open access to global financial infrastructure

Whether you're here to trade, lend, collect, or build – understanding how dApps function is step one toward using them without anxiety.

Ready to take the plunge? Here's your starter checklist:

Your First dApp Checklist

- Grab a wallet (MetaMask or Rainbow won't overwhelm you)

- Load it with a modest amount – $50-$100 is plenty to start

- Pick a straightforward dApp like Uniswap or Aave

- Connect your wallet and poke around

- Execute one simple action (token swap, liquidity provision, or just view your holdings)

- Watch the transaction confirm on Etherscan

- Revoke any approvals you don't need at Revoke.cash

Start small. Learn as you go. And remember: in the world of dApps, you're the bank, the custodian, and the customer service team.

Oh, and welcome to Web3!

Disclaimer: The content provided in this article is for educational and informational purposes only and should not be considered financial or investment advice. Interacting with blockchain, crypto assets, and Web3 applications involves risks, including the potential loss of funds. Venga encourages readers to conduct thorough research and understand the risks before engaging with any crypto assets or blockchain technologies. For more details, please refer to our terms of service.