Table of Contents

If you still think crypto only lives in a parallel universe of memes, charts, and digital investments, reality is showing otherwise… and loudly. Since the beginning of the year, the crypto ecosystem has been everywhere from financial escape to sanctions, wars, and even bets on regime change or military actions. It’s clearly about much more than just investment.

Iran: A Growing Crypto Usage in Crisis Times

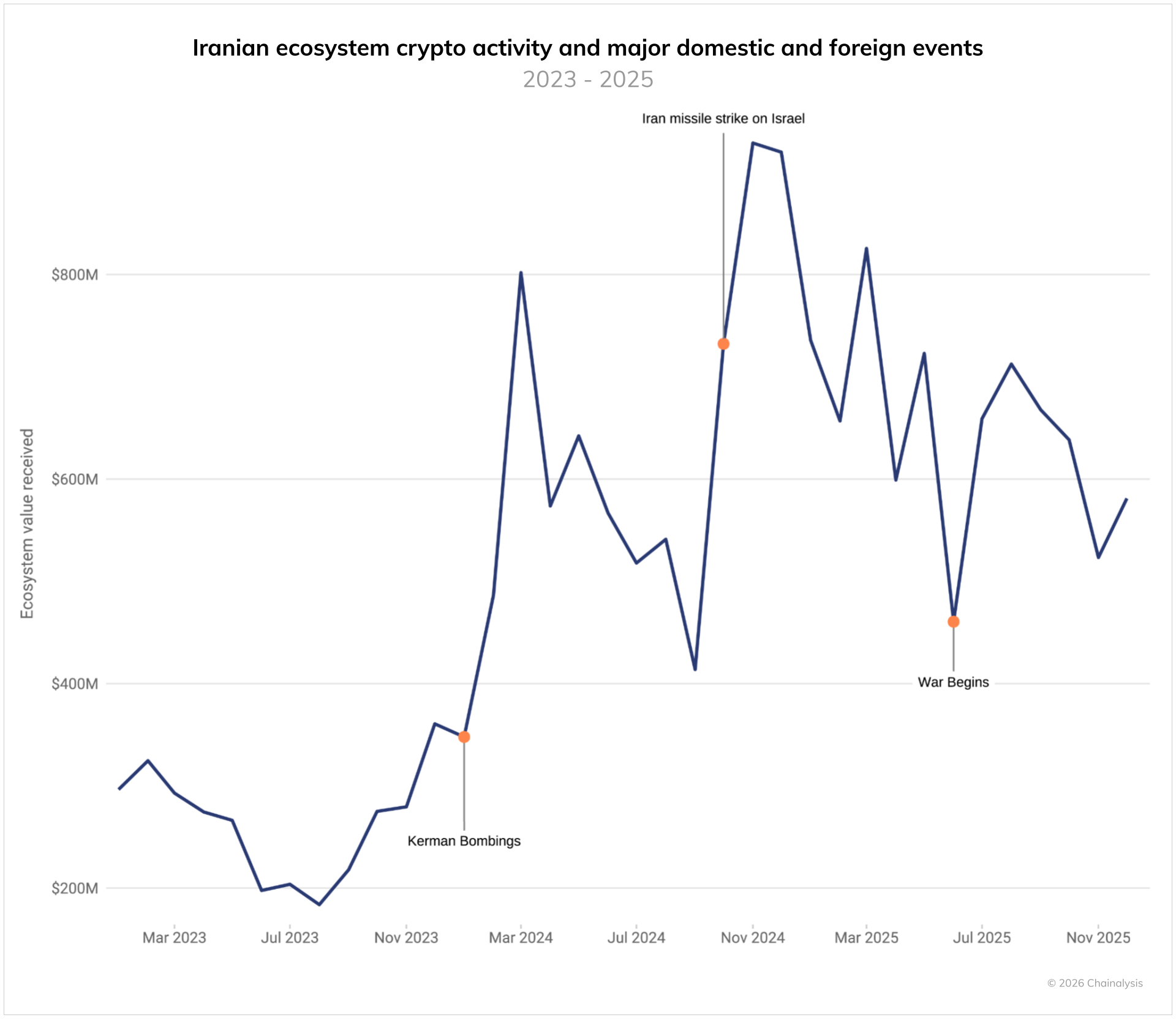

Iran’s crypto ecosystem is growing faster than ever and quietly crossed $7.8 billion in on-chain activity in 2025. This growth doesn’t seem random as it closely mirrors moments of crisis such as mass protests, military escalations, cyberattacks, and internet blackouts. In many ways, the blockchain has become a real-time barometer of political stress.

For an increasing number of Iranians, crypto — especially Bitcoin — looks less like an investment and more like an escape from a collapsing financial system:

- The rial has lost ~90% of its value since 2018

- Inflation sits around 40–50%

- Banks and online services can disappear overnight during crackdowns

During recent protests, Bitcoin withdrawals to self-custodied wallets spiked sharply. When trust in institutions collapses, the famous “not your keys, not your coins” stops being a slogan and starts being survival logic.

But crypto isn’t only a refuge for civilians. According to Chainalysis, around 50% of Iran’s observable crypto activity in late 2025 is linked to the IRGC, the regime’s powerful military force. These networks reportedly use crypto to move funds across borders, launder money through complex wallet structures, finance regional proxy operations, and evade sanctions.

Same technology, but two completely different use cases. Crypto is just a tool and it doesn’t pick sides, people do.

Prediction Markets: When Wars Become Speculative Events

Unsurprisingly, Iran has also appeared on prediction markets (you know, the platforms where users bet on real-world outcomes). These markets increasingly feature speculation around Iranian leadership changes, military strikes, and the situation as a whole.

We’re naturally talking about Polymarket here, which has seen massive volumes tied to geopolitical events, with particularly controversial activity around Venezuela.

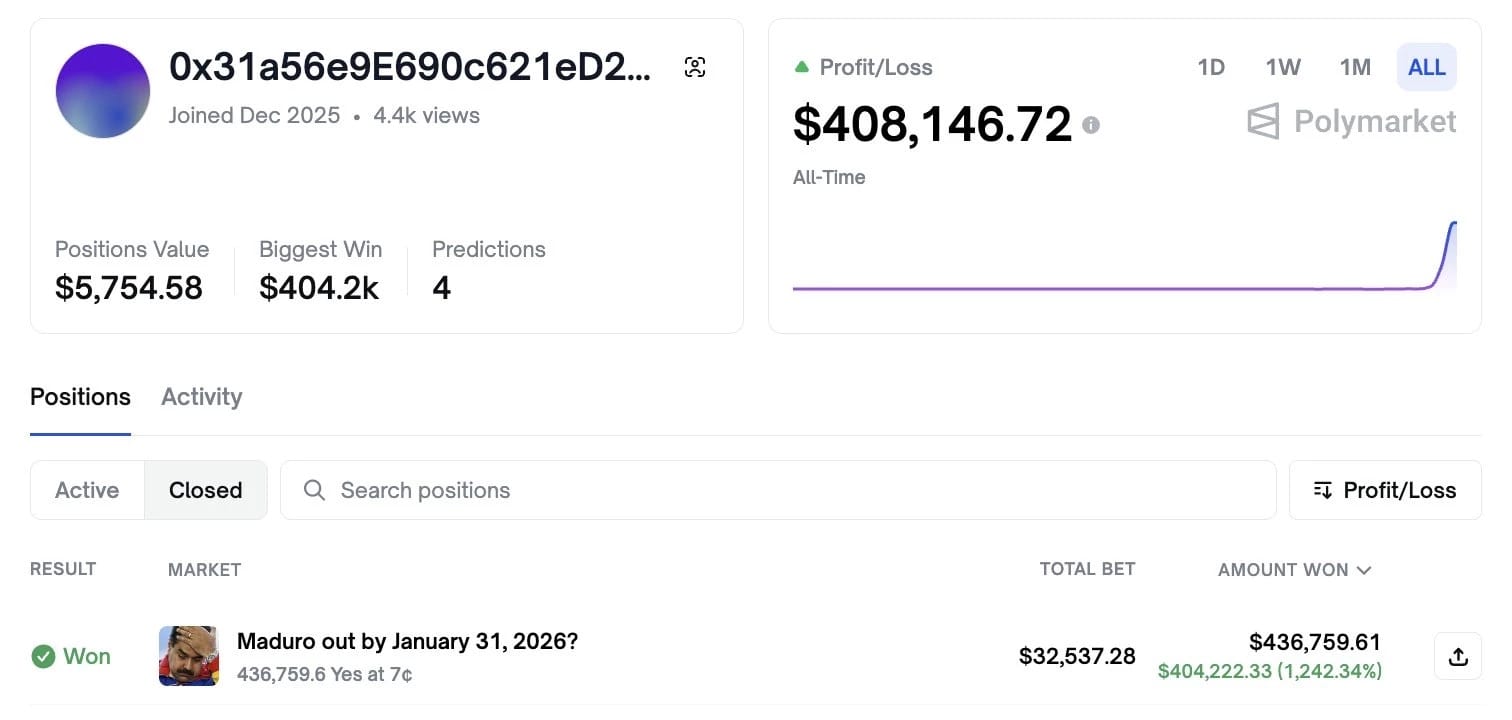

In early January, several wallets placed bets on Nicolás Maduro being captured. Yes, that’s incredibly and suspiciously well-timed. Those bets turned relatively small stakes into six-figure profits.

Well played… or maybe not so much. Politics quickly entered the picture:

- Some wallets went silent, others were frozen

- President Trump claimed a “Venezuela leaker” had been jailed

- US lawmakers began drafting bills targeting insider trading on prediction markets

The controversy escalated even more when Polymarket refused to settle a $10M+ bet on whether the US had “invaded” Venezuela, arguing that a military raid and extraction didn’t meet its definition of invasion. Of course, this caused outrage, comment-section chaos, and a perfect example of how ambiguous smart-contract resolution becomes when real-world events don’t fit clean definitions.

Polymarket has also hosted extensive European conflict speculation, with over $270M in Ukraine war-related wagers, according to Ukrainian monitoring. However, regulators there responded by blocking the platform in the country, citing unlicensed gambling and concerns over betting on an active war. Ukraine now joins more than 30 countries restricting access to the platform.

The Bigger Picture

The crypto ecosystem is no longer just about digital money or tech revolutions. It’s becoming a way to act during real-life crises whether that means securing a financial lifeline through Bitcoin during protests or speculating on global conflicts.

From Tehran’s streets to Washington politics, from Caracas bettors to Ukrainian regulators, crypto is redefining how power, information, and money move during crisis-driven moments. Blockchain’s role in the geopolitical and global landscape is only getting bigger.

It looks like now, when the world burns, the blockchain lights up.

Disclaimer: The content provided in this article is for educational and informational purposes only and should not be considered financial or investment advice. Interacting with blockchain, crypto assets, and Web3 applications involves risks, including the potential loss of funds. Venga encourages readers to conduct thorough research and understand the risks before engaging with any crypto assets or blockchain technologies. For more details, please refer to our terms of service.