Table of Contents

Have you ever come across the word “FOMO” when scrolling through discussions about a token that went through the roof? And wondered what that means?

Short for “Fear of Missing Out,” FOMO is a psychological phenomenon that can deeply impact a financial decision. More than half of consumers state that they made a purchase based on FOMO before. The phenomenon is even more relevant for the crypto space, as 84% of crypto traders report that they have made a trading decision based on FOMO at one point in their lives.

This means that few traders, whether trading crypto or in traditional finance, have been lucky enough not to find themselves drawn into this feeling and make an impulsive investment that eventually turned out to be a bad decision.

This guide explains what FOMO in crypto means, how to recognize it in your own behavior, and practical ways to manage it with practical examples.

What Does FOMO Mean?

FOMO is the anxiety felt when you believe you're missing out on an opportunity. The term is usually used in financial contexts, but the phenomenon actually affects all aspects of human life.

Not skipping a 50% sale on an item that you don’t actually need or want, attending a workshop you’re actually not interested in just to keep up with your co-workers or booking a flight ticket to not be left behind in the travel craze are all actions out of FOMO. In each case, the decision is shaped by environmental pressure rather than personal preference.

As human beings, we tend to compare ourselves with others, often to understand our place in relation to them. When that comparison creates a sense of missing what others have, the fear of missing out can be triggered. The feeling has its roots in primordial instincts, like the fear of death that occurs during social exclusion. FOMO is an evolved version of this antique feeling.

How Does FOMO Affect Crypto and Investing?

When you miss an opportunity, your brain tends to interpret it as a “loss,” though nothing tangible is actually lost. Researches show that a loss has twice the impact of a gain on psychology.

That’s why, investors watching an asset (that is not included in their basket) pierce through the sky regard this as a loss, and tend to act fast to catch the opportunity before it becomes a loss.

FOMO-based trading decisions like these are often devoid of logic and may lead traders to make trades that go down in flames, such as buying at market peaks.

Why FOMO Is Especially Strong in the Crypto Market

As previously stated, crypto traders experience FOMO at considerably higher rates than other groups, and there is a reason for that.

Cryptocurrencies, especially altcoins, are notorious for showing sudden price movements. What’s more, crypto is a market with no borders and intermediaries, so it never sleeps. Seeing a cryptocurrency go 5x overnight is not a rare sight. Being on constant alert for these sudden movements makes crypto traders prone to fear of missing out.

Social media, another fast-moving space, is the go-to platform for crypto traders seeking information. Most projects in the crypto space lack formal disclosures, so traders turn to Twitter, Telegram and Discord to follow updates and signals.

Social media is flooded with successful trade stories, and traders coming across those stories may feel others are getting ahead of them, which pushes FOMO even higher. What makes this even more intense is that losses are rarely shared with the same enthusiasm. This results in a distorted picture of how often others “win.”

Emotional Trading: Fear of Missing Out vs. Rational Investing

Trading out of FOMO is an impulsive, emotional act. Though FOMO traders intend to catch opportunities, they often end up with far less than rational, strategic traders.

The instinct to catch a break with a skyrocketing asset may lead traders to buy at market peaks. The only way after a peak is down, and the same emotional attitude may induce traders to exit early. The combination of entering late and exiting early means substantial losses for the FOMO trader.

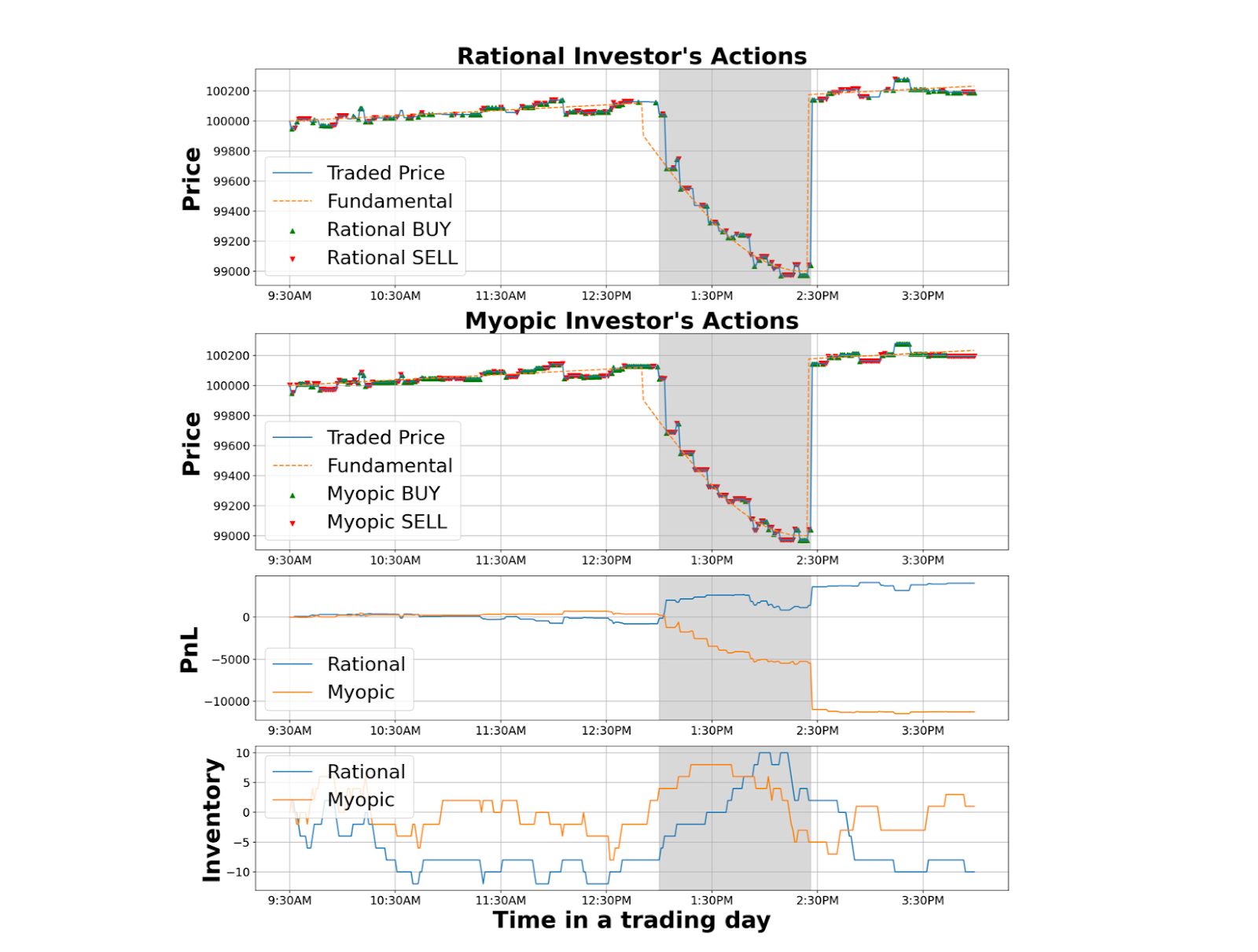

A 2022 simulation found that traders acting on emotional bias consistently earned less than those who followed data. Another research on initial public offerings revealed that buzz-heavy IPOs perform worse than lower-profile ones over time.

These studies lay on the same finding: FOMO-based trading creates a pattern that works against the trader. Prices are already stretched when the impulse to act kicks in, and the same impulse leads to early exits. This pattern performs materially worse than strategic trades.

Common Signs You’re Experiencing FOMO While Investing

Like with most investing mistakes, the first step in handling FOMO is noticing when it’s happening:

- The urge to act fast: If you feel like you have to act before the window of opportunity closes, you might be experiencing FOMO.

- Constantly monitoring prices: Refusing to turn down the screen to not miss a move is both a sign and a catalyst of FOMO.

- Buying out of plan: If you purchase an asset while it’s not part of your investment plan, only because the price went up fast, this might be a FOMO trade.

- Following the noise: Buying assets you barely heard of only because there is a social media hype around is another sign of FOMO.

- Making hypothetical calculations: A trader doing calculations over trades that never happened to find out how much could be earned might also be experiencing FOMO. Regret of not buying earlier often accompanies these calculations.

- Changing strategy frequently: If you change the goal, timeframe or style of your trading strategy frequently (to not miss current opportunities), you might be experiencing FOMO.

- Ignoring risk limits: All trading strategies must have a risk limit that aligns with what the trader can handle. If you jump into an asset that does not fit your risk level, increase position sizes without paying attention to risk level or skip stop-loss because “this one is different,” it might be a FOMO trade.

How to Avoid FOMO in Crypto

FOMO is a common problem in the cryptocurrency space; the majority of traders experience it at least once in their lives. But there are some precautions traders can take to avoid FOMO when investing in cryptocurrencies.

Set Clear Goals and Stick to Your Plan

No trader can catch all existing opportunities on the market. And that’s exactly why setting clear goals matters.

Establish a discipline around what you want to achieve and on what timeline. This will turn price spikes, once felt as missed chances, into mere market noise that you can easily ignore.

Base Decisions on Data Instead of Emotions or Trends

Taking a moment to do research about a project before investing can save traders from getting burned. Checking a project's team and fundamentals like use cases, tokenomics and audit can give a good clue about whether it’s worth investing in or not.

Technical indicators can help traders in the same way. Indicators like volume, momentum and trend strength reveal how the asset is actually doing. Making trade decisions based on indicators can help traders cut through the noise and provide a concrete basis for action.

Diversify Instead of Chasing the “Next Big Coin”

Creating a diversified portfolio is one of the first tips crypto traders get when jumping into the bandwagon, and it’s helpful to avoid FOMO, too.

Diversification spreads your risk, but it also spreads your attention, so you’re checking how your whole portfolio is doing instead of staring at one coin’s chart all day. Not obsessing with a single asset and evaluating the portfolio as a whole enables traders to focus on overall progress instead of chasing each spike. Diversified portfolios create some distance from individual assets, which makes falling for FOMO less likely.

Limit Exposure to Hype-Driven News and Communities

Social media is where FOMO happens. Traders, KOLs and community members meet there to exchange info and stories, which are usually successful ones.

On top of this, social media algorithms tend to show you more of what you already agree with, creating echo chambers. Limiting how often you scroll through hype-heavy news and communities on social media can make it much easier to keep FOMO in check.

Practice Patience and Long-Term Thinking

Patience is the part most traders skip, but it’s what keeps FOMO from running the show. Crypto moves fast, but that doesn’t mean every move is meant for you. Seeing the market as a long-term game rather than a get-rich-quick scheme helps you stop treating every spike as a chance you must act on right now.

How to Build a Healthy Investment Mindset

While a checklist might still be handy in controlling a trade, a more resilient mindset is what eventually makes those checklist steps feel natural instead of forced.

Below are some tips on cultivating a healthy investment mindset.

Focus on Continuous Learning and Research

A healthy investment decision requires knowledge, and that starts with understanding the basics of what you’re trading. Learning how blockchain technology functions, what gives a token utility and worth, or the 101 of trading strategies gives traders a solid foundation to build upon.

Keeping information updated is an important part as well. Blockchain technology is developing fast, and narratives can shift overnight in the crypto space. Treating education as an ongoing habit helps traders stay aligned with what’s actually happening rather than reacting to whatever is trending that week.

Learn from Mistakes Without Emotional Overreaction

If nobody ever made a mistake and lost when trading, no party would be winning either. Mistakes are a natural part of investing, and they happen to every trader at some point. What matters is noticing the pattern before every slip turns into a crisis.

Emotional reactions only make such situations worse. Trying to minimize a loss out of frustration or jumping into a new trade because you feel behind usually leads to the same pattern repeating itself. Approaching mistakes with a calm mind allows traders to adjust their strategy instead of doubling down on the problem.

Develop Emotional Discipline Through Consistency

Just like in all other aspects of life, having a strong mentality gives a huge advantage to a crypto trader. Emotional discipline doesn’t arrive overnight; it grows as you repeatedly follow your rules, even on days when the market feels chaotic.

Being consistent also makes it easier to look back at your results without turning every single win or loss into a verdict on you as a person. When you evaluate trades as part of a longer pattern, it becomes simpler to see what’s working and what isn’t. Over time, this approach turns emotional reactions into something manageable, not something that dictates the next move.

Conclusion: Turn FOMO Into Smart, Strategic Investing

FOMO is a common part of the crypto experience. Its fast-moving nature, hype-driven communities and the constant buzz with success stories make it easy to feel left behind. Most traders face this feeling at some point. Noticing when FOMO is present is the first step to stop it from shaping every trade decision.

Knowledge about the market helps, but it is not enough on its own. A trader can understand charts, indicators and tokenomics and still buy at the top if emotions are in charge. Trading skill goes beyond information; it's also about how to process that information.

But FOMO does not need to be something purely negative. It can be an indicator by itself that highlights where a trader needs improvement in trading skills. Instead of jumping straight into a trade, you can treat that rush of FOMO as a yellow light — a cue to slow down, double-check your reasoning and maybe sleep on the decision.

Before making a trade, ask yourself why this move feels urgent and check whether it fits the plan. If the trade does not seem within the plan, treat the feeling as a prompt to look deeper into the asset or the trend instead of directly reacting to it. Used in that way, FOMO can turn from a trigger into constructive feedback.

Disclaimer: The content provided in this article is for educational and informational purposes only and should not be considered financial or investment advice. Interacting with blockchain, crypto assets, and Web3 applications involves risks, including the potential loss of funds. Venga encourages readers to conduct thorough research and understand the risks before engaging with any crypto assets or blockchain technologies. For more details, please refer to our terms of service.