Table of Contents

Every four years or so, the crypto community kind of goes wild. Or enter a spiral of Fear of Missing Out (FOMO) —or both things at the same time, because yeah, welcome to crypto. That’s caused by the famous Bitcoin Halving event, which occurs every 210,000 transaction blocks on the Bitcoin network, and it’s actually an “invisible” thing for most users. It’s just how Bitcoin was designed to work from the beginning, so no surprises here.

Basically, the Bitcoin mining reward is cut by half. Fun fact, if we kindly check the Bitcoin whitepaper, which is the original Bitcoin source written and published by Satoshi Nakamoto, we’ll find around… zero mentions of this concept. What gives, then?

First of All: What on Earth is Bitcoin Mining, and Thus, Halving?

Maybe we should start by mentioning that Bitcoin is a network composed of blocks over blocks of digital transactions, all of them intertwined with the prior ones and secured with cryptography (very complex math). That’s the blockchain. There’s a new block created every ten minutes, more or less, and each one releases a certain number of new coins. It also collects transaction fees from users. Both are awarded to the miner (or group of miners) who adds that block to the blockchain first.

How do miners do that? You may ask. From the outside, a miner can be just anyone with a computer and specialized mining machines dubbed Application-Specific Integrated Circuits (ASICs). They set up a mining circuit or hardware device, configure the software, join a mining pool (or not), and... wait. Then, the consensus algorithm called Proof-of-Work (PoW) makes mining (and the functioning of Bitcoin) possible.

With this system, the machines must solve complex mathematical riddles to create new blocks, at the expense of a certain amount of electrical energy, usually high (hence the “work”). This is done to protect the network, avoid double-spending, and incentivize nodes (which means: random people participating) with a financial bounty to behave the way they’re meant to.

Remember that bit about a certain number of new coins issued with every block? That’s where the Bitcoin halving enters.

So, the Bitcoin Halving is…

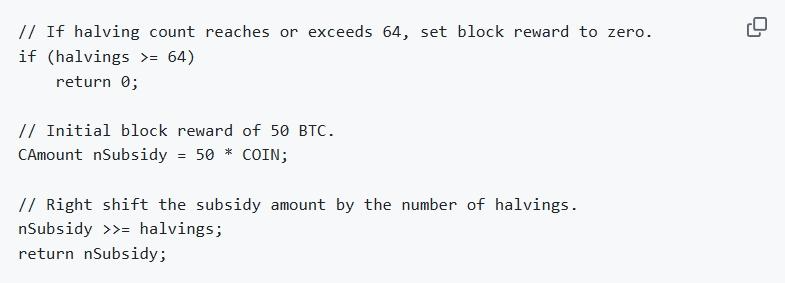

As we’ve mentioned above, the halving occurs when the Bitcoin protocol divides the mining reward by half every 210,000 blocks (roughly four years), but of course, there are more details to it. This concept isn’t described in the whitepaper, but you can find it in the protocol itself, if you know how to read it. It’s open source, and therefore, available for all and sundry on GitHub. Just for fun, here, check how it looks:

It’s not completely unreadable, right? We can see that the initial reward was 50 BTC per block. Now, after four halvings over the years, the block reward is at 3.125 BTC. That’s not bad at all, considering that Bitcoin started with a price of virtually zero and now it surpasses $110,000 per unit. This makes the current bounty around $350,000 per block. Considering that, you can understand why there are whole mining companies and thousands of miners around.

Now, an important piece from above there. Notice how they say, “if halving count reaches or exceeds 64, set block reward to zero”? Well, that’s because only 64 halvings will ever exist, and only 21 million BTC will ever be issued. That doesn’t mean Bitcoin will stop working afterward, but the contrary. There are powerful reasons to limit it that way.

Why is Bitcoin Halving necessary at all?

Bitcoin didn’t pop into existence just because. It arrived during an era when people were frustrated with how money worked —well, that era is still with us. Anyway, if you peek inside the very first Bitcoin block, you’ll find a little hidden message left by its mysterious creator, Satoshi Nakamoto:

It’s not there by accident. It’s a timestamp, sure, but also a wink: a quiet protest against the endless cycle of bank rescues and money printing that marked the 2008 financial crisis. That moment shaped Bitcoin’s entire DNA. You see, in traditional economies, central banks can decide to release more currency when they see fit, which often dilutes the value of the money you already hold.

Bitcoin didn’t want that, so the rules were set from the start: only 21 million BTC, ever. Totally fixed supply. Each new block creates a few coins, but fewer and fewer over time. That shrinking reward isn’t a bug; it’s the plan. It’s how Bitcoin stays scarce, a bit like gold buried deep underground. Except here, everyone already knows exactly how much there is and how it’ll come out.

This is why the Bitcoin halving exists. It’s like a gentle brake pedal, slowing the flow of new coins so Bitcoin doesn’t lose its punch as the years roll by. If it didn’t have that mechanism, the software would be a vault with a bottomless hole and coins spilling forever. Instead, it’s more like bits of buried and limited gold waiting to be extracted with a certain amount of effort. Scarcity is value!

What Happens to Bitcoin Miner Machines and Coins After a Halving?

Well, they don’t suddenly explode and the Bitcoin network stops working, if you were wondering. A key point: all coins are safe and functional. Nothing happens with them —except maybe for the prices, but we’ll talk about that later.

Everyone just goes on about their day, including average users transacting every second if they want to, but yes, some things may happen behind the shiny curtains. The truth is that some miners leave if the block rewards no longer cover their electricity bills. When the block reward drops, the least efficient, older machines often get switched off first.

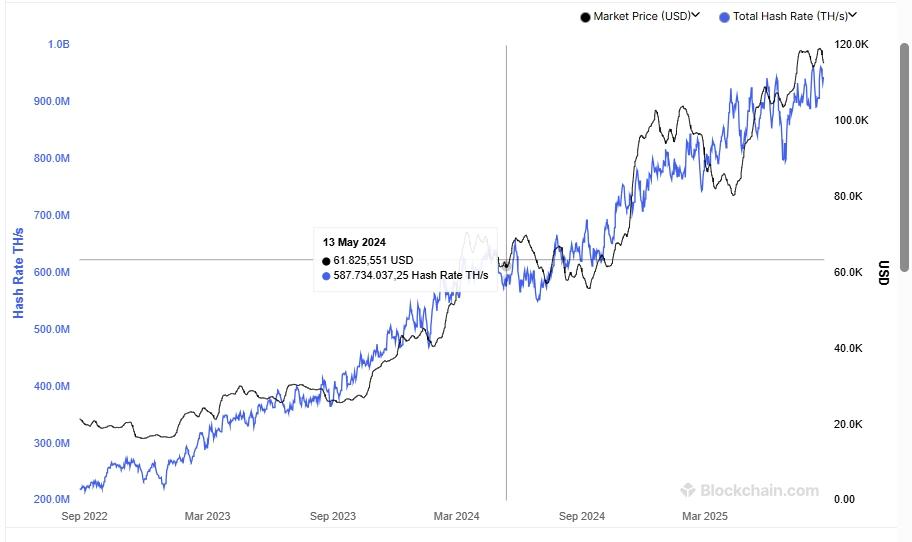

The newest, most efficient mining rigs, like the latest and absurdly expensive ASICs, tend to survive the storm. It’s a bit like a natural selection moment for mining hardware. Companies and hobbyists both review their costs and, if they can’t keep up, they unplug. You can see this in the network’s hash rate (total power), which often dips right after a halving event, then gradually recovers.

Bitcoin Halving & Difficulty

An interesting thing happens here, and it’s about the Bitcoin Mining Difficulty. This is a setting that tells miners how hard it is to find a valid block, and it changes every 2016 blocks, equivalent to two weeks or so. It’s always a moving target: when more miners join and the network is processing blocks too fast, the target shrinks, making the “puzzle” harder. If miners leave and blocks are found too slowly, the target grows, making it easier.

That's why, back in 2009, people could mine Bitcoin on a simple laptop CPU, and now it takes giant mining farms and pools to see some profits. In any case, our idea here is that numerous miners often leave after a halving, making it easier for the others to mine. Good news for some, bad for others. In general, we as Bitcoin users need as many miners as possible to secure and decentralize the network, so it’s a good thing this is temporary.

How Does Bitcoin Halving Affect the Price of Bitcoin?

This is it. This is why the crypto community goes wild and often FOMO around Bitcoin halvings. Fewer new bitcoins are created now and scarcity is valuable. So, people hope for a positive impact on price post-halving. A nice increase in the price of Bitcoin can happen, yes, but that’s not automatic.

Bitcoin price over time related to Halvings. Only 34% of needed blocks have been filled for the next one in 2028. Chart by Bitbo.io

The halving event doesn’t magically pump the price overnight. It just sets the stage. With fewer new coins entering the market, if demand stays the same or grows, prices can climb over time. And with “time,” we don’t mean minutes or days; it’ll likely be weeks or even months, at the very least. This isn’t a lever or a button to activate a price rally. Market sentiment, world events, and investor actions all play a role.

Looking back, previous halvings have often been followed by strong price rallies, but always with a lag and lots of ups and downs in between. The 2012 and 2016 halvings, for instance, both resulted in huge gains months later, while the one in 2020 unfolded alongside an entirely different, let’s say, macroeconomic landscape (C-Disease-Which-Must-Not-Be-Named). So, while scarcity sets the stage, it’s only one piece of the puzzle.

Speaking of past halvings…

The 2012 Halving: Bitcoin’s First Major Shift

The community wasn’t big back then, and this was the first-ever Bitcoin halving event, so you can only imagine the mixed panic and hope. Check this presentation just before: “Prepare to fall to your knees and shake your fist to the heavens, a terrible milestone is upon us, one that will forever change the fabric of an entire community.” Maybe a little magnified, but that was the feeling.

This first halving event took place at block 210,000, on November 28, 2012, and reduced the block reward from 50 BTC to 25 BTC. If you search that specific block on a blockchain explorer, you’ll likely find it tagged as notable or emblematic. Around 50% of all bitcoins were already mined by then.

Talking about prices, Bitcoin was at $12.5 per token a day before halving, and it soared to a staggering… $12.6 two days later. Oh well, we did say the halving wasn’t a magical button. The best part is that it took a whole year, but the price of Bitcoin actually reached a major All-Time High (ATH) on December 4, 2013: $1,151.17 per token. Now, that was something. An increase of over 9,109%, to be more precise. If you had held 1 BTC from November 2012 to December 2013, you would have earned over $1,138 —just like that.

The 2016 Halving: Amid Another Debate

Not to say that the halving wasn’t important this year, but the narrative around Bitcoin was getting heated by another debate at the time: the Blocksize Wars. Several developers and companies were fighting about how to increase (or not) the block size of Bitcoin, which could ultimately make it faster and able to handle more users over time. In theory, at least, because there was a reason to be contrary: changing the original Bitcoin code to this extent could bring serious security concerns.

The halving was going to happen, anyway, and to sum up that particular war, Bitcoin ended up adopting SegWit (a less drastic solution for scalability). The people who didn’t like this forked the code (copypasted it) to create a whole new cryptocurrency in 2017: Bitcoin Cash (BCH). Before this, the Bitcoin halving happened on July 9, 2016, at block height 420,000, and reduced the mining reward to 12.5 BTC. By that day, around 15.75 million BTC were already circulating. That’s 75% of the total supply.

The reason we mentioned the Blocksize Wars is that, in all likelihood, they impacted the Bitcoin price as much as the halving in 2016. We can’t know for sure but Bitcoin started with a price of about $653 per unit a day before the halving, and it didn’t end the month well abandoning the $600-dollar range. The next year would bring a huge price rally, though. On December 15, 2017, Bitcoin surpassed an ATH of $19,665 per unit. It was an increase of over 2,911%.

The 2020 Halving: Institutional Investment Comes In

This wasn’t the best year for everyone because reasons, and yet, miners and Bitcoin users alike didn’t stop. Indeed, all the contrary. Months prior to the halving event, Bitcoin’s hashrate and mining difficulty hit all-time highs. This indicated that many more nodes than usual were mining new coins right before the reward was reduced again.

The great moment arrived on May 11, 2020, when block number 630,000 triggered the halving, dropping the reward for mining to 6.25 BTC. Up to that point, approximately 18.3 million BTC had already been mined (around 87%).

Against all odds, Bitcoin flourished this and the next year. Not only because of the halving, but also thanks to institutional investments and adoption from big companies like MicroStrategy and PayPal. The price of Bitcoin pre-halving was at $8,752, and this time it started to steadily increase right after the halving, until it reached a big ATH of $63,576 in April 2021 —a positive difference of 626.4%.

The 2024 Halving: ETF Fever

Again, the last Bitcoin halving was almost a side event. In January 2024, the US Securities and Exchange Commission (SEC) finally approved, after years of agonizing rejections, 11 Bitcoin Spot Exchange Traded Funds (ETFs). That meant Bitcoin hit the big leagues, and companies and individuals could find it as a regulated and official investment tool on stock exchanges.

This was seriously big news, and the Bitcoin price hit a new ATH of over $73,000 per unit in March 2024. That was over a month before the fourth halving, which cut the block rewards to 3.125 BTC at the block 850,000 by April 19, 2024. About 19.68 million BTC were circulating at that moment (93.7%).

From then on, the Bitcoin price would reach more ATHs. Until August 2025, the higher one was $123,561, increasing by over 69% since the ETF news. Other events have played a key role in it, though. The Trump administration in the US has been very friendly towards cryptocurrencies. Among other things, like the establishment of a strategic Bitcoin reserve, digital assets can now be included in 401(k) investments (US retirement savings plans).

What Will Happen After the Final Bitcoin Halving?

The next Bitcoin halving will happen on April 17, 2028, and the following one beyond that will be in 2032. Fewer and fewer BTC will be issued per block: 1.56 BTC, 0.78 BTC, 0.39 BTC, and so on. There are currently 19.91 million BTC in the wild, which means that only 5.2% of the total Bitcoin supply remains to be mined. It sounds like a little, but it’ll be a long while: the final Bitcoin halving is scheduled for the year 2140. Unless you’re a vampire, we probably won’t be around to see it.

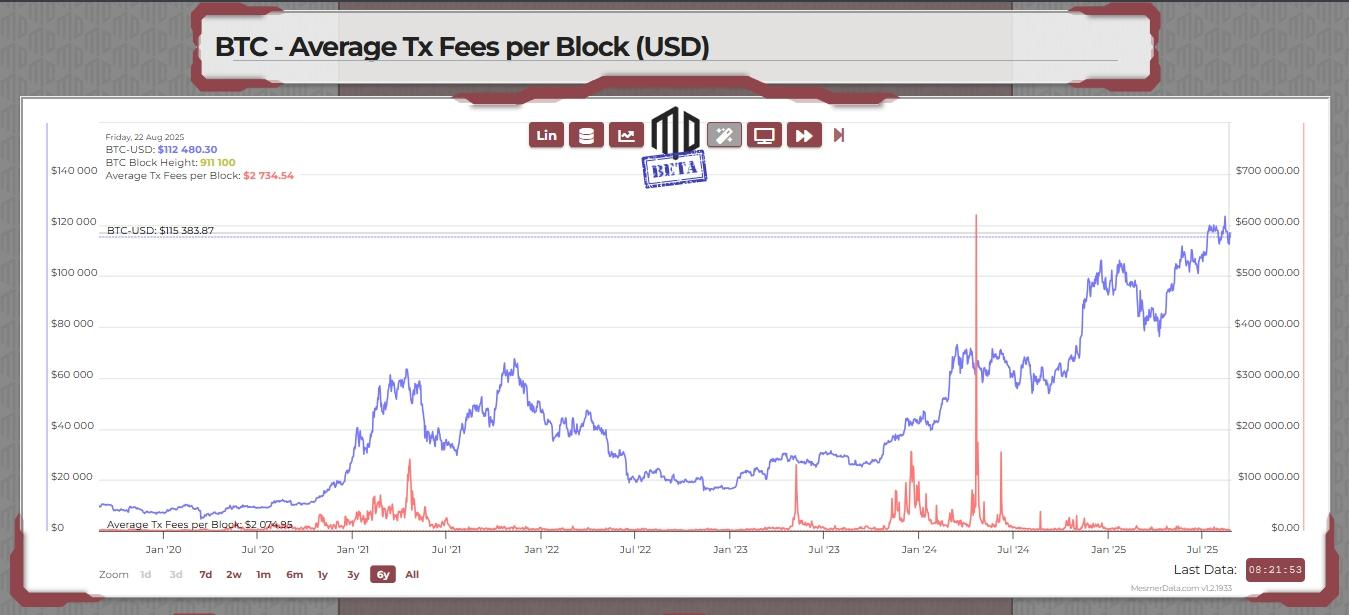

We can guess there will be concern, though. The transaction fees will remain as block rewards for miners to verify operations and secure the network, but who knows if that will be enough for them. As of August 2025, those fees per block amounted to $2,734, and the total transaction fees paid to miners on the same date were $116,866. This is far less than the mining reward, so these numbers, hopefully, will change in the upcoming years as more and more users join the network.

If Bitcoin continues to hum with lots of transactions, the fees that people pay might still make mining a profitable endeavor, even after no new coins are being minted. However, if it dies down and fewer people are using it, those fees may not be sufficient to keep miners on board.

Following the last Bitcoin halving, the first cryptocurrency will be a truly scarce asset, given that no more new coins will be added to the system ever again. Its viability from that point will rely on its community. Will they offer enough fees to pay miners and maintain the network? We’ll see! (Well no actually we won’t, it’s too far away). For the time being, let’s enjoy the network as it is.

Disclaimer: The content provided in this article is for educational and informational purposes only and should not be considered financial or investment advice. Interacting with blockchain, crypto assets, and Web3 applications involves risks, including the potential loss of funds. Venga encourages readers to conduct thorough research and understand the risks before engaging with any crypto assets or blockchain technologies. For more details, please refer to our terms of service.