Table of Contents

Have you ever gone outside to walk your dog on a sunny afternoon and forgotten to lock the door leaving your house exposed to potential thieves who might want to break in and steal your money and maybe your box of cereal that’s sitting on the kitchen table? Well, that’s sort of what it’s like to invest in cryptocurrency without analyzing it and doing your research first.

Without proper research and analysis, you leave yourself more vulnerable to potential rug pulls or other scams that could cause you to lose not just a little bit, but potentially ALL of your money. Unreliable projects and cryptocurrencies are out there in the cryptocurrency/blockchain space, placed sometimes right beside the well managed projects. It’s your job as an investor to be able to spot the risky projects from the ones that will become successful.

Besides the potential for investing in unreliable projects, without proper analysis before you invest you could be impacted more severely by the extreme volatility in the crypto space. So, what we're saying is, it’s better to take the time to be extra prepared and to know your stuff before making any investment decisions.

This guide helps investors evaluate cryptocurrencies objectively using fundamental and technical analysis so they can make sure they know what they are doing before putting their hard-earned money from mowing the neighbor’s grass in their yard or from their regular, boring 9 to 5 into any cryptocurrency.

What Crypto Analysis Involves

So what is crypto analysis, you ask? Crypto analysis is the process of studying a cryptocurrency project’s fundamentals, market data, and investor behavior to estimate it’s overall value and growth prospects. Think of it this way: you wouldn’t want to invest in a crypto project that doesn’t seem like it is going to grow in value or offer anything unique and innovative to the cryptocurrency space, but without analyzing the crypto you could miss spotting the likely to fail projects and telling them apart from the amazing projects.

Why Thorough Research Matters Before You Invest

Proper research will help you spot the potential scams and identify long-term opportunities. In the cryptocurrency space, it’s easy to get caught up in hype and follow the crowd, unfortunately sometimes following the crowd into a scam. By doing research beforehand, you can avoid these types of situations and reduce the potential of making emotional or speculative decisions.

How to Perform Fundamental Analysis

Fundamental analysis involves looking into an asset’s “fundamentals”, incorporating a cryptocurrency’s financials, user community, and real-world applications. To perform fundamental analysis you need to focus on evaluating a cryptocurrency’s real-world value, technology, and long-term sustainability. Ask yourself what value the cryptocurrency brings and whether you think it will last and grow over a long period of time or whether it will fail quickly.

Evaluating the Project’s Vision and Real Use Case

Cryptocurrencies and cryptocurrency projects exist to solve real problems. You should analyze if the project you are looking into is solving a real problem or just following what other people in the market are doing. Innovation and problem solving are the keys to success in the cryptocurrency space. Skilled investors don’t invest in projects that are just doing the same thing that everyone else is doing with their cryptocurrencies. There’s only innovation in new technologies if people solve new problems and don’t simply follow the crowd.

Reviewing the Team, Whitepaper, and Roadmap

When analyzing a cryptocurrency within the crypto market, it’s important to review the credibility of the team members. What skills do they have? Have they started a company before in fintech or crypto? Then read the whitepaper. Does it seem like the team members listed can pull off whatever their goals are and create a thriving cryptocurrency? Does the white paper seem clear and well thought out?

Then look at the roadmap that they have produced. Does it seem likely that they will be able to follow and achieve each of the steps of the roadmap as it is outlined? Do the steps seem possible in the time periods outlined in the roadmap or does it seem like they won’t possibly be able to achieve their goals on time?

Understanding Tokenomics and Supply Models

Token distribution, inflation rate, and utility impact price stability and growth by influencing supply and demand. Tokenomics includes supply models, distribution mechanisms, utility, and governance which all influence the value of a cryptocurrency.

Analyzing Community Strength and Adoption Levels

Next, it’s important to analyze the community that is behind a particular cryptocurrency. Is there strong community engagement with the project and does the project have partnerships that can help take it to the next level? Community engagement and partnerships can help potential investors determine if people are actually adopting, using, and supporting the cryptocurrency and the leaders of the project.

Technical Analysis Essentials for Crypto Traders

Technical analysis focuses on historical market performance by examining price over time and trading volume over time. See things like whether people are overall putting money into the asset or taking their money out. Is the asset traded in large amounts? Is the asset increasing or decreasing in value over time?

How to Read Crypto Price Charts

A key aspect of technical analysis is candlestick charts. Taller candlesticks represent a greater difference between opening and closing prices and shorter ones show a smaller price move from the same period.

If the price of the asset increased in the specific time frame shown by the candle, the candle will be green. A red (or sometimes black) candle represents a price decrease over that time period. The thin lines on the candlestick represent the highest and lowest prices during the specific time period.

You can determine price trends based on specific patterns that can be read from candlestick charts. For example, a bullish engulfing pattern is a two candlestick pattern. The first candlestick is a bearish (red) candle and the other is a larger bullish (green) candle that “engulfs” the previous red candle. This shows that the market may change direction and there could be a further increase in prices. There are other patterns as well that can also help traders predict price trends.

Key Indicators to Watch: RSI, MACD, and Moving Averages

There are a variety of indicators that can help traders complete technical analysis. The Relative Strength Index (RSI) helps measure the speed and change of price movements. It moves up and down between 0 and 100. When the RSI is above 70, it indicates overbought conditions. When it is below 30 it indicates oversold conditions.

Moving Average Convergence/Divergence (MACD) helps investors identify price trends, measure trend momentum, and identify entry points for buying and selling an asset. Traders usually buy an asset when the MACD line passes above the signal line and sell -or short- an asset when the MACD line passes below the signal line. A Moving Average (MA) levels out daily price movements by creating a constantly updated average price. A rising MA indicates that an asset is in an uptrend and a declining MA indicates it is in a downtrend.

Identifying Market Trends, Support, and Resistance Levels

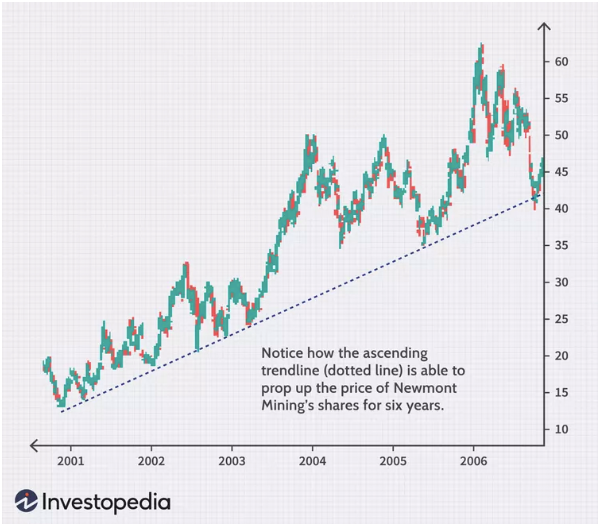

Traders often pay attention as the price drops toward the support of a trendline because historically this has been an area that has prevented the asset from moving a lot lower. This helps them determine when to enter and exit investments.

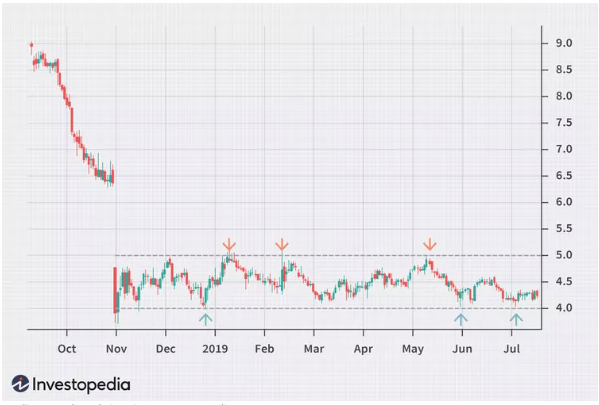

Horizontal levels are price points where resistance or support previously occurred. They help traders decide entry and exit points on their trades because the historical data helps them predict what may be likely to occur again.

Using On-Chain and Market Data for Deeper Insights

On-chain metrics reveal blockchain activity that traditional price charts don’t show. Indicators like active addresses, hash rate, and transaction count can help traders measure usage and security. Transaction count allows traders to see how much a cryptocurrency is actually being used and traded.

High liquidity and trading volume show that investor confidence is high and the cryptocurrency is stable. Also, by tracking transactions of people with large wallets, investors can see if certain cryptocurrencies are being accumulated and how they are being distributed amongst investors.

How to Evaluate Risk and Security in Crypto Projects

If you spend enough time researching before making an investment, you can spot vulnerabilities in crypto projects early, helping prevent any loss of money or a failed investment. By researching the team and white paper behind a project, you can determine whether the project seems reliable or not before you become an investor in it.

Recognizing Red Flags and Potential Scams

The old saying goes “If something seems too good to be true, it probably is.” Crypto project teams might make unrealistic promises that seem too good to be true in order to try to attract investors. So if they say they are going to change the industry in a day, don’t buy it. Some teams may try to stay anonymous, but this can sometimes be because they intend to rug pull and don’t want to get caught when they do.

So make sure the team members of the cryptocurrencies and crypto projects you invest in are showing their smiling faces and not hiding.It’s also important to make sure that the white paper you read has not been copied from some other source. White papers should be unique or original to that project, not copied from some other previous project.

Checking Exchange Listings and Liquidity Levels

Make sure that cryptocurrencies that you invest in are listed on reputable, well known exchanges with good liquidity. This makes the project appear more legitimate. If exchanges don’t list a cryptocurrency, there is probably a good reason for that.

Combining Fundamental and Technical Analysis

By combining fundamental and technical analysis techniques, you can ensure that cryptocurrencies you invest in are the most reputable.

Final Thoughts: Staying Informed and Objective in a Volatile Market

Being successful at crypto investing requires discipline, constant learning, and emotional control. Although markets are unpredictable, investors who focus on data and extensive research rather than hype are more likely to make successful decisions long term. Research is the key to being profitable with investing.

Disclaimer: The content provided in this article is for educational and informational purposes only and should not be considered financial or investment advice. Interacting with blockchain, crypto assets, and Web3 applications involves risks, including the potential loss of funds. Venga encourages readers to conduct thorough research and understand the risks before engaging with any crypto assets or blockchain technologies. For more details, please refer to our terms of service.